- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

What Recent Vaccine Safety Headlines Mean for Novavax’s 2025 Stock Valuation

Reviewed by Simply Wall St

Trying to figure out what to do with Novavax stock? You are not alone. With a recent close at $7.98, Novavax has been one of the more dramatic rides in the biotech world, and lately, headlines have seemed to throw fuel onto an already volatile fire. In the last week, shares are up 1.0%. However, zooming out, the story gets trickier. Over the last month, Novavax is down 16.7%, and year-to-date, it has slipped 6.9%. Stretch that time horizon even more, and the losses get jaw-dropping: down 41.4% over the past twelve months and a staggering 92.6% in the last five years. This definitely raises the question of risk versus reward for new investors or those weighing whether to hold on.

Recent news has added to the uncertainty, with reports that federal officials might limit COVID vaccine access due to safety concerns, and fresh debate over the future of these vaccines in the U.S. market. That type of government scrutiny can shake investor confidence in all vaccine players, Novavax included.

There is also another factor to consider. From a pure value perspective, Novavax currently scores a 3 out of 6 on common undervaluation checks. That means, by at least half of standard measures, the stock looks like a potential bargain to value-seeking investors. Of course, numbers never tell the whole story. Up next, we will walk through each valuation approach side by side, so stick around, because there may be an even sharper lens for weighing Novavax’s true value.

Why Novavax is lagging behind its peersApproach 1: Novavax Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future free cash flows and discounts them back to today’s dollars, aiming to estimate the business’s intrinsic value based on its ability to generate cash in the future.

For Novavax, the most recent reported Free Cash Flow stands at negative $668.4 million. Looking ahead, analysts forecast significant volatility, with projected free cash flow rising to $76 million in both 2026 and 2029, dropping to negative $49 million in 2027, then climbing as high as $263 million by 2028. Beyond those years, subsequent estimates are extrapolated, showing a gradual tapering of free cash flow growth into the next decade, with projections dropping below $5 million by 2035.

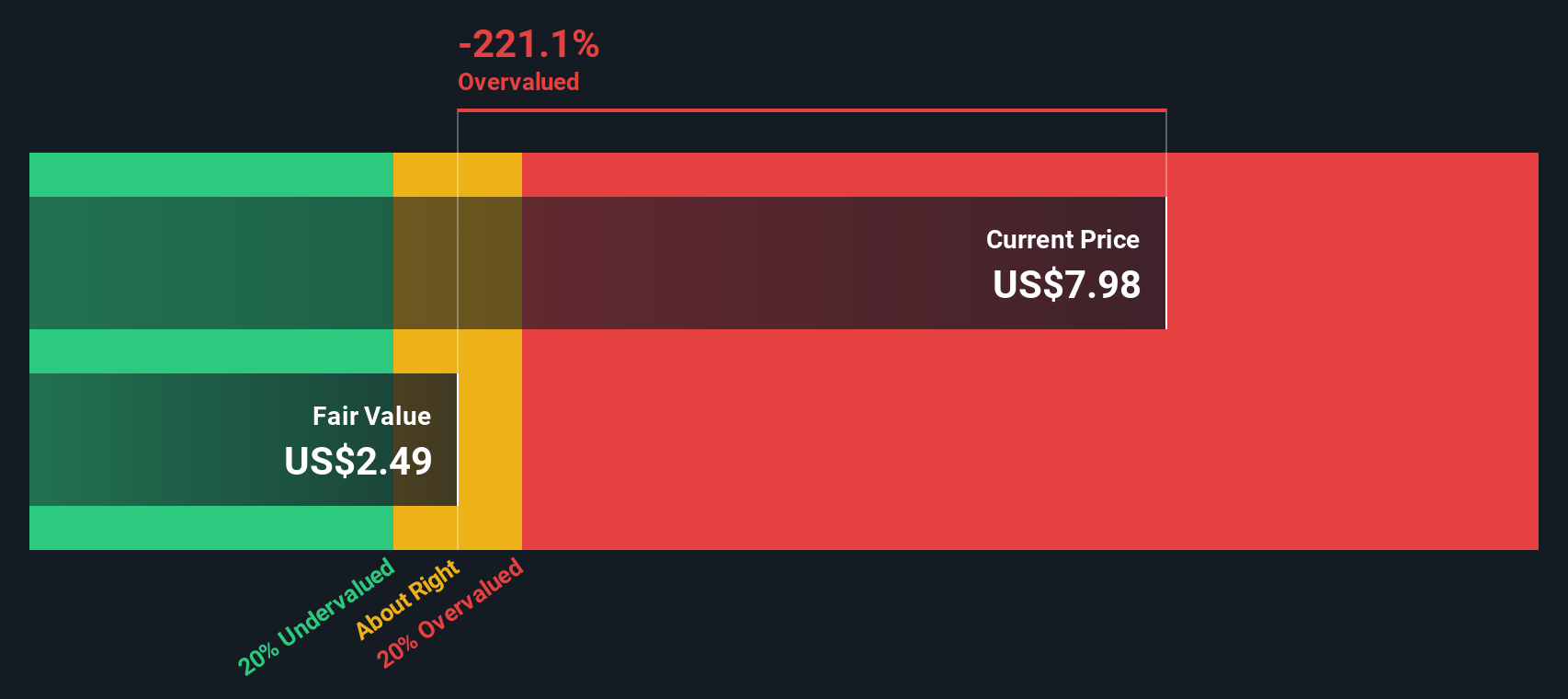

Despite these future cash flows, the DCF analysis results in an estimated intrinsic value of $2.49 per share. With Novavax stock recently closing at $7.98, this calculation suggests shares are 221.1 percent above their fair value. In other words, the stock appears significantly overvalued according to this cash flow-based approach.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Novavax.

Approach 2: Novavax Price vs Earnings

The price-to-earnings (PE) ratio is a classic measure for valuing companies that are generating profits, as it tells investors what they are paying for each dollar of current earnings. For profitable biotech firms, the PE ratio helps quickly compare relative value, especially when gauging what the market expects in future growth, profitability, and risk.

Growth expectations, profit margin sustainability, and perceived risks all play a role in what is considered a “normal” or “fair” PE ratio. Typically, companies with higher stability and stronger growth command higher PE ratios. Firms facing uncertainty or shrinking earnings may trade at a discount.

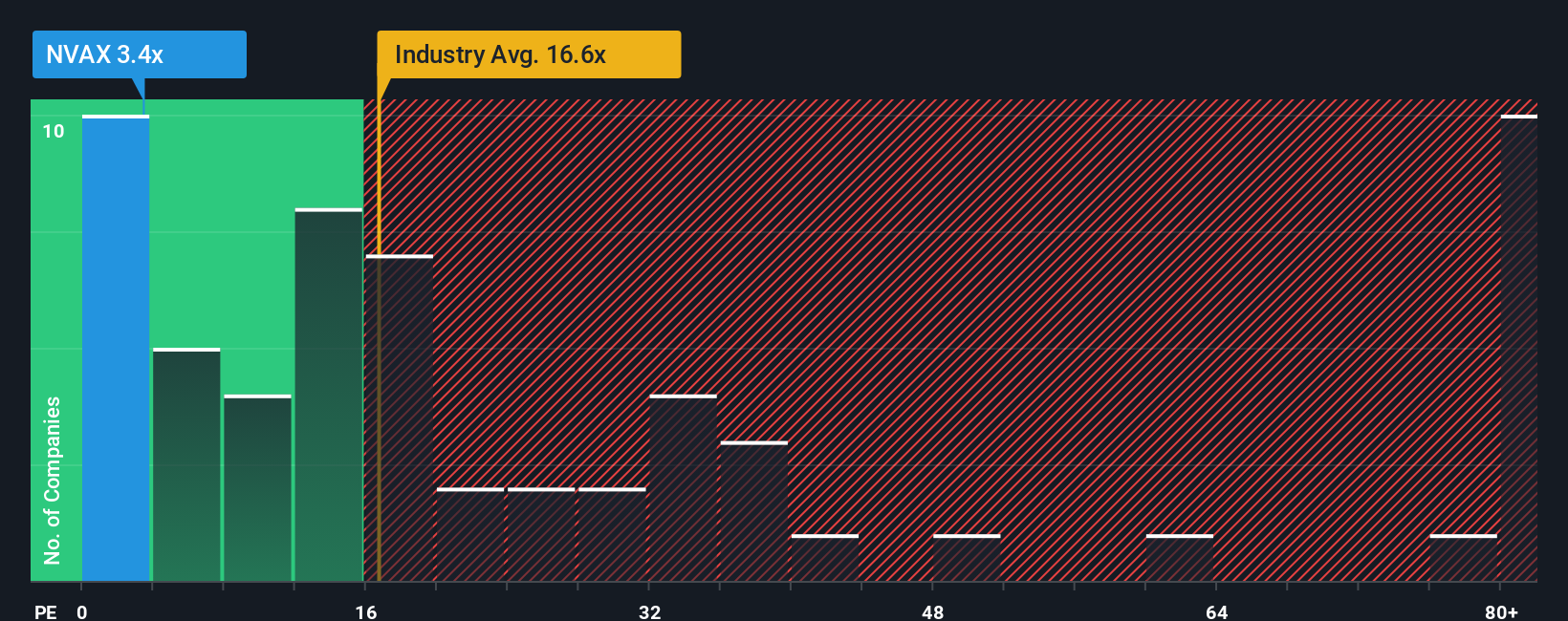

Novavax currently trades at a strikingly low PE ratio of 3.1x. This is far below the biotech industry average of 15.3x and much lower than the average PE of its peers, which sits around 54.6x. However, rather than simply comparing these benchmarks, Simply Wall St uses a proprietary “Fair Ratio” to estimate where Novavax’s PE should be, factoring in growth prospects, industry trends, profit margins, market cap, and specific risks. For Novavax, this Fair Ratio comes out to 8.5x, reflecting the company’s unique combination of opportunity and challenges. With Novavax’s PE ratio well below this mark, the stock appears undervalued on this metric. Investors should always weigh the broader risk factors alongside headline multiples.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Novavax Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future, reflecting the “why” behind your numbers. It is where you connect your assumptions about future revenue, margins, and growth to a fair value estimate and an investment thesis.

In other words, Narratives provide the bridge between what you believe about Novavax’s business outlook and the numbers you see. This lets you align financial forecasts and a resulting fair value with real-world events. On Simply Wall St’s Community page (trusted by millions of investors), Narratives are an easy-to-use tool for capturing your thinking and automatically updating your fair value estimates when new data, news, or earnings are released.

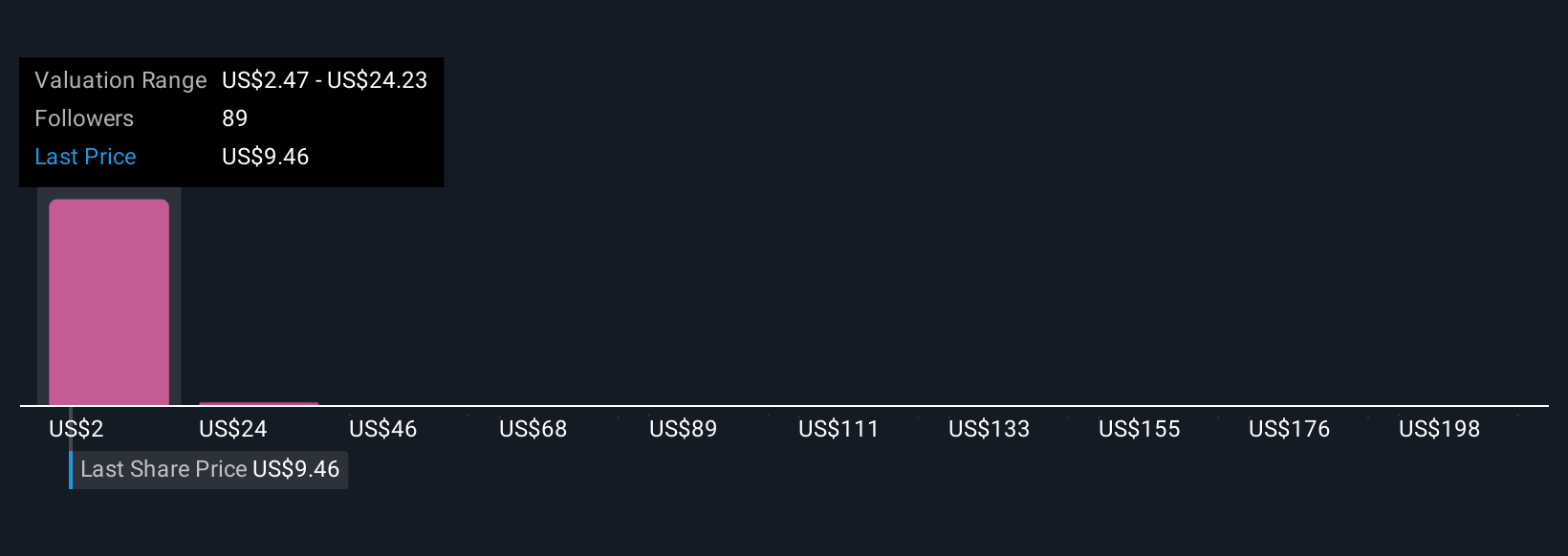

This helps you evaluate whether you think Novavax is a buy or sell at its current market price compared to your own fair value, or measure how your view stacks up against other investors. For example, some see a bullish scenario where Novavax's fair value is as high as $25.00 if key partnerships and platform launches succeed, while others assign a more cautious value of $6.00 given significant execution and regulatory risks. Narratives put these perspectives at your fingertips and make it easier to take action with confidence.

Do you think there's more to the story for Novavax? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026