- United States

- /

- Life Sciences

- /

- NasdaqCM:NOTV

Inotiv, Inc. (NASDAQ:NOTV) Stock Rockets 61% But Many Are Still Ignoring The Company

Those holding Inotiv, Inc. (NASDAQ:NOTV) shares would be relieved that the share price has rebounded 61% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

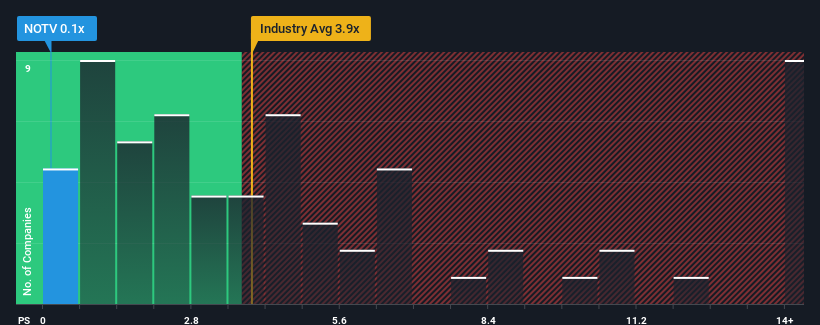

Although its price has surged higher, Inotiv may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.9x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Inotiv

How Has Inotiv Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Inotiv has been doing quite well of late. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Inotiv will help you uncover what's on the horizon.How Is Inotiv's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Inotiv's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.5% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 3.7% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 4.8% per year, which is not materially different.

With this in consideration, we find it intriguing that Inotiv's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Inotiv's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Inotiv's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You need to take note of risks, for example - Inotiv has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NOTV

Inotiv

Provides nonclinical and analytical drug discovery and development services to the pharmaceutical and medical device industries in the United States, the Netherlands, and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives