- United States

- /

- Biotech

- /

- OTCPK:MTEM

Need To Know: The Consensus Just Cut Its Molecular Templates, Inc. (NASDAQ:MTEM) Estimates For 2021

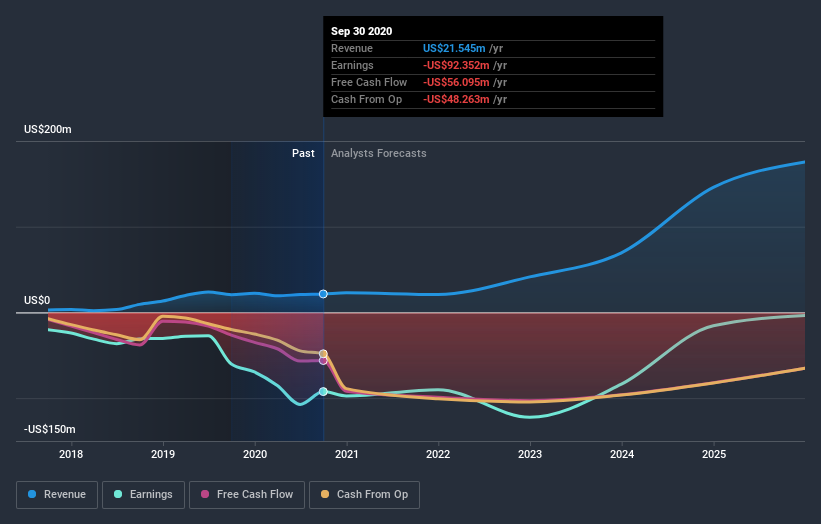

Today is shaping up negative for Molecular Templates, Inc. (NASDAQ:MTEM) shareholders, with the analysts delivering a substantial negative revision to next year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

Following the downgrade, the current consensus from Molecular Templates' six analysts is for revenues of US$34m in 2021 which - if met - would reflect a major 56% increase on its sales over the past 12 months. Before the latest update, the analysts were foreseeing US$24m of revenue in 2021. The consensus has definitely become more optimistic, showing a considerable lift to revenue forecasts.

View our latest analysis for Molecular Templates

Of course, another way to look at these forecasts is to place them into context against the industry itself. Next year brings more of the same, according to the analysts, with revenue forecast to grow 56%, in line with its 54% annual growth over the past five years. Compare this with the wider industry, which analyst estimates (in aggregate) suggest will see revenues grow 21% next year. So although Molecular Templates is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Molecular Templates next year. Analysts also expect revenues to grow faster than the wider market. Overall, given the drastic downgrade to next year's forecasts, we'd be feeling a little more wary of Molecular Templates going forwards.

Still got questions? At least one of Molecular Templates' six analysts has provided estimates out to 2025, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Molecular Templates, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:MTEM

Molecular Templates

A clinical stage biopharmaceutical company, focuses on the discovery and development of biologic therapeutics for the treatment of cancer and other serious diseases in the United States.

Adequate balance sheet slight.

Market Insights

Community Narratives