- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Is Natera’s Rally Justified After Soaring 58.5% on Genetic Testing Breakthroughs?

Reviewed by Bailey Pemberton

Natera stock has captured a lot of attention lately and for good reason. If you’re holding shares or considering jumping in, you’ve probably noticed the numbers don’t lie: up 17.1% year-to-date, a huge 58.5% in the past year, and an astonishing 305.9% return over just the last three years. That kind of trajectory can make anyone wonder if this is just the beginning or if the best gains are in the rearview mirror.

Much of this momentum has come on the heels of breakthroughs in genetic testing, increased adoption across major healthcare systems, and industry-wide optimism about precision medicine. Investors’ optimism seems to have gained even more ground as Natera expanded its partnerships and announced new product validations, leading some to believe there could be plenty of growth left to realize. At the same time, a subtle shift in risk perception is playing out beneath the surface as markets react to Natera’s strategic positioning and potential leadership in its space.

But here’s the key question: with all this enthusiasm swirling around, is Natera’s stock truly undervalued, or is the market already pricing in all those exciting prospects? Based on six standard valuation checks, Natera currently earns a value score of zero out of six, suggesting there’s little evidence of undervaluation right now. So, how should investors interpret that result, and are there better ways to measure value than what the numbers alone can tell us? In the next section, we’ll dig into the major valuation approaches and consider where they might fall short, with a look ahead to an even smarter perspective on determining Natera’s worth.

Natera scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Natera Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today, factoring in risk and the time value of money. For Natera, this model starts with its most recent Free Cash Flow of $104.8 million. Analysts expect this figure to climb steadily, with projections reaching $747 million by the end of 2029. Notably, cash flow estimates beyond 2029 are extrapolated by external sources due to limited analyst forecasts.

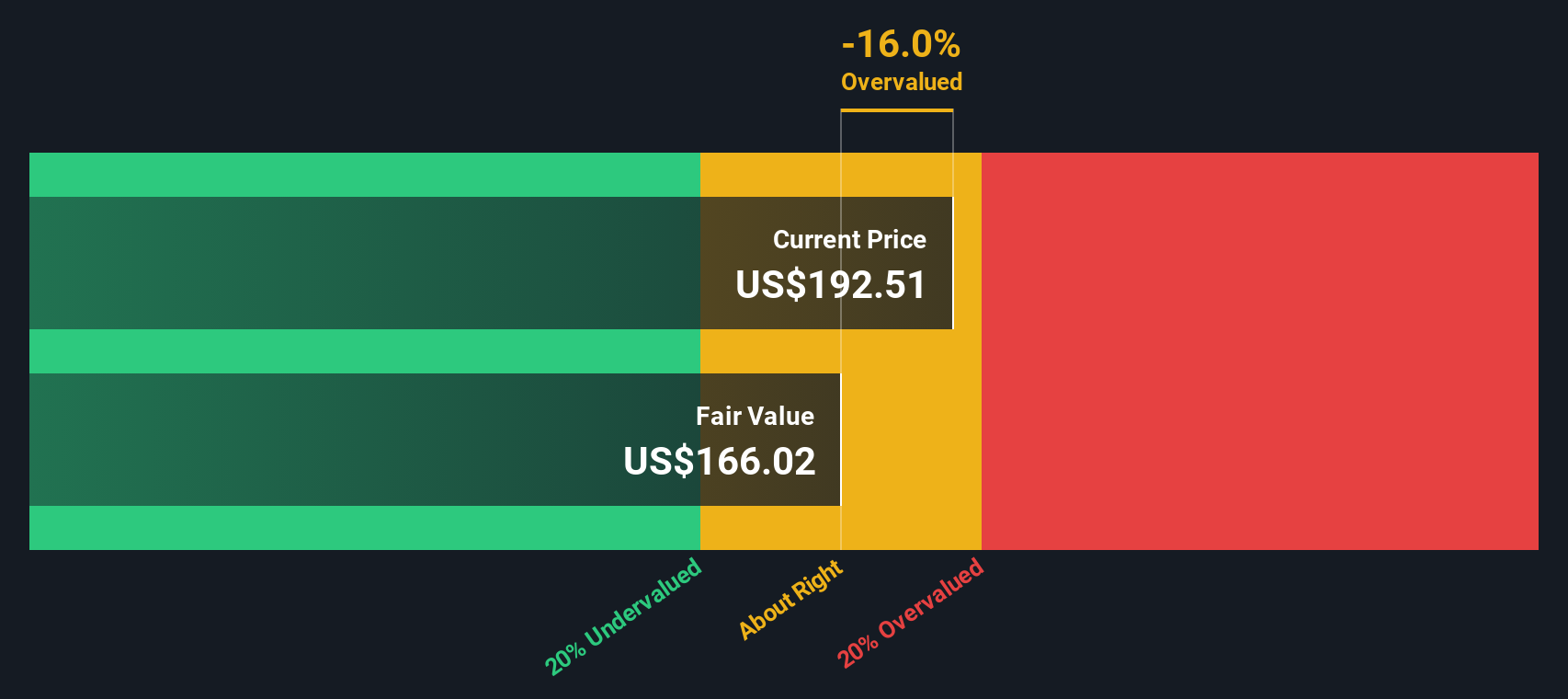

The DCF approach used here is the 2 Stage Free Cash Flow to Equity model, which incorporates both analyst projections and longer-term growth assumptions. Using these projections, the model arrives at an estimated intrinsic value for Natera of $165.90 per share. However, according to the DCF model, this price implies the stock is about 13.3% overvalued at its current market price.

For investors, this means the market is already including a fair amount of optimism regarding Natera’s growth prospects. From a purely cash flow perspective, the current share price sits above what the fundamentals alone would suggest is fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Natera may be overvalued by 13.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Natera Price vs Sales (P/S)

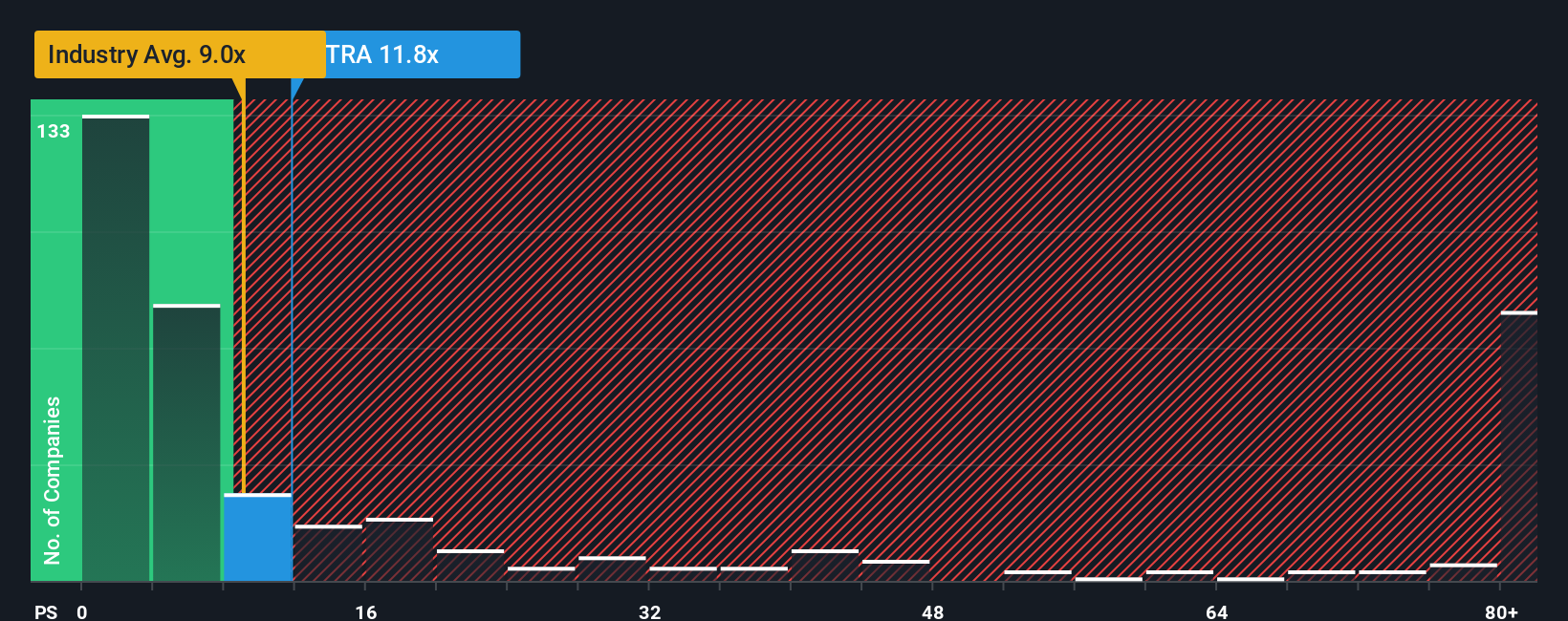

For companies like Natera that are not yet profitable, the Price-to-Sales (P/S) ratio is the preferred valuation metric. This multiple is especially relevant in growth industries like biotechnology, where profits often lag behind revenue growth due to heavy investments in research and expansion. Investors use P/S as a tool to compare how much they are paying for a dollar of sales, with the understanding that strong revenue growth could eventually translate into future profits.

Growth expectations and risk play a big role in shaping what is considered a “normal” P/S ratio. Fast-growing companies or those in innovative spaces often trade at higher P/S multiples, reflecting investors’ willingness to pay a premium for future potential. In contrast, high risk or slowing growth can depress what the market is willing to pay for each sales dollar.

Currently, Natera trades at a P/S ratio of 13.1x. This stands above both the biotech industry average of 10.8x and the peer average of 5.8x. At first glance, this suggests the stock is expensive compared to peers. However, Simply Wall St's proprietary Fair Ratio for Natera is 7.3x. Unlike a simple comparison with peers or industry averages, the Fair Ratio takes into account Natera’s revenue growth prospects, profit margin outlook, risk profile, and size to determine what multiple is justified for the business. This data-driven approach results in a more tailored and holistic view of value.

By comparing Natera's actual P/S of 13.1x to the Fair Ratio of 7.3x, it is clear the stock trades well above what is considered fair given its fundamentals, growth, and risks.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Natera Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a user-friendly framework that lets you connect your outlook on a company—its story, future prospects, or risks—to your own forecast for revenue, margins, and ultimately, a fair value estimate. Narratives take the numbers a step further by anchoring them to your big-picture perspective, so you can easily see how your own expectations for Natera might translate into a buy, hold, or sell decision.

Available on Simply Wall St’s Community page, Narratives empower millions of investors to stress-test their views by comparing their Fair Value estimate with Natera’s live market price, and then refine those forecasts as new earnings, clinical trial results, or major news updates are released. Narratives are dynamic and give you real-time context as new information emerges, so you are never making decisions in a vacuum.

For example, some Natera investors might believe molecular diagnostics and AI integration will drive rapid revenue and margin growth, leading them to set Fair Values as high as $268 per share. Others are more cautious, emphasizing regulatory risks and estimating Fair Value closer to $37. Narratives let you see, question, and adjust these scenarios based on what you think is most likely, enabling a sharper, more personal way to decide when to buy or sell.

Do you think there's more to the story for Natera? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives