- United States

- /

- Biotech

- /

- NasdaqGM:MIRM

Mirum Pharmaceuticals (MIRM): Reviewing Valuation After Strong Q3 Beat and Upgraded 2025 Revenue Outlook

Reviewed by Simply Wall St

Mirum Pharmaceuticals (MIRM) just turned in an upbeat third quarter, topping earnings and revenue expectations and nudging its 2025 sales outlook higher, a combination that tends to pull fresh attention toward the stock.

See our latest analysis for Mirum Pharmaceuticals.

Even after a softer reaction today, with the latest 1 day share price return at minus 4.26 percent and the stock now trading around 68.48 dollars, Mirum’s year to date share price return of 62.89 percent and three year total shareholder return of 277.09 percent suggest momentum has been building as investors warm to both its rare disease franchise and the new Fragile X program.

If Mirum’s run has you rethinking your healthcare exposure, this could be a good moment to explore other specialist healthcare stocks that might be under the market’s radar.

With Mirum now trading at a sizable discount to analyst targets despite brisk revenue and earnings momentum, investors face a familiar dilemma: is this a fresh entry point, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 22.2% Undervalued

With Mirum closing at 68.48 dollars against a narrative fair value of 87.99 dollars, the stage is set around whether its growth runway truly merits that gap.

Multiple late-stage pipeline catalysts, including three pivotal study readouts (VISTAS, VANTAGE, EXPAND) over the next 24 months and the initiation of the Phase II Fragile X study, set the stage for further product label expansions and new indication launches, underpinning future revenue diversification and potential earnings acceleration.

Want to see what kind of revenue climb and margin shift might justify this bolder price tag, and why the implied future earnings multiple looks so punchy? Dive in to unpack the assumptions powering this narrative.

Result: Fair Value of $87.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained upside hinges on timely, positive data. Any clinical delays or disappointing results could quickly challenge the current undervalued thesis.

Find out about the key risks to this Mirum Pharmaceuticals narrative.

Another Angle on Valuation

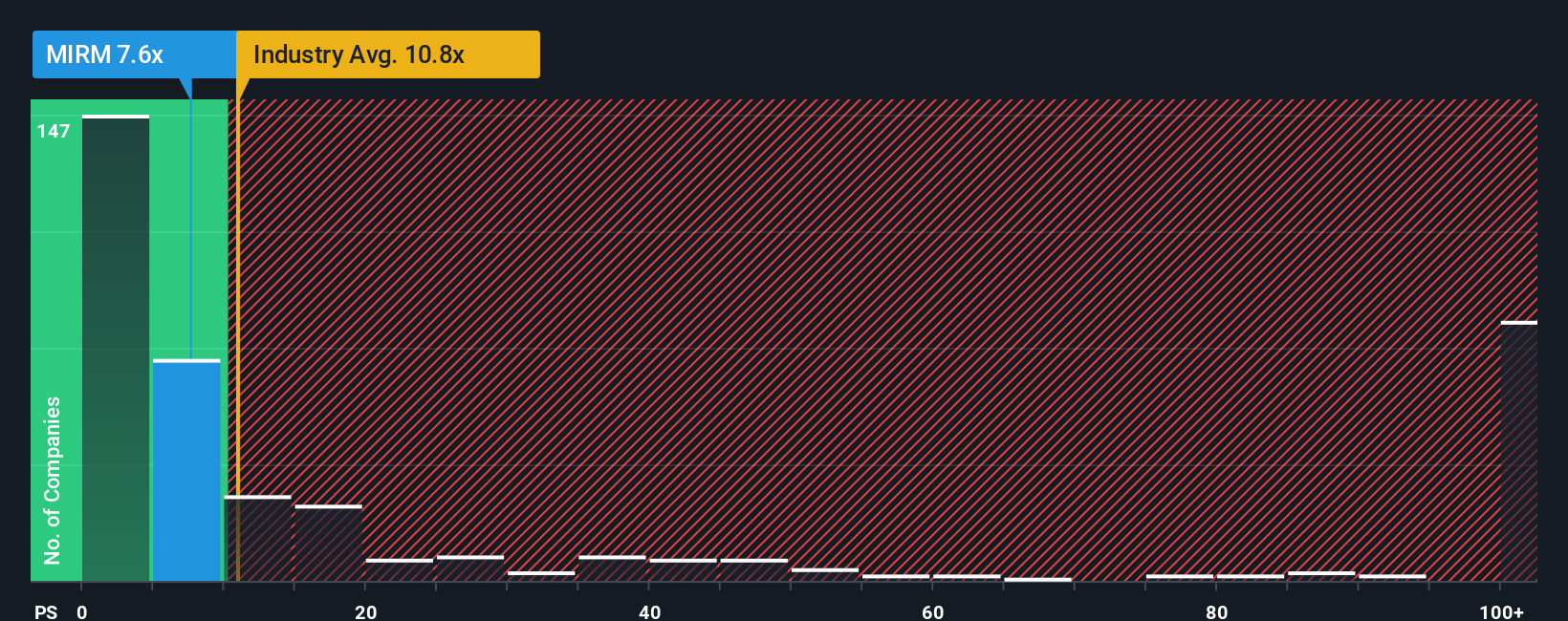

While the narrative fair value points to upside, the market is sending a mixed signal on simple sales metrics. Mirum trades on a price to sales ratio of 7.5 times, richer than its fair ratio of 6.9 times, but cheaper than biotech peers at 10.7 times, so is this really a margin of safety or just relative value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mirum Pharmaceuticals Narrative

If you are not completely sold on this view or would rather examine the numbers yourself, you can build a personalized storyline in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mirum Pharmaceuticals.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to pinpoint focused themes that could upgrade your portfolio’s growth, income, and innovation potential.

- Capture rapid growth potential by scanning these 3574 penny stocks with strong financials that already show strong financial foundations instead of just hype.

- Position yourself at the forefront of innovation by targeting these 26 AI penny stocks that blend breakthrough technology with scalable business models.

- Strengthen your portfolio’s income engine by filtering for these 15 dividend stocks with yields > 3% that can support regular cash returns without sacrificing quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MIRM

Mirum Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026