- United States

- /

- Biotech

- /

- NasdaqGS:MRNA

Halted mRNA Programs and Facility Consolidation Might Change The Case For Investing In Moderna (MRNA)

Reviewed by Sasha Jovanovic

- On November 19, 2025, Moderna announced it had halted development of three mRNA drug candidates, a herpes vaccine, a shingles vaccine, and a rare disease therapy, and would consolidate all mRNA manufacturing into its expanded Norwood, Massachusetts facility, targeted for completion by the first half of 2027.

- This shift signals both a reprioritization of research and a move to streamline production, reflecting broader challenges in consumer sentiment for mRNA treatments and ongoing post-pandemic adjustments.

- We'll explore how Moderna's decision to discontinue several mRNA programs and concentrate manufacturing could reshape its pipeline outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Moderna Investment Narrative Recap

Moderna investors must believe in the long-term potential of mRNA technology to drive new revenue beyond COVID-19. The November decision to halt three drug programs and concentrate manufacturing does not materially alter the company's current primary catalyst: near-term results and regulatory milestones for its late-stage vaccine candidates. However, the biggest risk remains exposure to revenue swings from seasonal vaccine sales and the uncertain success of pipeline diversification.

One of the most relevant recent announcements is Moderna's new US$1,500,000,000 credit facility, providing fresh liquidity as the company restructures operations and shifts its manufacturing strategy. This financing is connected to key regulatory milestones in its late-stage pipeline, which continue to serve as major catalysts for the business as it adapts to a changing post-pandemic market.

By contrast, investors should be aware that heavy reliance on cost reduction, such as streamlining R&D and portfolio cuts, could limit innovation if future launches disappoint...

Read the full narrative on Moderna (it's free!)

Moderna's outlook anticipates $3.5 billion in revenue and $498.6 million in earnings by 2028. Achieving this would entail 4.6% annual revenue growth and a $3.4 billion improvement in earnings from current losses of $-2.9 billion.

Uncover how Moderna's forecasts yield a $37.32 fair value, a 49% upside to its current price.

Exploring Other Perspectives

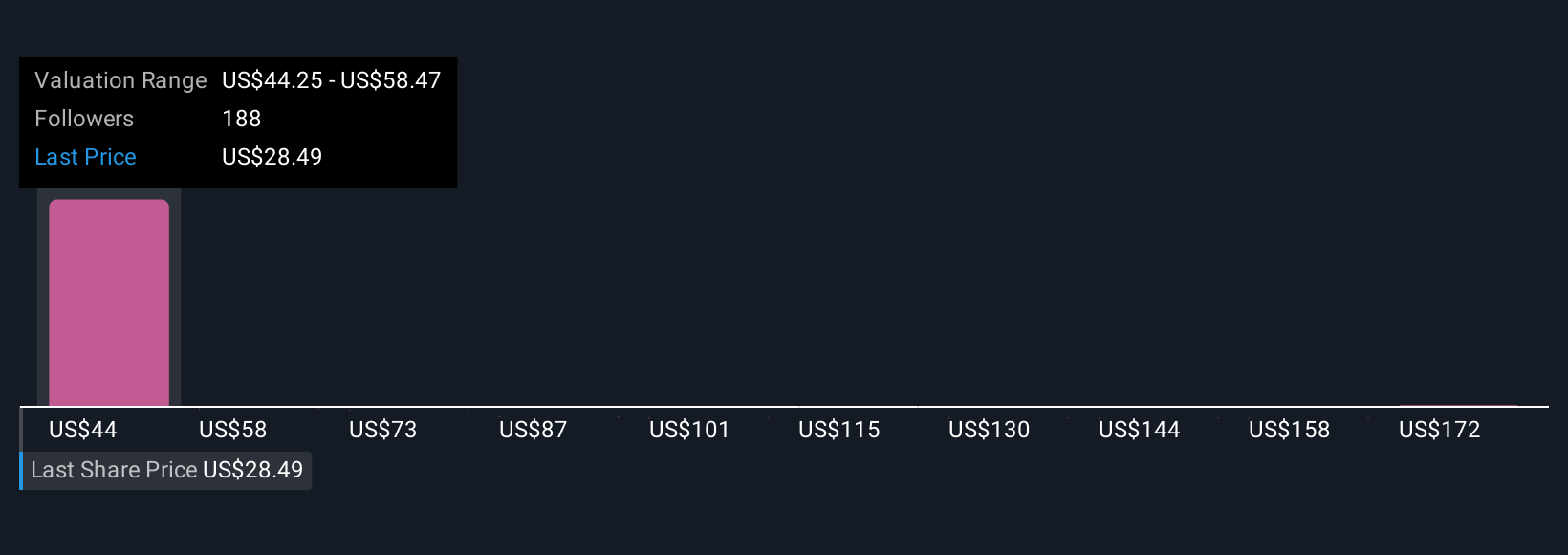

The Simply Wall St Community’s 25 fair value estimates for Moderna stock range broadly from US$37 to US$175 per share. Opinions differ significantly as many weigh the company's cash position and pipeline against ongoing volatility in vaccine revenues and the need for successful product launches.

Explore 25 other fair value estimates on Moderna - why the stock might be worth just $37.21!

Build Your Own Moderna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moderna research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Moderna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moderna's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRNA

Moderna

A biotechnology company, provides messenger RNA medicines in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success