- United States

- /

- Life Sciences

- /

- NasdaqCM:NOTV

Market Cool On Inotiv, Inc.'s (NASDAQ:NOTV) Revenues Pushing Shares 32% Lower

To the annoyance of some shareholders, Inotiv, Inc. (NASDAQ:NOTV) shares are down a considerable 32% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

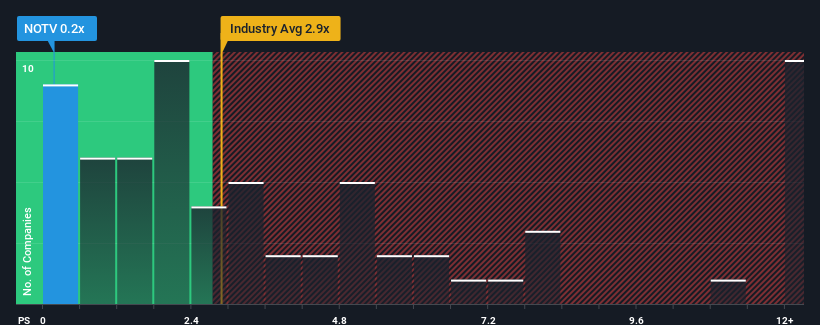

After such a large drop in price, Inotiv may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 2.9x and even P/S higher than 6x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Inotiv

How Inotiv Has Been Performing

Inotiv hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Inotiv's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Inotiv?

The only time you'd be truly comfortable seeing a P/S as depressed as Inotiv's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 205% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 6.8% per annum over the next three years. With the industry predicted to deliver 6.5% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Inotiv's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Inotiv's P/S Mean For Investors?

Inotiv's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Inotiv's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Inotiv (2 make us uncomfortable!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NOTV

Inotiv

Provides nonclinical and analytical drug discovery and development services to the pharmaceutical and medical device industries in the United States, the Netherlands, and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives