- United States

- /

- Pharma

- /

- NasdaqGM:MRNS

Why Investors Shouldn't Be Surprised By Marinus Pharmaceuticals, Inc.'s (NASDAQ:MRNS) P/S

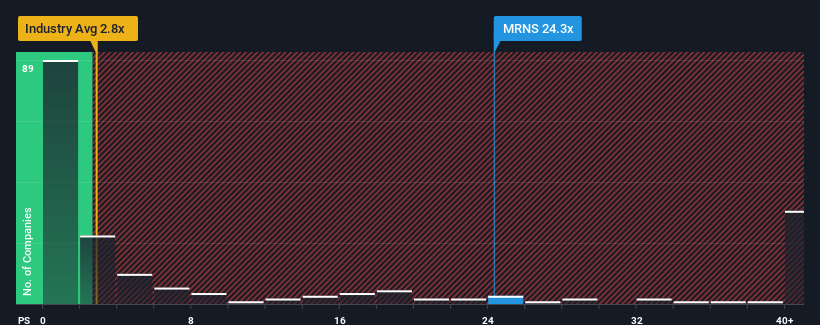

When close to half the companies in the Pharmaceuticals industry in the United States have price-to-sales ratios (or "P/S") below 2.8x, you may consider Marinus Pharmaceuticals, Inc. (NASDAQ:MRNS) as a stock to avoid entirely with its 24.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Marinus Pharmaceuticals

How Has Marinus Pharmaceuticals Performed Recently?

Marinus Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Marinus Pharmaceuticals.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Marinus Pharmaceuticals would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 93% each year during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 41% per annum growth forecast for the broader industry.

With this information, we can see why Marinus Pharmaceuticals is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Marinus Pharmaceuticals' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Marinus Pharmaceuticals maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Marinus Pharmaceuticals that you should be aware of.

If you're unsure about the strength of Marinus Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Marinus Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MRNS

Marinus Pharmaceuticals

A pharmaceutical company, focuses on development and commercialization of therapeutic products for patients suffering from rare genetic epilepsies and other seizure disorders.

High growth potential and good value.