- United States

- /

- Life Sciences

- /

- NasdaqGM:OLK

Olink Holding (NASDAQ:OLK) Is In A Strong Position To Grow Its Business

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Olink Holding (NASDAQ:OLK) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Olink Holding

How Long Is Olink Holding's Cash Runway?

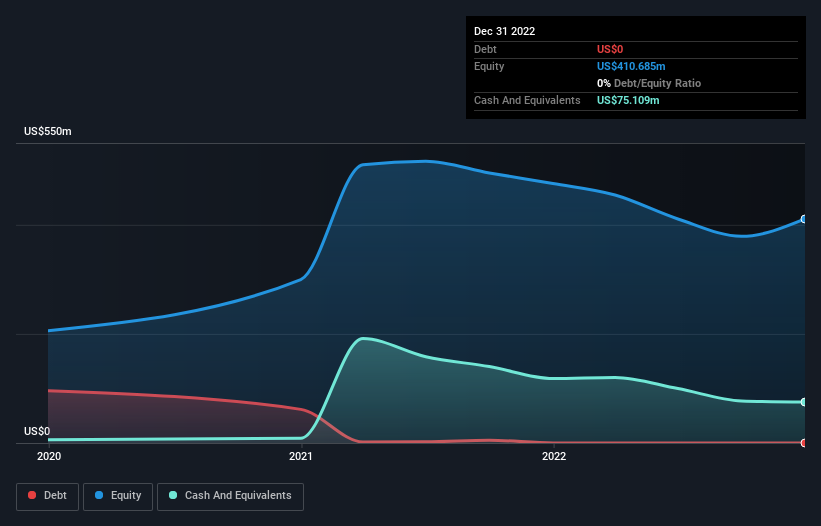

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2022, Olink Holding had cash of US$75m and no debt. Looking at the last year, the company burnt through US$39m. So it had a cash runway of approximately 23 months from December 2022. Notably, however, analysts think that Olink Holding will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

How Well Is Olink Holding Growing?

It was fairly positive to see that Olink Holding reduced its cash burn by 44% during the last year. And considering that its operating revenue gained 47% during that period, that's great to see. It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Olink Holding Raise Cash?

We are certainly impressed with the progress Olink Holding has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Olink Holding's cash burn of US$39m is about 1.4% of its US$2.8b market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Olink Holding's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Olink Holding is burning through its cash. For example, we think its revenue growth suggests that the company is on a good path. And even though its cash runway wasn't quite as impressive, it was still a positive. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Olink Holding that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:OLK

Olink Holding

Develops, produces, markets, and sells biotechnological products and services for the academic, government, biopharmaceutical, biotechnology, service provider, and other institutions that focuses on life science research.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026