- United States

- /

- Capital Markets

- /

- NYSE:FRGE

3 US Penny Stocks With Market Caps Up To $400M

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs following Donald Trump's election victory, investors are keenly observing how different sectors and asset classes will perform under the new administration. Amidst this backdrop, penny stocks—often representing smaller or newer companies—remain a point of interest for those seeking unique investment opportunities. Though the term 'penny stock' might sound like a relic of past trading days, these stocks can still offer significant growth potential when backed by solid financials and strategic positioning in today's evolving market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80735 | $5.81M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.05B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.59 | $588.6M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $173.78M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.50 | $129.74M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.26 | $9.77M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.9606 | $50.3M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $91.21M | ★★★★☆☆ |

Click here to see the full list of 750 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Paysign (NasdaqCM:PAYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Paysign, Inc. offers prepaid card programs, patient affordability solutions, digital banking services, and integrated payment processing for businesses, consumers, and government entities with a market cap of $203.52 million.

Operations: Paysign, Inc. has not reported any specific revenue segments at this time.

Market Cap: $203.52M

Paysign, Inc. has demonstrated strong financial performance with significant earnings growth of 420.5% over the past year, surpassing industry averages. The company is debt-free, with short-term assets exceeding both short and long-term liabilities, contributing to financial stability. Recent earnings reports show a rise in revenue and net income compared to the previous year, reflecting high-quality past earnings and improved profit margins from 3.5% to 14.3%. Despite this positive trajectory, insider selling over the last quarter may warrant caution for potential investors considering its inclusion in portfolios focused on penny stocks.

- Click to explore a detailed breakdown of our findings in Paysign's financial health report.

- Gain insights into Paysign's future direction by reviewing our growth report.

Nautilus Biotechnology (NasdaqGS:NAUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nautilus Biotechnology, Inc. is a development stage life sciences company focused on creating a platform technology to quantify and unlock the complexity of the proteome, with a market cap of approximately $331.49 million.

Operations: Currently, there are no reported revenue segments for this development stage life sciences company.

Market Cap: $331.49M

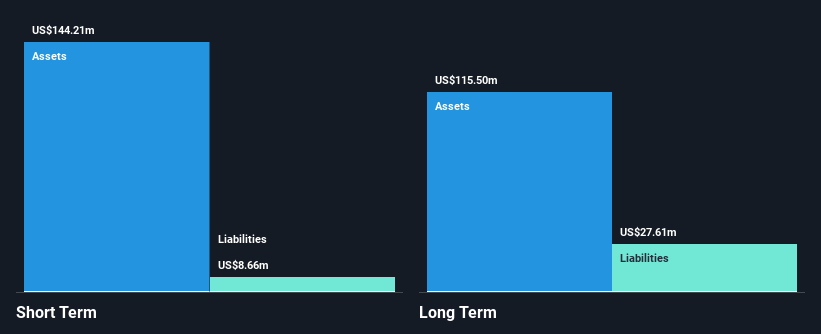

Nautilus Biotechnology is a pre-revenue company with a market cap of US$331.49 million, focused on developing proteome quantification technology. Despite having no significant revenue streams, the company maintains financial stability with short-term assets of US$144.2 million covering both its short and long-term liabilities. Nautilus remains debt-free and has a cash runway sufficient for over a year under current conditions. Recent earnings reports indicate continued net losses, which have increased compared to the previous year, while management changes include appointing an experienced Chief Marketing Officer to bolster strategic growth efforts amidst challenges like being dropped from the S&P Global BMI Index.

- Jump into the full analysis health report here for a deeper understanding of Nautilus Biotechnology.

- Assess Nautilus Biotechnology's future earnings estimates with our detailed growth reports.

Forge Global Holdings (NYSE:FRGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forge Global Holdings, Inc. operates a financial services platform in California and has a market cap of approximately $217.96 million.

Operations: The company generates revenue primarily from its Integrated Private Markets Service Provider segment, which accounted for $79.15 million.

Market Cap: $217.96M

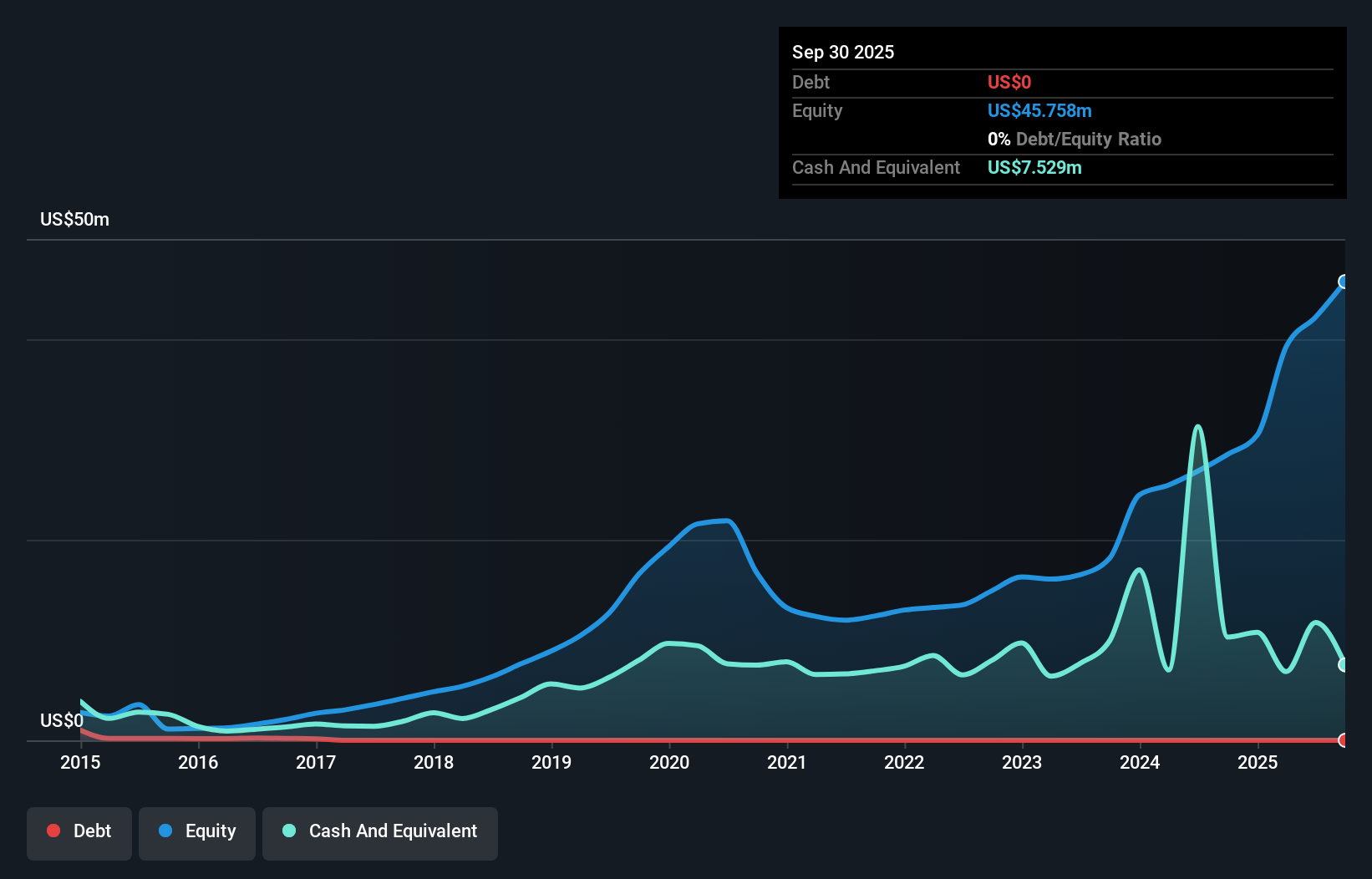

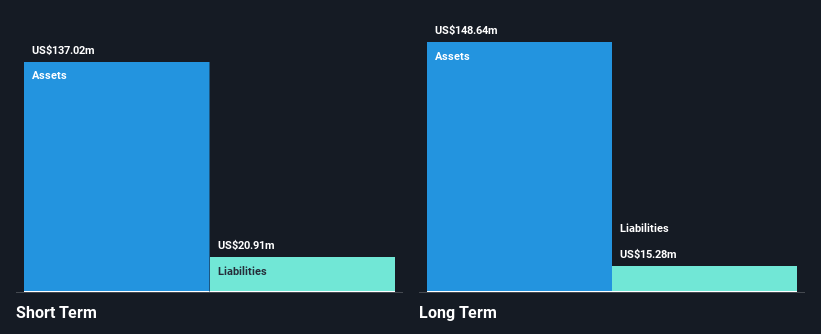

Forge Global Holdings, Inc. has a market cap of US$217.96 million and primarily generates revenue from its Integrated Private Markets Service Provider segment, reporting US$22.28 million for Q2 2024. Despite being debt-free with short-term assets of US$137 million covering liabilities, the company remains unprofitable with a negative return on equity and recent shareholder dilution by 5.1%. Management changes include the upcoming resignation of board member Blythe Masters in December 2024. Forge's cash runway extends beyond three years if free cash flow continues to decline at historical rates, but profitability is not expected within the next three years.

- Get an in-depth perspective on Forge Global Holdings' performance by reading our balance sheet health report here.

- Explore Forge Global Holdings' analyst forecasts in our growth report.

Where To Now?

- Click here to access our complete index of 750 US Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRGE

Forge Global Holdings

Operates a financial services platform in California.

Flawless balance sheet low.