- United States

- /

- Life Sciences

- /

- NasdaqCM:NOTV

Positive Sentiment Still Eludes Inotiv, Inc. (NASDAQ:NOTV) Following 29% Share Price Slump

Unfortunately for some shareholders, the Inotiv, Inc. (NASDAQ:NOTV) share price has dived 29% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

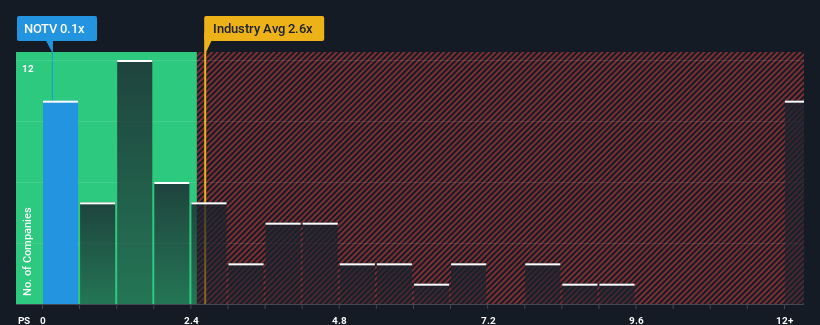

After such a large drop in price, Inotiv's price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Life Sciences industry in the United States, where around half of the companies have P/S ratios above 2.6x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Our free stock report includes 5 warning signs investors should be aware of before investing in Inotiv. Read for free now.View our latest analysis for Inotiv

What Does Inotiv's P/S Mean For Shareholders?

Inotiv hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inotiv.Is There Any Revenue Growth Forecasted For Inotiv?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Inotiv's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 205% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 6.6% per annum during the coming three years according to the three analysts following the company. With the industry predicted to deliver 6.8% growth per annum, the company is positioned for a comparable revenue result.

With this information, we find it odd that Inotiv is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Inotiv's P/S

Inotiv's P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Inotiv remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you settle on your opinion, we've discovered 5 warning signs for Inotiv (2 are significant!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NOTV

Inotiv

Provides nonclinical and analytical drug discovery and development services to the pharmaceutical and medical device industries in the United States, the Netherlands, and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives