- United States

- /

- Biotech

- /

- NasdaqGM:MRUS

Merus N.V.'s (NASDAQ:MRUS) Business Is Yet to Catch Up With Its Share Price

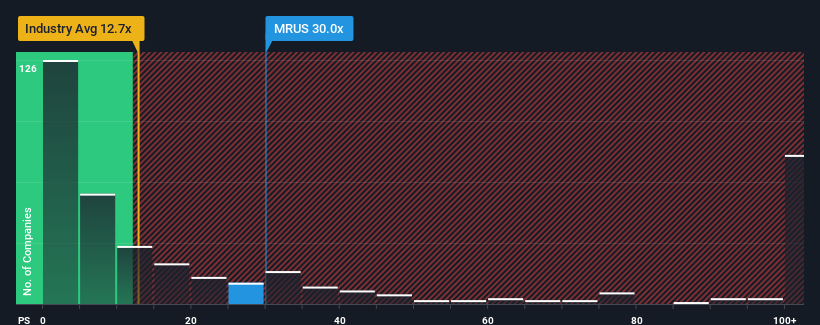

Merus N.V.'s (NASDAQ:MRUS) price-to-sales (or "P/S") ratio of 30x might make it look like a strong sell right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios below 12.7x and even P/S below 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Merus

How Has Merus Performed Recently?

While the industry has experienced revenue growth lately, Merus' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Merus.How Is Merus' Revenue Growth Trending?

In order to justify its P/S ratio, Merus would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Still, the latest three year period has seen an excellent 52% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 42% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 97% each year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Merus' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Merus currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 2 warning signs for Merus that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MRUS

Merus

A clinical-stage immuno-oncology company, engages in the development of antibody therapeutics in the Netherlands.

Flawless balance sheet and good value.