- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

How Moderna's (MRNA) mRNA-4359 Cancer Vaccine Data Is Shaping Its Pipeline Diversification Narrative

Reviewed by Sasha Jovanovic

- In the past week, Moderna presented updated clinical data for its mRNA-4359 cancer vaccine at the 2025 ESMO Congress in Berlin, showing a 24% objective response rate and promising results in PD-L1+ tumors in advanced melanoma patients.

- This update highlighted progress in Moderna's transition from COVID-focused products to a broader oncology pipeline, but also underscored persistent questions about the company's ability to offset falling vaccine revenues with new therapies.

- We'll explore how investor reactions to the mRNA-4359 cancer vaccine trial results may influence Moderna's investment narrative around pipeline diversification and growth.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Moderna Investment Narrative Recap

To be a Moderna shareholder today, you need to believe the company can successfully transition from its COVID-19 revenue base into a broad platform for mRNA-driven innovation, particularly in oncology. While the recent mRNA-4359 cancer vaccine data from ESMO 2025 strengthens the story around pipeline diversification, it does not materially resolve the short-term risk around sustained COVID-19 vaccine revenue declines and insufficient non-seasonal sales to offset these losses.

Of the recent announcements, Moderna’s upcoming Q3 2025 earnings report on November 6 is the most relevant. It will offer investors a closer look at whether early cancer vaccine data and cost reduction measures are translating into improved financial results, or if volatility from falling respiratory vaccine sales continues to pressure margins and cash burn.

Yet, the real test investors should keep in mind is the company’s ongoing exposure to COVID-19 revenue volatility, especially as...

Read the full narrative on Moderna (it's free!)

Moderna's outlook projects $3.5 billion in revenue and $498.6 million in earnings by 2028. This is based on an annual revenue growth rate of 4.6% and an earnings increase of approximately $3.4 billion from current earnings of -$2.9 billion.

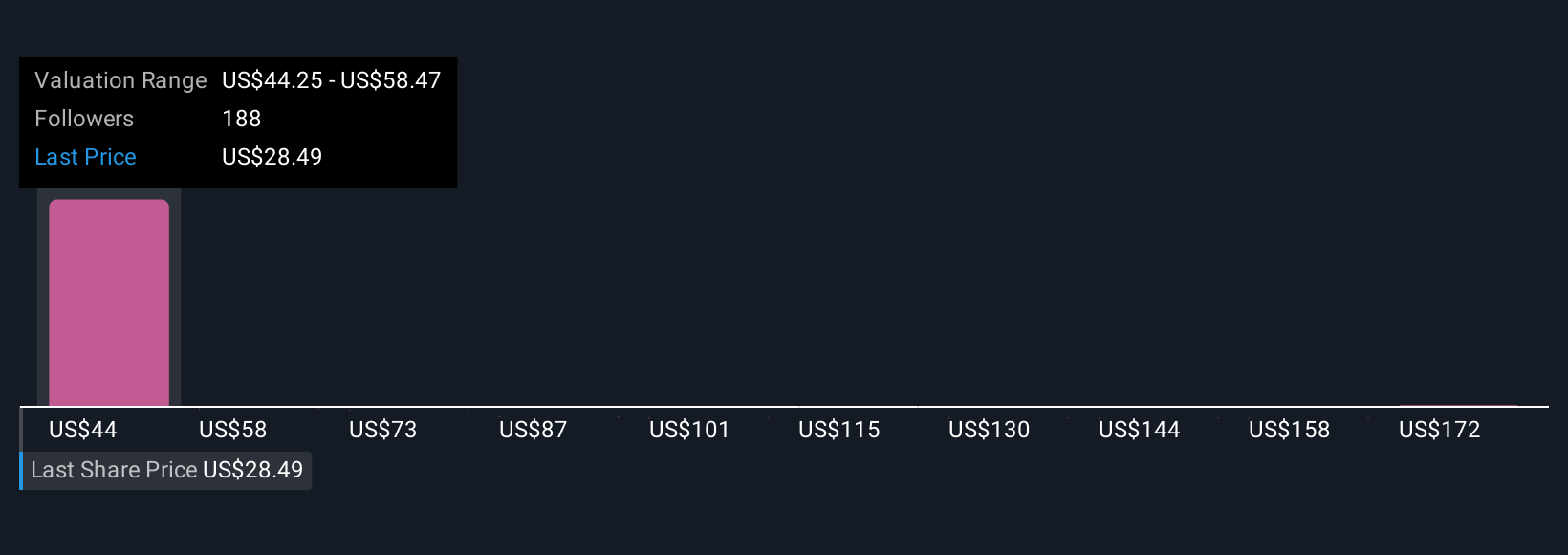

Uncover how Moderna's forecasts yield a $44.25 fair value, a 70% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published 26 fair value estimates for Moderna, ranging from US$44.25 to US$186.49 per share. While opinions vary widely, many are weighing diversification progress against sharp declines in COVID-19 vaccine revenues and persistent net losses.

Explore 26 other fair value estimates on Moderna - why the stock might be worth just $44.25!

Build Your Own Moderna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moderna research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Moderna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moderna's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives