- United States

- /

- Life Sciences

- /

- NasdaqGM:OABI

OmniAb, Inc. (NASDAQ:OABI) Shares Slammed 29% But Getting In Cheap Might Be Difficult Regardless

To the annoyance of some shareholders, OmniAb, Inc. (NASDAQ:OABI) shares are down a considerable 29% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 62% share price decline.

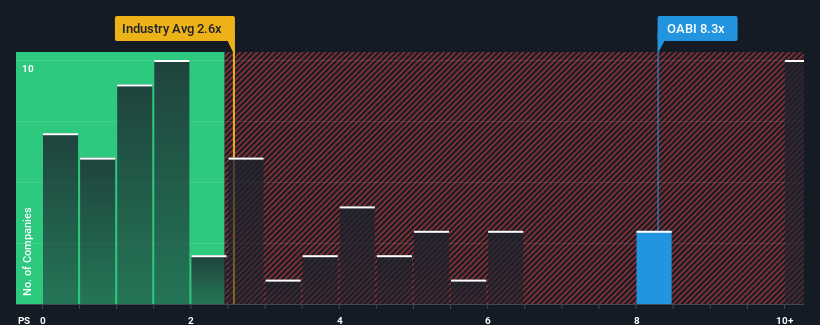

Although its price has dipped substantially, given around half the companies in the United States' Life Sciences industry have price-to-sales ratios (or "P/S") below 2.6x, you may still consider OmniAb as a stock to avoid entirely with its 8.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for OmniAb

What Does OmniAb's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, OmniAb's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think OmniAb's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For OmniAb?

In order to justify its P/S ratio, OmniAb would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 26% per annum as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.4% per year, which is noticeably less attractive.

With this information, we can see why OmniAb is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

OmniAb's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of OmniAb's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for OmniAb that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:OABI

OmniAb

A biotechnology company, licenses discovery research technology to pharmaceutical and biotech companies, and academic institutions to enable the discovery of therapeutics in the United States, Europe, Japan, China, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives