- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA): Assessing Valuation Potential as Shares Enter a Quiet Phase

Reviewed by Kshitija Bhandaru

Natera (NTRA) shares have seen modest movement during a relatively quiet period. This offers investors a chance to reassess the company’s fundamentals and consider how recent performance aligns with broader biotech trends.

See our latest analysis for Natera.

After gaining momentum earlier in the year, Natera’s share price has recently leveled out, reflecting a market more focused on long-term growth outlooks than short-term excitement. The 1-year total shareholder return remains robust, showing continued confidence in the company’s trajectory despite recent market quietness.

If you’re looking for the next opportunity in healthcare and biotech, consider exploring the field’s top movers and innovators with our curated list in See the full list for free..

With Natera trading below its analyst price target and showing impressive long-term returns, investors must ask whether recent quiet periods have made shares undervalued or if the market is already pricing in future growth potential.

Most Popular Narrative: 17.3% Undervalued

Natera’s most widely followed narrative suggests that its fair value is higher than the current share price, indicating potential upside if the narrative holds true. The last close was $160.21, while the narrative’s fair value is estimated at $193.80. This highlights a gap the market might be underestimating. Let’s look at a direct catalyst from this narrative that supports this view.

Investment in new product launches (e.g., Fetal Focus NIPT, Signatera Genome, AI-based biomarkers) and a robust R&D pipeline positions Natera to capture growth from long-term trends in personalized medicine and early detection, supporting future revenue expansion.

Want to know what’s powering this optimism? This narrative’s fair value is based on ambitious growth forecasts, rising margins, and a potential turnaround in profitability. Is there a bold earnings leap included in the analysis, or a focus on margin improvements that could make a significant difference? Find out which surprising assumptions are influencing this valuation.

Result: Fair Value of $193.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and heavy investment needs could delay profitability or hinder revenue growth. These factors present real risks to the current optimistic outlook.

Find out about the key risks to this Natera narrative.

Another View: What Do Market Ratios Say?

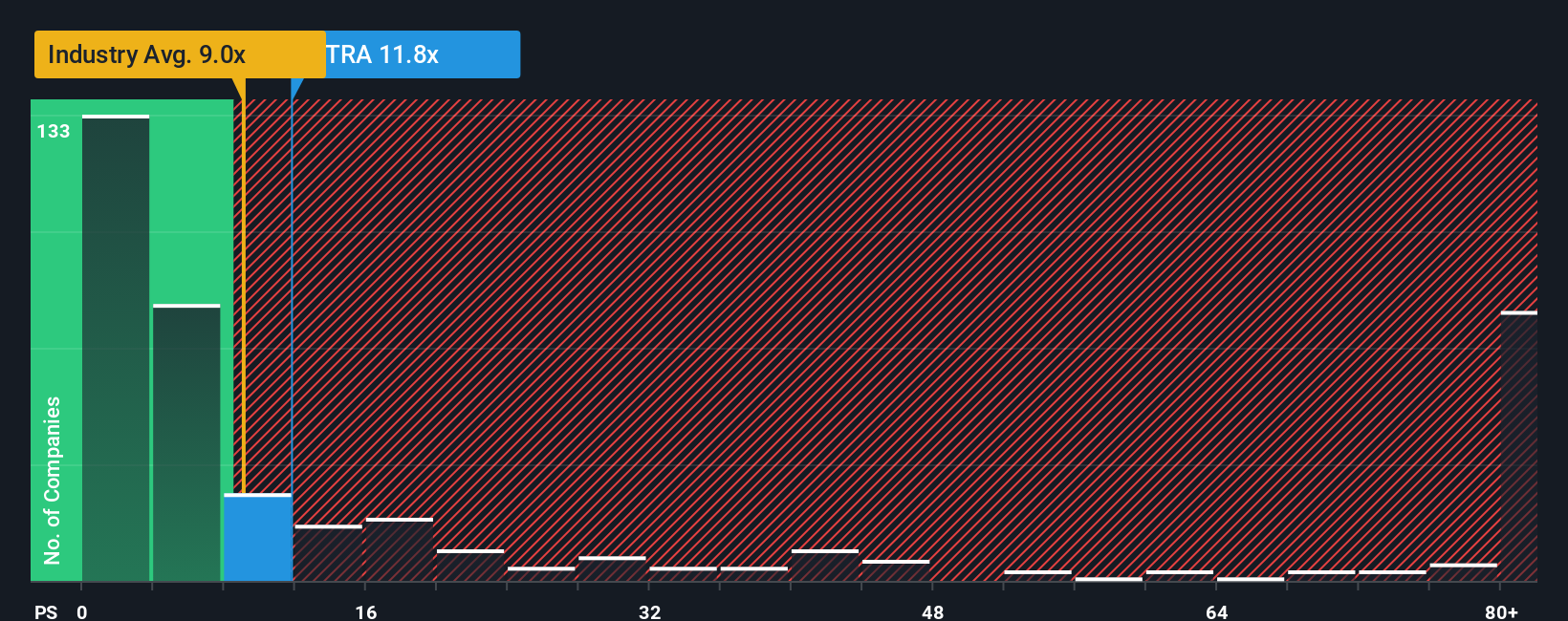

When we turn to market ratios, Natera looks expensive compared to its peers. Its price-to-sales ratio stands at 11.2x, notably above the US biotech industry average of 9.7x and the peer average of 6x. The fair ratio, based on market trends, is closer to 7.1x. This gap suggests valuation risk if investor sentiment changes. Are recent gains already priced in? Is there more upside left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If you want to challenge these assumptions or prefer to dive into the numbers yourself, it only takes a few minutes to craft your own perspective, Do it your way.

A great starting point for your Natera research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next big mover to pass you by. Take control of your portfolio and identify unique opportunities using the Simply Wall Street Screener today.

- Supercharge your growth strategy by tapping into the momentum of these 24 AI penny stocks that are shaping tomorrow’s digital landscape.

- Unlock new income streams and strengthen your financial foundation with these 19 dividend stocks with yields > 3% which offer yields above 3%.

- Stay ahead of the curve by identifying value gems among these 909 undervalued stocks based on cash flows that are trading at compelling prices based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives