- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

MannKind (MNKD) Is Up After $500M Blackstone Deal and Profit Turnaround Are Investors Missing the Inflection Point?

Reviewed by Simply Wall St

- Earlier this week, MannKind Corporation announced it had secured up to US$500 million in non-dilutive financing from Blackstone to accelerate its commercial and pipeline initiatives, alongside posting higher second quarter revenues and a return to net profitability compared to last year.

- This major cash infusion is expected to fuel MannKind's pipeline expansion, commercial team growth, and the anticipated launch of Afrezza in pediatric diabetes.

- We'll assess how the new Blackstone funding agreement enhances MannKind's investment case and supports its development priorities.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MannKind Investment Narrative Recap

MannKind shareholders are ultimately betting on the company’s ability to drive Afrezza’s uptake, expand into pediatric diabetes, and deliver on its late-stage inhaled therapies, while managing revenue concentration and cost pressures. The recent US$500 million Blackstone financing boosts MannKind’s flexibility to pursue these priorities, but does not materially reduce the ongoing risk tied to Afrezza’s slow adoption and the need to prove broader commercial traction in the near term.

Among MannKind’s latest announcements, the filing of a supplemental Biologics License Application for Afrezza in the pediatric population stands out as directly tied to a short-term catalyst. This regulatory milestone, if successfully cleared, could further diversify revenue, but its impact remains contingent on both payer acceptance and physician prescribing habits, which are still the critical levers for unlocking Afrezza’s market potential.

In contrast, investors should note the persistent challenge MannKind faces in scaling adult Afrezza prescriptions and its effects on future growth...

Read the full narrative on MannKind (it's free!)

MannKind's narrative projects $443.5 million in revenue and $111.5 million in earnings by 2028. This requires 13.7% yearly revenue growth and a $78.7 million earnings increase from the current $32.8 million.

Uncover how MannKind's forecasts yield a $9.12 fair value, a 159% upside to its current price.

Exploring Other Perspectives

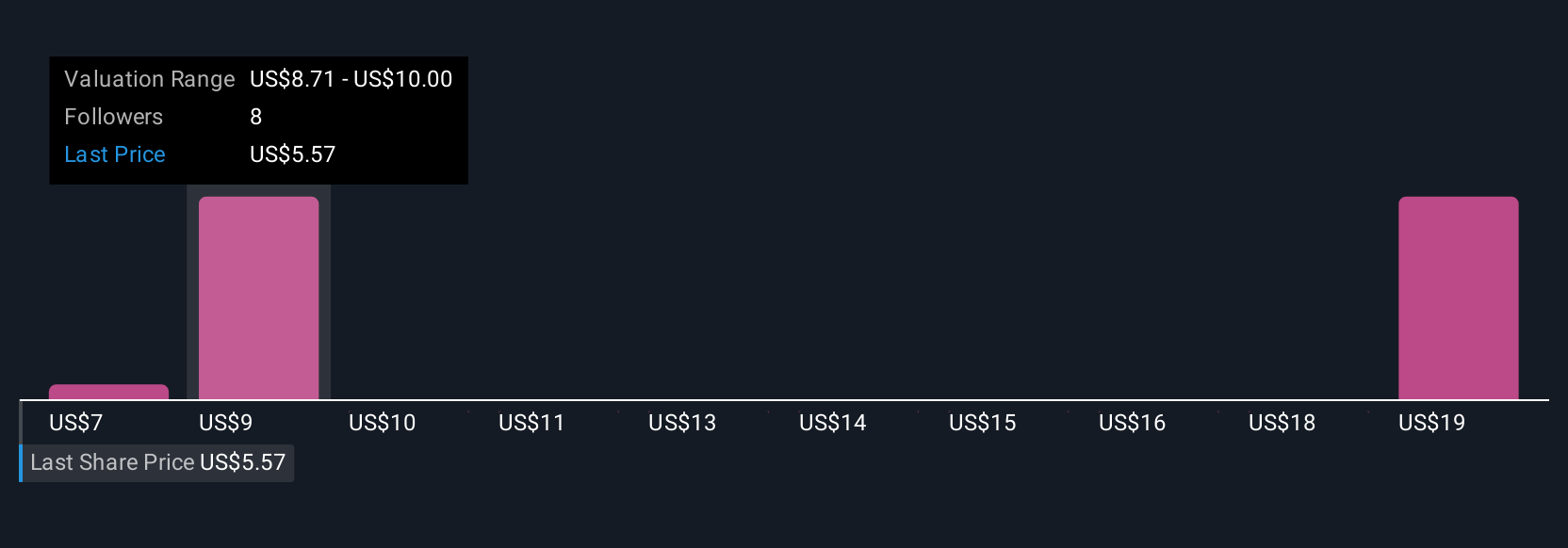

Three fair value estimates from the Simply Wall St Community range from US$7.42 to US$20.13, reflecting contrasting expectations for MannKind’s upside. While broader market adoption of Afrezza remains uncertain, these varied views illustrate how investors can weigh the same risks quite differently.

Explore 3 other fair value estimates on MannKind - why the stock might be worth just $7.42!

Build Your Own MannKind Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MannKind research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MannKind research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MannKind's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives