- United States

- /

- Biotech

- /

- NasdaqGS:MYGN

Myriad Genetics, Inc. (NASDAQ:MYGN) Not Doing Enough For Some Investors As Its Shares Slump 31%

Myriad Genetics, Inc. (NASDAQ:MYGN) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 52% loss during that time.

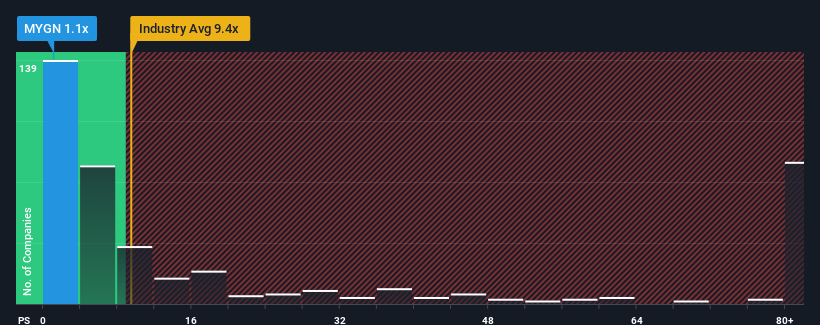

Following the heavy fall in price, Myriad Genetics' price-to-sales (or "P/S") ratio of 1.1x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 9.4x and even P/S above 55x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Myriad Genetics

How Has Myriad Genetics Performed Recently?

Myriad Genetics could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Myriad Genetics will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Myriad Genetics would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Revenue has also lifted 21% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 6.0% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 142% per year, which is noticeably more attractive.

With this information, we can see why Myriad Genetics is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Myriad Genetics have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Myriad Genetics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You always need to take note of risks, for example - Myriad Genetics has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MYGN

Myriad Genetics

A molecular diagnostic testing and precision medicine company, develops and provides molecular tests.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives