- United States

- /

- Logistics

- /

- NasdaqCM:CRGO

3 US Penny Stocks Under $200M Market Cap To Consider

Reviewed by Simply Wall St

The U.S. stock market has recently experienced a surge to record highs, driven by significant gains in sectors such as banking and cryptocurrency following political developments. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area despite their somewhat outdated designation. These stocks can offer surprising value when backed by strong financial health, potentially providing opportunities for growth and stability in a fluctuating market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7995 | $5.81M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.06B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.58 | $603.4M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $170.21M | ★★★★★★ |

| Commercial Vehicle Group (NasdaqGS:CVGI) | $2.40 | $99.68M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.10 | $3.51M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.04 | $50.42M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.46 | $128.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.12 | $99.38M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Freightos (NasdaqCM:CRGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Freightos Limited operates a vendor-neutral booking and payment platform for international freight, with a market cap of $65.24 million.

Operations: The company generates revenue through two main segments: Platform, contributing $7.49 million, and Solutions, which brings in $13.89 million.

Market Cap: $65.24M

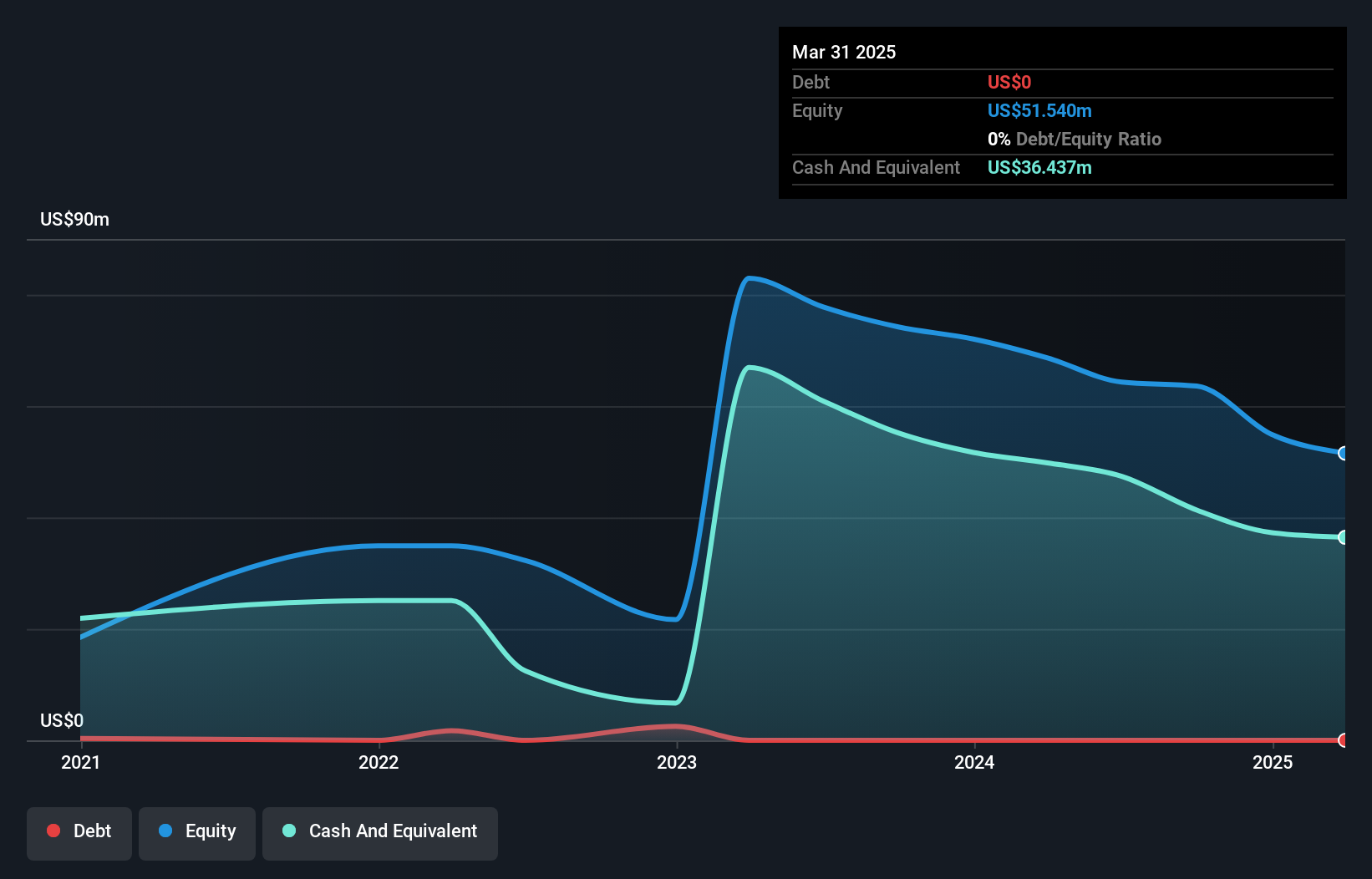

Freightos Limited, with a market cap of US$65.24 million, operates a digital platform for freight booking and payment. The company is unprofitable but shows potential with revenue from its Platform and Solutions segments. It recently expanded its WebCargo platform by integrating Pacific Air Cargo, enhancing service routes to Hawaii and the Pacific Islands. Freightos has no debt and maintains a stable cash runway exceeding three years. Despite management's experience, the board's short tenure suggests limited governance stability. Revenue forecasts indicate growth, yet ongoing losses highlight challenges in achieving profitability amidst industry competition.

- Unlock comprehensive insights into our analysis of Freightos stock in this financial health report.

- Review our growth performance report to gain insights into Freightos' future.

Lulu's Fashion Lounge Holdings (NasdaqGM:LVLU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lulu's Fashion Lounge Holdings, Inc. is an online retailer specializing in women's apparel, footwear, and accessories with a market cap of $55.08 million.

Operations: The company's revenue is primarily generated from its retail segment, amounting to $327.30 million.

Market Cap: $55.08M

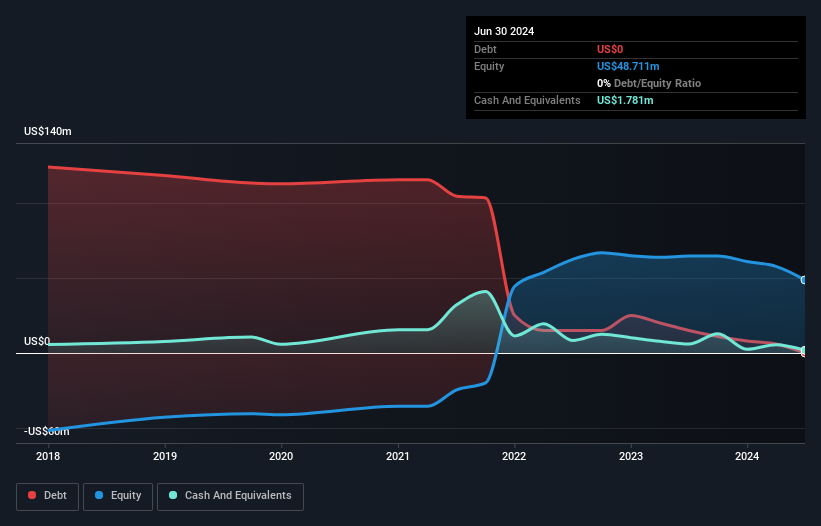

Lulu's Fashion Lounge Holdings, with a market cap of US$55.08 million, is currently unprofitable and has seen increasing losses over the past five years. Despite being debt-free and possessing sufficient cash runway for over three years, its short-term liabilities exceed its assets by US$16.8 million. Recent board restructuring aims to streamline operations, indicating a focus on cost reduction and governance improvement. Although the company expects third-quarter revenue between US$75 million and US$79 million—down from last year's figures—it continues share buybacks to bolster investor confidence amidst high stock volatility and shareholder dilution concerns.

- Dive into the specifics of Lulu's Fashion Lounge Holdings here with our thorough balance sheet health report.

- Gain insights into Lulu's Fashion Lounge Holdings' outlook and expected performance with our report on the company's earnings estimates.

PLAYSTUDIOS (NasdaqGM:MYPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PLAYSTUDIOS, Inc. develops and publishes free-to-play casual games for mobile and social platforms both in the United States and internationally, with a market cap of approximately $172.76 million.

Operations: The company's revenue primarily comes from its Playgames segment, generating $303.39 million, with an additional contribution of $0.003 million from Playawards.

Market Cap: $172.76M

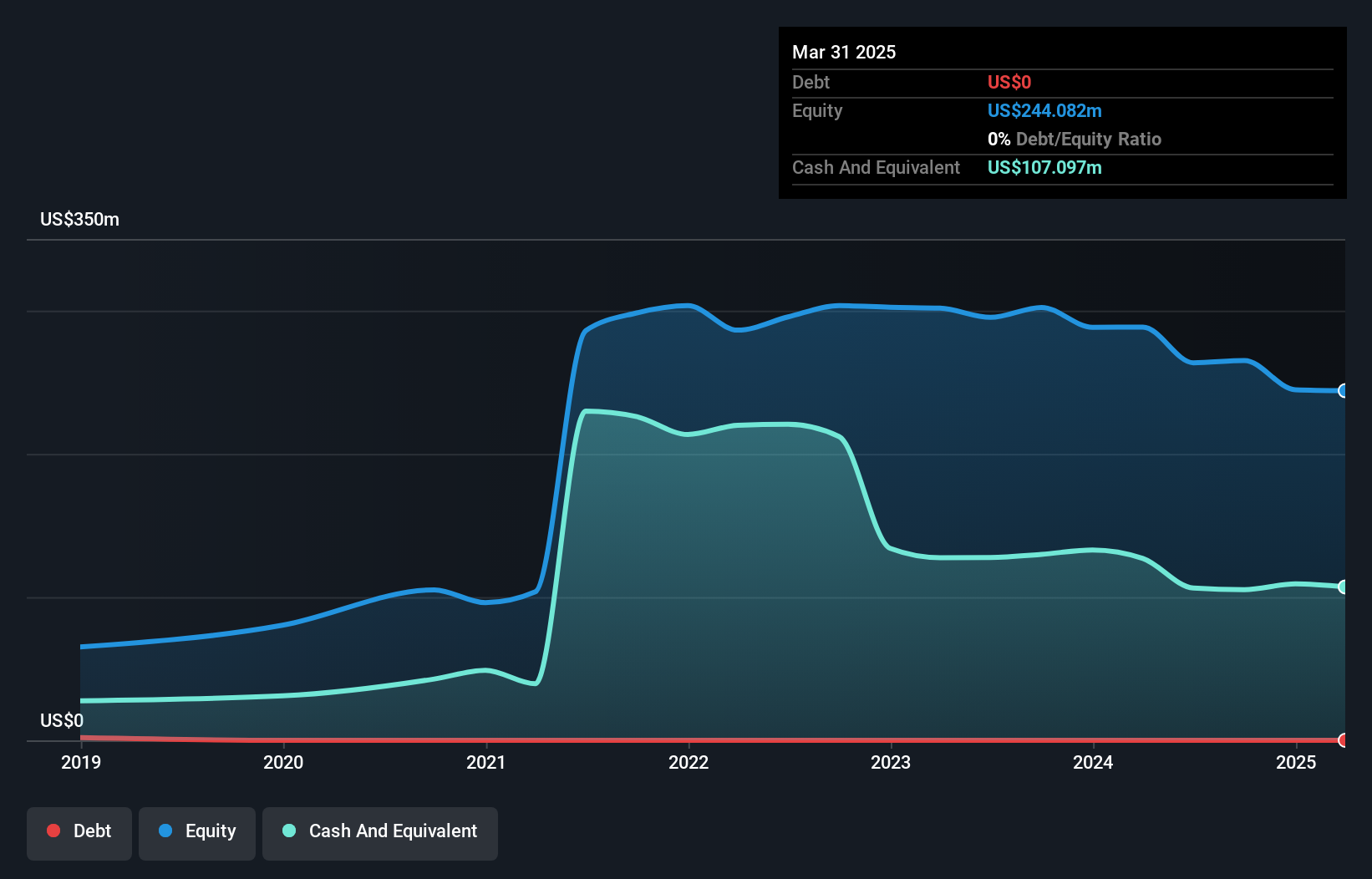

PLAYSTUDIOS, Inc., with a market cap of US$172.76 million, is currently unprofitable but debt-free, maintaining a stable weekly volatility of 8%. The company forecasts earnings growth of 73.44% annually and has sufficient cash runway for over three years despite shrinking free cash flow by 8.1% per year. Its short-term assets (US$147 million) comfortably cover both short-term (US$35.5 million) and long-term liabilities (US$34.4 million). Recent corporate guidance reaffirmed expected net revenue between US$285 to US$295 million for 2024, while ongoing share buybacks aim to support investor sentiment amidst financial challenges.

- Get an in-depth perspective on PLAYSTUDIOS' performance by reading our balance sheet health report here.

- Evaluate PLAYSTUDIOS' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Reveal the 755 hidden gems among our US Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CRGO

Freightos

Operates a vendor-neutral booking and payment platform for international freight.

Flawless balance sheet with limited growth.