- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX): Assessing Valuation as Investors Weigh Recent Volatility and Shifting Outlook

Reviewed by Simply Wall St

Novavax (NVAX) shares have experienced recent volatility, drawing attention from investors curious about the stock’s direction. As market participants digest performance over the past month, the broader outlook for the biotech remains a topic of discussion.

See our latest analysis for Novavax.

Over the past year, Novavax shares have shown significant volatility as sentiment has swung between optimism about growth potential and concerns over risk. While the 90-day share price return sits at a solid 14.1%, the one-year total shareholder return is down 12.6%, which reflects lingering caution among investors despite recent momentum.

If you’re interested in discovering more opportunities beyond the latest biotech shifts, now is a great time to explore See the full list for free.

With shares trading well below analyst targets, but profitability and revenue trending lower, investors now face a pivotal question: is Novavax offering a genuine bargain, or has the market already priced in its prospects for future growth?

Most Popular Narrative: 35.5% Undervalued

Novavax’s most-followed narrative points to a fair value of $13.21, significantly above the latest close of $8.52. This gap has sparked debate around whether the current price reflects hidden potential or persistent risks.

Ongoing cost optimization and the shift to a leaner, partnership-focused operational model, with substantial selling, general and administrative reductions and Sanofi absorbing additional costs, position Novavax for improved gross and net margins. This is expected to support an accelerated path to sustained profitability and stronger long-term earnings.

Will a streamlined business model rewrite Novavax’s profit story? The narrative hinges on dramatic swings in margins and the business’s ability to unlock new recurring income. Discover which expectations about future efficiency and royalty growth drive this valuation stamp.

Result: Fair Value of $13.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in new partnerships or disappointing demand for key vaccines could quickly undermine the outlook and challenge the current bullish valuation narrative.

Find out about the key risks to this Novavax narrative.

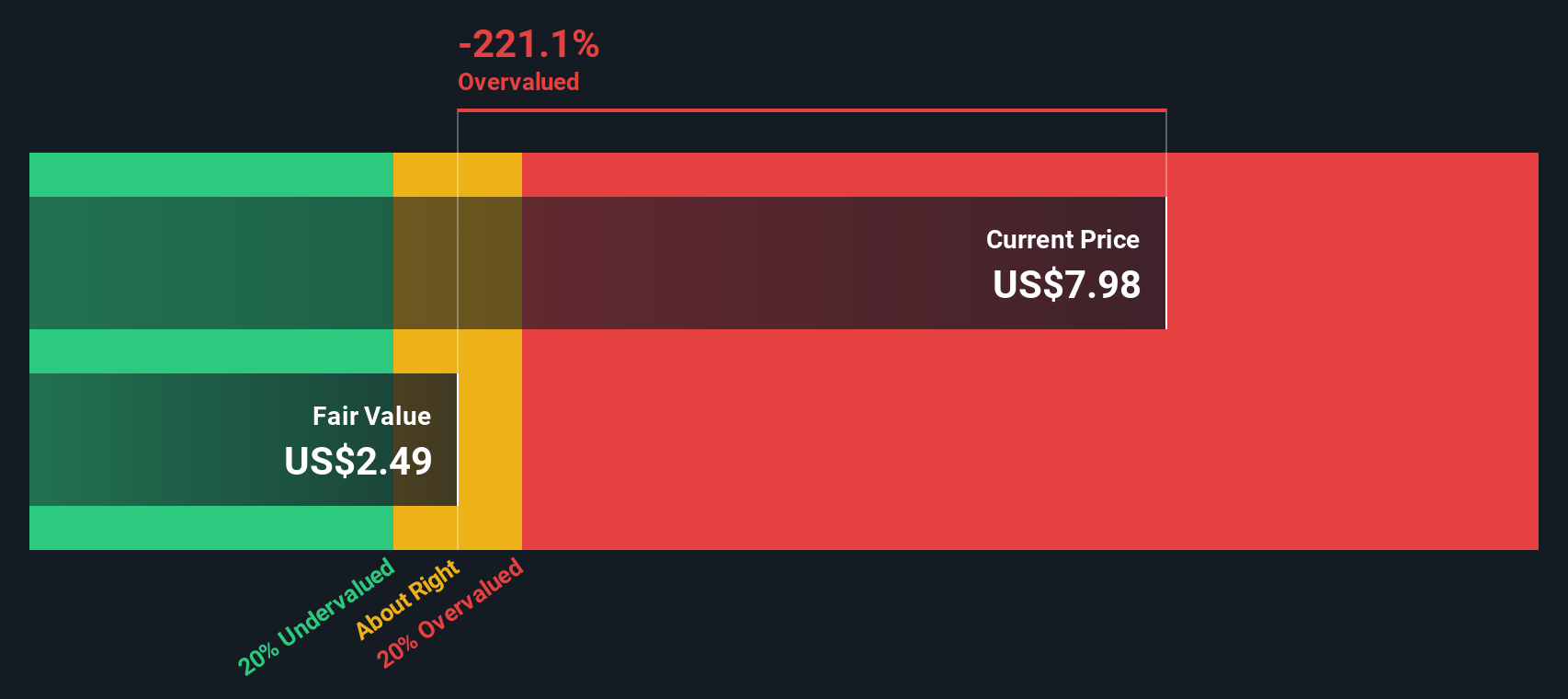

Another View: Discounted Cash Flow Model

While the consensus price target values Novavax well above its current share price, the SWS DCF model offers a contrasting perspective. According to this approach, Novavax is actually trading significantly above its estimated fair value. This raises questions about whether the market is still too optimistic despite recent challenges.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novavax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novavax Narrative

If you see the numbers differently or want to test your own assumptions, you can dive into the data and shape your own story in just a few minutes. Do it your way

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Every market shift brings new opportunities. Don’t miss the chance to get ahead by arming yourself with fresh strategies and untapped prospects using these smart screeners:

- Tap into future tech and unlock hidden potential with these 27 AI penny stocks driving artificial intelligence innovation across industries.

- Find steady income streams by targeting these 17 dividend stocks with yields > 3%, which offers reliable yields over 3% and is perfect for boosting your portfolio’s resilience.

- Catch tomorrow’s discounted winners by pouncing on these 873 undervalued stocks based on cash flows before others spot their true value and the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives