- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

A Fresh Look at Natera (NTRA) Valuation After Launch of ARCHER Phase III Bladder Cancer Trial

Reviewed by Simply Wall St

Natera (NTRA) just made headlines by announcing the activation of the ARCHER phase III trial for muscle-invasive bladder cancer, a major step forward for its flagship Signatera molecular residual disease (MRD) test. With support from the National Cancer Institute and more than 100 sites participating across the U.S. and Canada, this trial puts Natera’s technology at the forefront of a rapidly evolving therapeutic area. For investors watching the stock, this partnership signals a direct pipeline to major clinical adoption, which could reshape the company’s trajectory if successful.

This move seems to have sparked renewed attention for Natera’s shares. Over the past year, the stock is up 42%, momentum that sits on top of its impressive three-year gain. Despite a drop in the past week, Natera’s shares have advanced more than 10% in the last month, showing that enthusiasm around clinical progress is still very much alive. The ongoing conversation around commercial adoption and further conference presentations, like the upcoming Morgan Stanley Healthcare Conference, only add to the sense that something important could be in the works.

After such a run and the excitement around new trials, the big question is whether Natera is attractively valued, or is the market already baking all this future growth into the current price?

Most Popular Narrative: 15.7% Undervalued

According to the most widely followed narrative, Natera appears undervalued, with the current share price trading at a notable discount to fair value based on analyst expectations for future earnings and revenue growth.

Investment in new product launches (e.g., Fetal Focus NIPT, Signatera Genome, AI-based biomarkers) and a robust R&D pipeline positions Natera to capture growth from long-term trends in personalized medicine and early detection. This underpins future revenue expansion.

Want the full inside story behind this valuation? The narrative’s bold fair value hinges on ambitious growth and margin assumptions, setting the stage for potentially dramatic moves ahead. What exactly are analysts betting on to justify this price? The numbers backing up their conviction may surprise you.

Result: Fair Value of $198.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory hurdles and the heavy spending needed for new trials could easily derail Natera's promising long-term growth story.

Find out about the key risks to this Natera narrative.Another View: Market-Based Comparison Tells a Different Story

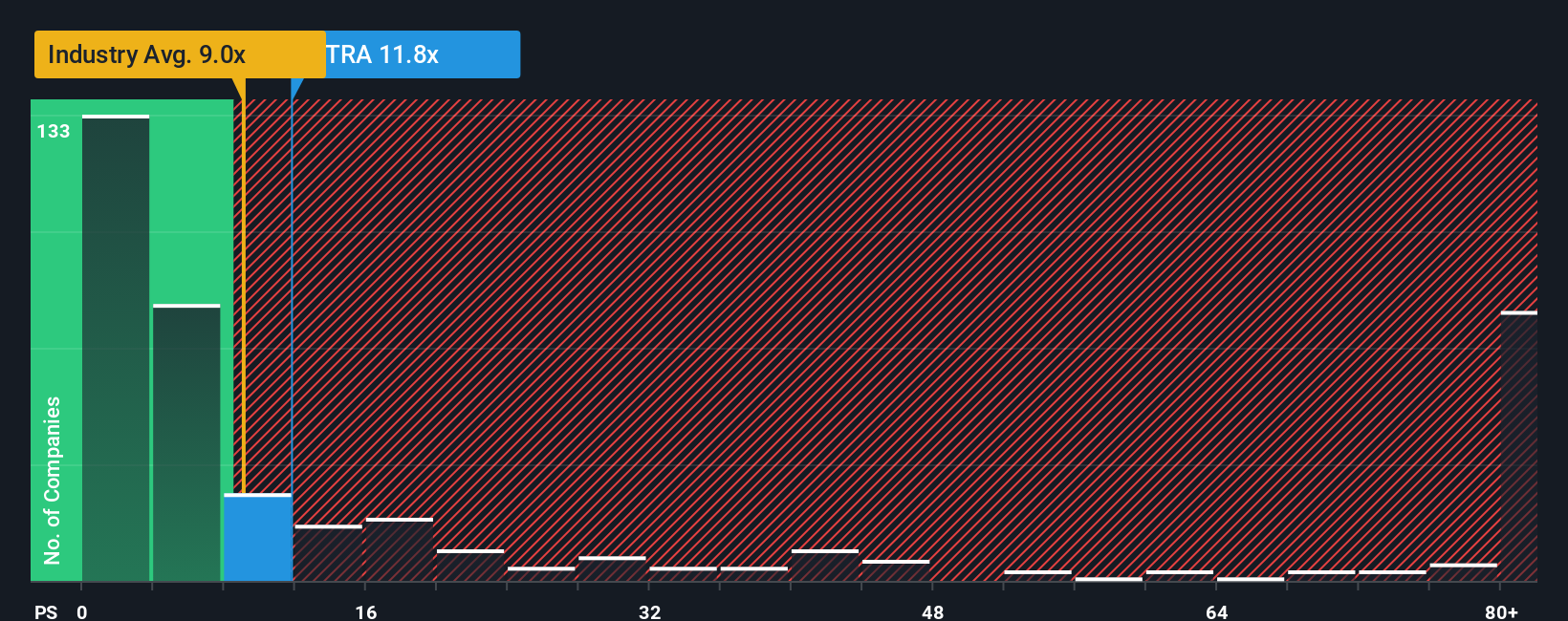

Switching gears, a look at the market-based comparison suggests Natera is trading at a price well above what is typical for its industry. This clashes with the earlier optimistic case and raises a key question: which view will win out?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Natera to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Natera Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily craft your own interpretation in just a few minutes. Do it your way

A great starting point for your Natera research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

Don't let great opportunities pass you by. Simply Wall Street's tools can match you with sectors bubbling with potential and fresh ideas for your portfolio. See what you could be missing out on right now:

- Unlock up-and-coming market disruptors that have strong financial foundations by checking out penny stocks with strong financials.

- Capture yield potential from companies offering robust dividends, all vetted for quality with dividend stocks with yields > 3%.

- Seize undervalued plays based on cash flows before the crowd spots them. Start your search with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives