- United States

- /

- Biotech

- /

- NasdaqGS:NUVL

Nuvalent (NUVL) Valuation After FDA Breakthrough Designation and Investor Optimism in Lung Cancer Franchise

Reviewed by Simply Wall St

Nuvalent (NUVL) has been on investors radar after the FDA accepted its New Drug Application for Zide with Breakthrough Therapy Designation, a key step that could accelerate its lung cancer franchise.

See our latest analysis for Nuvalent.

Despite a small pullback in the latest session, Nuvalent’s roughly 13 percent 1 month share price return and robust 3 year total shareholder return of about 225 percent suggest momentum is still building around its growing lung cancer pipeline and recent financing.

If Nuvalent’s story has caught your attention, this could be a good moment to explore other innovative names in healthcare via healthcare stocks and see what else is emerging on investors radar.

With shares already up strongly and analysts’ targets sitting well above today’s price, the key question now is whether Nuvalent is still trading at a discount to its future lung cancer potential, or if markets are already pricing in that growth.

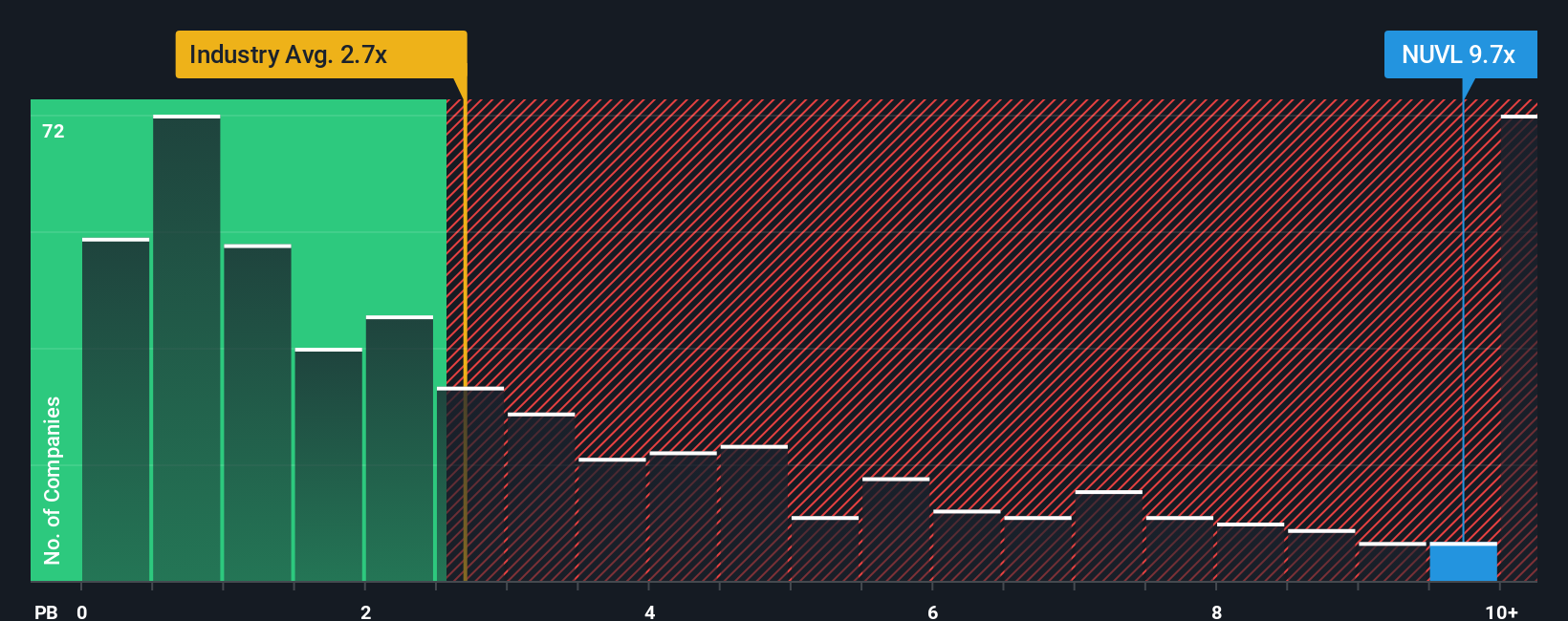

Price to Book of 9.7x: Is it justified?

Nuvalent last closed at $105.09, and on our preferred price to book lens, the stock screens as expensive versus much of the biotech space.

The price to book ratio compares a company’s market value to the accounting value of its net assets, a common yardstick for early stage biotechs that do not yet generate meaningful revenue or profits. For a clinical stage name like Nuvalent, a high price to book often reflects investor confidence that today’s R&D spend will translate into future commercial assets.

In Nuvalent’s case, the current price to book multiple of 9.7 times is well above the 2.8 times average across US biotech peers. This suggests investors are paying a substantial premium to get exposure to its oncology pipeline and anticipated revenue ramp. While our SWS DCF model suggests fair value of $57.21, implying the shares trade 84 percent above that estimate, the elevated price to book indicates the market is leaning heavily into the long term growth story rather than current fundamentals.

Compared with the broader US biotech industry, where most companies cluster at lower asset based valuations, Nuvalent’s 9.7 times price to book stands out as distinctly richer than the pack. This underlines how much optimism has already been embedded into the share price.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 9.7x (OVERVALUED)

However, setbacks in its clinical trials or a weaker than expected commercial launch for Zide could quickly challenge the premium currently embedded in Nuvalent’s valuation.

Find out about the key risks to this Nuvalent narrative.

Another View: Analyst Targets vs Today’s Price

While the price to book view flags Nuvalent as richly valued, analyst targets tell a more optimistic story. With consensus pointing to about $141.82, roughly 35 percent above the current $105.09 share price, the Street still sees room for upside if the pipeline delivers.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nuvalent for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nuvalent Narrative

If you see Nuvalent’s prospects differently or want to dive into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A great starting point for your Nuvalent research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused, data driven stock ideas that fit your strategy.

- Tap into potential multi baggers by scanning these 3590 penny stocks with strong financials for smaller companies whose fundamentals could support outsized long term returns.

- Ride the next wave of automation and smarter software by zeroing in on these 27 AI penny stocks shaping the future of intelligent technology.

- Secure a stronger income stream by targeting these 15 dividend stocks with yields > 3% that offer attractive yields backed by solid business profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvalent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NUVL

Nuvalent

A clinical-stage biopharmaceutical company, engages in the development of therapies for patients with cancer.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026