- United States

- /

- Pharma

- /

- NasdaqGS:OPTN

OptiNose, Inc. (NASDAQ:OPTN) Might Not Be As Mispriced As It Looks After Plunging 31%

Unfortunately for some shareholders, the OptiNose, Inc. (NASDAQ:OPTN) share price has dived 31% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

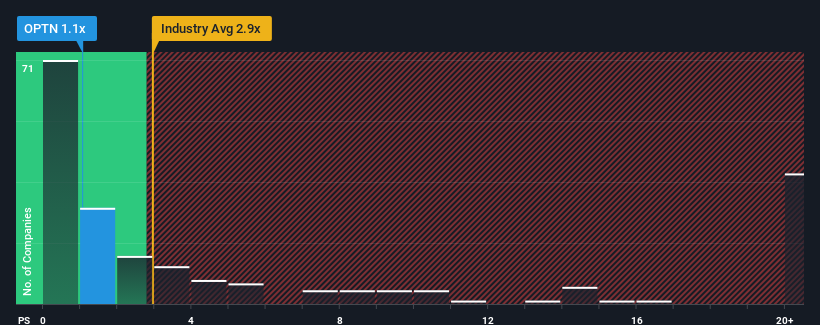

Since its price has dipped substantially, OptiNose may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 2.9x and even P/S higher than 14x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for OptiNose

What Does OptiNose's P/S Mean For Shareholders?

Recent times haven't been great for OptiNose as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OptiNose.Do Revenue Forecasts Match The Low P/S Ratio?

OptiNose's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.1%. Revenue has also lifted 10% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 33% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 19% per year, which is noticeably less attractive.

With this information, we find it odd that OptiNose is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From OptiNose's P/S?

The southerly movements of OptiNose's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems OptiNose currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider and we've discovered 4 warning signs for OptiNose (1 can't be ignored!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPTN

OptiNose

A specialty pharmaceutical company, focuses on the development and commercialization of products for patients treated by ear, nose, throat, and allergy specialists.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives