- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NASDAQ:NTRA) Shareholders Have Enjoyed A Whopping 311% Share Price Gain

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. But when you hold the right stock for the right time period, the rewards can be truly huge. One bright shining star stock has been Natera, Inc. (NASDAQ:NTRA), which is 311% higher than three years ago. Better yet, the share price has risen 11% in the last week.

View our latest analysis for Natera

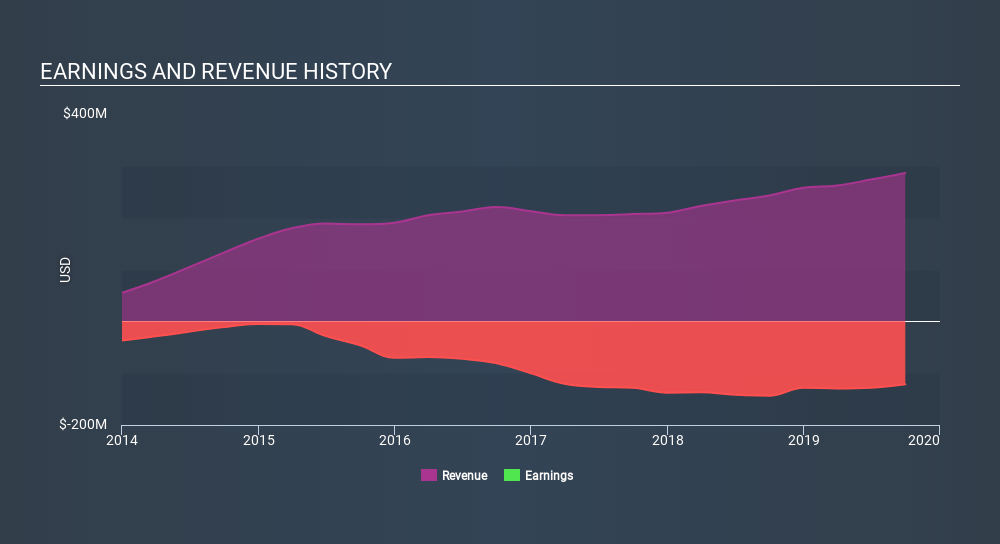

Natera wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Natera's revenue trended up 11% each year over three years. That's a very respectable growth rate. Some shareholders might think that the share price rise of 60% per year is a lucky result, considering the level of revenue growth. After a price rise like that many will have the business, and plenty of them will be wondering whether the price moved too high, too fast.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Natera

A Different Perspective

We're pleased to report that Natera rewarded shareholders with a total shareholder return of 169% over the last year. That gain actually surpasses the 60% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Natera that you should be aware of.

But note: Natera may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives