- United States

- /

- Pharma

- /

- NasdaqGS:NGM

NGM Biopharmaceuticals, Inc.'s (NASDAQ:NGM) Business Is Trailing The Industry But Its Shares Aren't

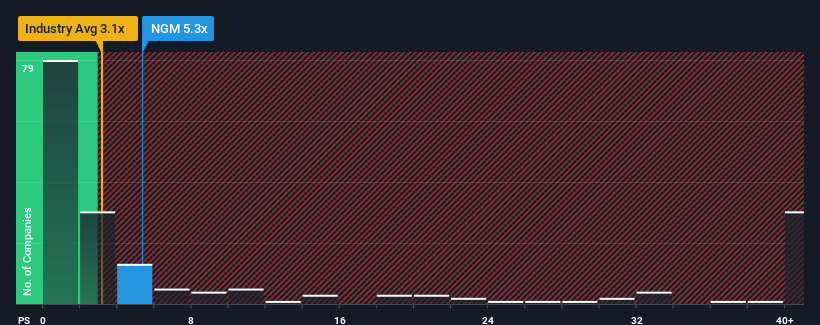

NGM Biopharmaceuticals, Inc.'s (NASDAQ:NGM) price-to-sales (or "P/S") ratio of 5.3x might make it look like a strong sell right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 3.1x and even P/S below 0.9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for NGM Biopharmaceuticals

What Does NGM Biopharmaceuticals' P/S Mean For Shareholders?

NGM Biopharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on NGM Biopharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

NGM Biopharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 29%. This means it has also seen a slide in revenue over the longer-term as revenue is down 47% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue growth is heading into negative territory, declining 31% per year over the next three years. Meanwhile, the broader industry is forecast to expand by 31% per annum, which paints a poor picture.

In light of this, it's alarming that NGM Biopharmaceuticals' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From NGM Biopharmaceuticals' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of NGM Biopharmaceuticals' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with NGM Biopharmaceuticals (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade NGM Biopharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NGM Biopharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NGM

NGM Biopharmaceuticals

NGM Biopharmaceuticals, Inc., a biopharmaceutical company, engages in the discovery and development of novel therapeutics to treat liver and metabolic diseases, retinal diseases, and cancer.

Flawless balance sheet with limited growth.