- United States

- /

- Biotech

- /

- NasdaqGS:MYGN

The Myriad Genetics (NASDAQ:MYGN) Share Price Has Gained 53% And Shareholders Are Hoping For More

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Myriad Genetics, Inc. (NASDAQ:MYGN), which is up 53%, over three years, soundly beating the market return of 37% (not including dividends).

See our latest analysis for Myriad Genetics

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Myriad Genetics actually saw its earnings per share (EPS) drop 67% per year.

So we doubt that the market is looking to EPS for its main judge of the company's value. Given this situation, it makes sense to look at other metrics too.

It may well be that Myriad Genetics revenue growth rate of 4.6% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

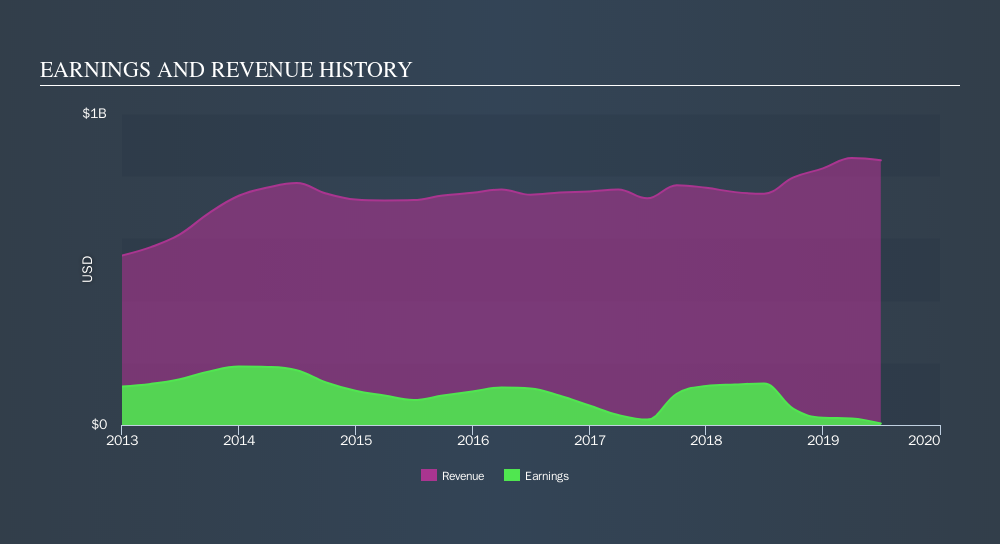

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Myriad Genetics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Myriad Genetics had a tough year, with a total loss of 32%, against a market gain of about 9.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3.4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Myriad Genetics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MYGN

Myriad Genetics

A molecular diagnostic testing and precision medicine company, develops and provides molecular tests in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives