- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Some Nektar Therapeutics (NASDAQ:NKTR) Shareholders Look For Exit As Shares Take 35% Pounding

Nektar Therapeutics (NASDAQ:NKTR) shares have retraced a considerable 35% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 108%.

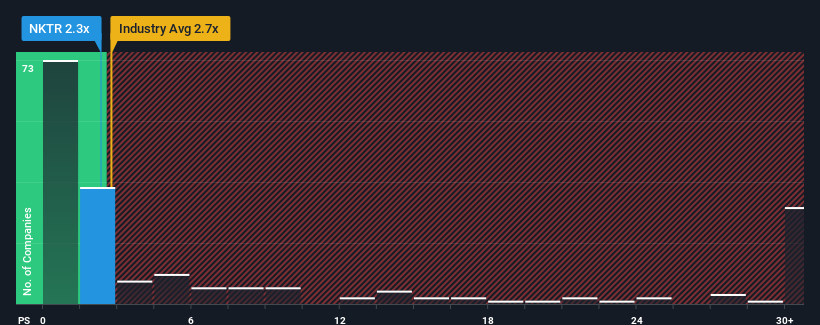

In spite of the heavy fall in price, there still wouldn't be many who think Nektar Therapeutics' price-to-sales (or "P/S") ratio of 2.3x is worth a mention when the median P/S in the United States' Pharmaceuticals industry is similar at about 2.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Nektar Therapeutics

How Nektar Therapeutics Has Been Performing

Nektar Therapeutics could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Nektar Therapeutics will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Nektar Therapeutics?

The only time you'd be comfortable seeing a P/S like Nektar Therapeutics' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 28% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 4.6% per annum during the coming three years according to the five analysts following the company. With the industry predicted to deliver 17% growth per annum, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Nektar Therapeutics' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

With its share price dropping off a cliff, the P/S for Nektar Therapeutics looks to be in line with the rest of the Pharmaceuticals industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of Nektar Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You should always think about risks. Case in point, we've spotted 3 warning signs for Nektar Therapeutics you should be aware of.

If these risks are making you reconsider your opinion on Nektar Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders.

Excellent balance sheet and fair value.