- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Is Nektar Therapeutics (NASDAQ:NKTR) In A Good Position To Invest In Growth?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Nektar Therapeutics (NASDAQ:NKTR) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Nektar Therapeutics

SWOT Analysis for Nektar Therapeutics

- Currently debt free.

- No major weaknesses identified for NKTR.

- Forecast to reduce losses next year.

- Good value based on P/S ratio compared to estimated Fair P/S ratio.

- Has less than 3 years of cash runway based on current free cash flow.

- Not expected to become profitable over the next 3 years.

How Long Is Nektar Therapeutics' Cash Runway?

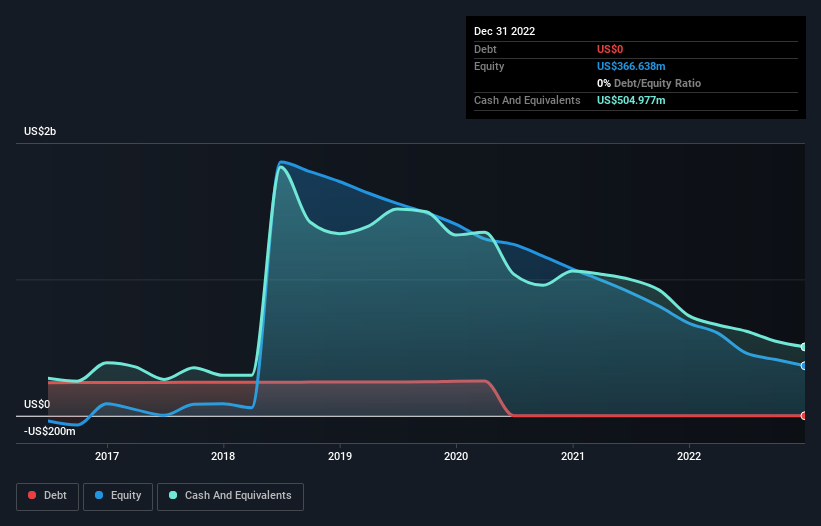

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at December 2022, Nektar Therapeutics had cash of US$505m and no debt. Looking at the last year, the company burnt through US$310m. So it had a cash runway of approximately 20 months from December 2022. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. Importantly, if we extrapolate recent cash burn trends, the cash runway would be a lot longer. You can see how its cash balance has changed over time in the image below.

How Well Is Nektar Therapeutics Growing?

We reckon the fact that Nektar Therapeutics managed to shrink its cash burn by 28% over the last year is rather encouraging. But the revenue dip of 9.7% in the same period was a bit concerning. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Nektar Therapeutics Raise More Cash Easily?

Even though it seems like Nektar Therapeutics is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Nektar Therapeutics' cash burn of US$310m is about 188% of its US$165m market capitalisation. Given just how high that expenditure is, relative to the company's market value, we think there's an elevated risk of funding distress, and we would be very nervous about holding the stock.

Is Nektar Therapeutics' Cash Burn A Worry?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Nektar Therapeutics' cash burn reduction was relatively promising. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. On another note, Nektar Therapeutics has 3 warning signs (and 1 which is significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Nektar Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Excellent balance sheet slight.