- United States

- /

- Biotech

- /

- NasdaqGM:NRIX

What Nurix Therapeutics, Inc.'s (NASDAQ:NRIX) 26% Share Price Gain Is Not Telling You

The Nurix Therapeutics, Inc. (NASDAQ:NRIX) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

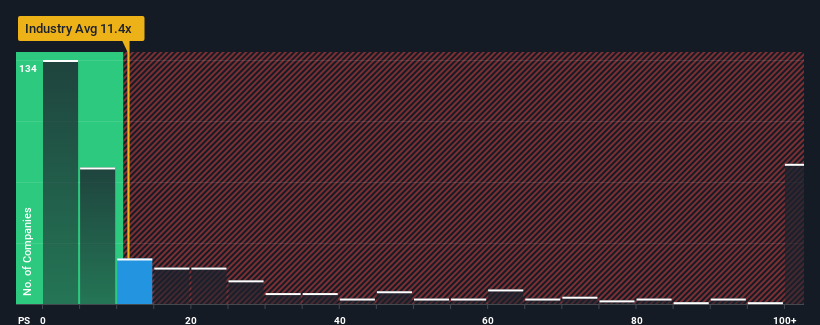

Even after such a large jump in price, there still wouldn't be many who think Nurix Therapeutics' price-to-sales (or "P/S") ratio of 11.4x is worth a mention when it essentially matches the median P/S in the United States' Biotechs industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Nurix Therapeutics

What Does Nurix Therapeutics' P/S Mean For Shareholders?

Nurix Therapeutics' revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Nurix Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nurix Therapeutics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 94%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 3.4% per year as estimated by the ten analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 209% each year, which is noticeably more attractive.

With this information, we find it interesting that Nurix Therapeutics is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Nurix Therapeutics' P/S?

Nurix Therapeutics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Nurix Therapeutics' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you take the next step, you should know about the 4 warning signs for Nurix Therapeutics (1 is concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nurix Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NRIX

Nurix Therapeutics

A clinical stage biopharmaceutical company, focuses on the discovery, development, and commercialization of small molecule and antibody therapies for the treatment of cancer, inflammatory conditions, and other diseases.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives