- United States

- /

- Pharma

- /

- NasdaqGM:OCUL

Ocular Therapeutix (OCUL): Assessing Valuation After FDA Special Protocol Assessment Boosts Analyst Interest

Reviewed by Kshitija Bhandaru

Ocular Therapeutix (OCUL) recently caught Wall Street’s eye after announcing that the FDA has granted a Special Protocol Assessment for its upcoming registrational program of AXPAXLI in non-proliferative diabetic retinopathy. This regulatory update has stirred investor interest.

See our latest analysis for Ocular Therapeutix.

Momentum appears to be building for Ocular Therapeutix, driven by positive sentiment after the FDA’s Special Protocol Assessment for AXPAXLI and its prominent conference appearances. This renewed optimism is reflected in the year-to-date share price return of 35.47%, while the three-year total shareholder return stands at a remarkable 221.74%.

If this wave of biotech news has you curious about what’s next, now is a great time to explore opportunities through our See the full list for free.

Yet with shares up more than 35 percent year to date and analyst targets signaling significant upside, the key question is whether Ocular Therapeutix is still undervalued or if the market is already accounting for its future growth.

Most Popular Narrative: 46% Undervalued

Compared to the last close of $11.84, the latest narrative-driven fair value of $21.92 suggests significant upside potential, with bullish and bearish factors creating strong debate among market watchers.

The anticipated approval of AXPAXLI, potentially the first wet AMD product with a superiority label and longer dosing intervals (every 6 or 12 months), may allow Ocular Therapeutix to capture significant market share in a rapidly growing population of elderly patients with retinal disease. This could unlock large revenue growth opportunities as the global prevalence of ophthalmic disorders increases.

Want to unlock what drives this lofty valuation? Analysts are baking in aggressive growth, ambitious margin improvements, and premium multiples. Curious which future developments could justify such a dramatic re-rating? Dive into the full narrative to see the projections that shape this bold outlook.

Result: Fair Value of $21.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in ongoing late-stage trials or less-than-expected pivotal readouts could quickly undermine optimism surrounding Ocular Therapeutix’s potential trajectory.

Find out about the key risks to this Ocular Therapeutix narrative.

Another View: What About Multiples?

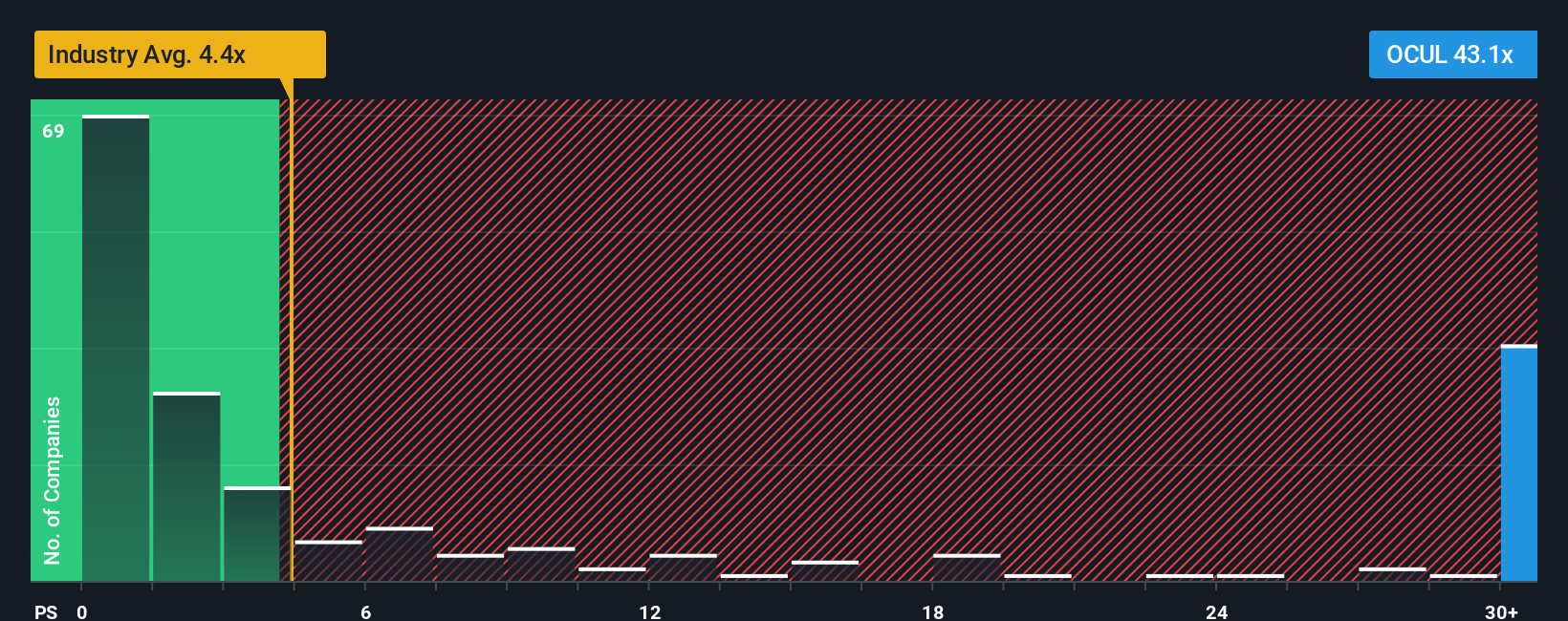

While our earlier analysis leans on narrative-driven fair value, a look at Ocular Therapeutix’s price-to-sales ratio paints a cautionary picture. The company trades at 44.3x sales, which is significantly higher than the US Pharmaceuticals industry average of 4.7x and a calculated fair ratio of just 0.4x. This large gap suggests the market expects major breakthroughs. However, if those fail to materialize, there is valuation risk. Are investors too optimistic, or is this the premium for future leadership?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ocular Therapeutix Narrative

If the consensus doesn’t match your outlook or you’d rather dig into the details yourself, crafting a personalized narrative can take less than three minutes with our interactive tools. Do it your way.

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let unique opportunities pass you by. Use the Simply Wall Street Screener to find standout stocks that fit your specific strategy before the crowd catches on.

- Capture major upside from overlooked gems by checking out these 878 undervalued stocks based on cash flows. These are priced below their potential and show strong fundamentals.

- Boost your income potential by uncovering these 18 dividend stocks with yields > 3%, which deliver attractive yields above 3% for resilient, income-focused portfolios.

- Ride the next wave of tech innovation as you tap into these 24 AI penny stocks. These companies are harnessing artificial intelligence to transform entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCUL

Ocular Therapeutix

A biopharmaceutical company, engages in the development and commercialization of therapies for retinal diseases and other eye conditions using its bioresorbable hydrogel-based formulation technology in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives