- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

Could a Broader Clinic Footprint Boost Niagen Bioscience's (NAGE) Edge in Wellness Therapy?

Reviewed by Sasha Jovanovic

- Niagen Bioscience recently announced an expansion of its Niagen Plus product line through a partnership with iCRYO, making its pharmaceutical-grade Niagen IV and injection products available in over 900 clinics nationwide, including more than 50 new iCRYO locations.

- This broadening of clinic access reflects rising acceptance and demand for the company’s NAD+-enhancing healthspan products within the growing health and wellness sector.

- We'll explore how this expanded clinic distribution with iCRYO may influence Niagen Bioscience's long-term growth outlook and competitive positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Niagen Bioscience Investment Narrative Recap

For investors to be confident in Niagen Bioscience, they need to believe in the long-term growth of the NAD+ supplement market and the company’s ability to strengthen its presence through clinic and wellness channel partnerships like the recent iCRYO deal. While this expanded clinic access is a clear step forward, its immediate influence on earnings, seen as the main short-term catalyst, will likely depend on execution and uptake rather than just distribution reach. However, ongoing supply chain reliability for Niagen IV and injection products remains a significant risk to watch.

The company’s announcement in August 2025, raising its full-year revenue guidance to 22 to 27 percent growth, ties directly to recent business expansions like the iCRYO partnership. This reinforces the idea that execution on clinic rollouts could translate into stronger near-term financial results if Niagen delivers on distribution and demand. The contrast, however, lies in the company’s past experience with supply chain disruptions, which investors should be aware of as they consider the potential risks...

Read the full narrative on Niagen Bioscience (it's free!)

Niagen Bioscience's outlook anticipates $196.4 million in revenue and $33.0 million in earnings by 2028. This projection implies a 19.1% annual revenue growth rate and an $15.3 million earnings increase from current earnings of $17.7 million.

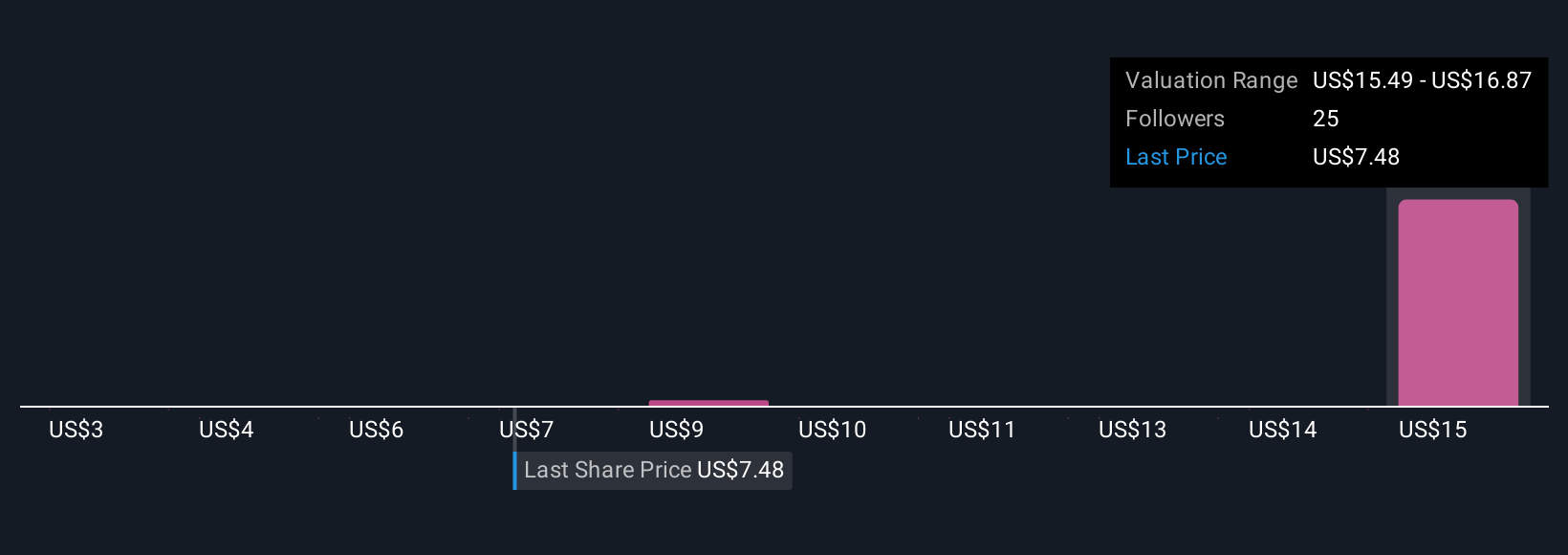

Uncover how Niagen Bioscience's forecasts yield a $16.04 fair value, a 131% upside to its current price.

Exploring Other Perspectives

Private estimates from seven Simply Wall St Community members span from US$3 to over US$17.58 per share, reflecting a broad debate on fair value. With the recent clinic expansion, your own view on growth and supply chain execution could make all the difference in how you see the company’s future.

Explore 7 other fair value estimates on Niagen Bioscience - why the stock might be worth less than half the current price!

Build Your Own Niagen Bioscience Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Niagen Bioscience research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Niagen Bioscience research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Niagen Bioscience's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives