- United States

- /

- Biotech

- /

- NasdaqGS:CRBU

908 Devices Leads These 3 Penny Stocks To Consider

Reviewed by Simply Wall St

In an extraordinary turn of events, the U.S. stock market experienced a significant surge as major indices like the Dow Jones and Nasdaq posted some of their best performances in years, following a temporary pause on tariffs by President Trump. Amidst this backdrop, investors are exploring various avenues for potential returns, including penny stocks—a term that may seem outdated but continues to represent opportunities in smaller or newer companies. Despite their reputation for volatility, these stocks can offer unique growth prospects when backed by solid financial health and strategic positioning within the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.28 | $319.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.17 | $1.23B | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (NYSE:CINT) | $4.88 | $619.35M | ✅ 5 ⚠️ 0 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.788 | $14.01M | ✅ 4 ⚠️ 4 View Analysis > |

| Global Self Storage (NasdaqCM:SELF) | $4.80 | $54.65M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.85 | $44.52M | ✅ 4 ⚠️ 3 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.34 | $282M | ✅ 5 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.79 | $5.52M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $213.14M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $4.18 | $91.53M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 777 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

908 Devices (NasdaqGM:MASS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 908 Devices Inc. is a commercial-stage technology company with a market cap of $128.25 million, focusing on developing and manufacturing analytical devices for chemical and biochemical analysis.

Operations: The company's revenue is primarily generated from its Scientific & Technical Instruments segment, which reported $59.63 million.

Market Cap: $128.25M

908 Devices Inc., with a market cap of US$128.25 million, is navigating challenges typical of penny stocks, such as high volatility and unprofitability. Despite a net loss increase to US$19.45 million in Q4 2024, the company secured a significant US$1.7 million order from Ukraine's Ministry of Health for its MX908 device, highlighting potential demand for its technology. The firm remains debt-free and has ample short-term assets (US$103.1 million) covering liabilities while maintaining an experienced management team and board. Recent earnings guidance projects modest revenue growth for 2025 despite ongoing financial hurdles like goodwill impairments.

- Click to explore a detailed breakdown of our findings in 908 Devices' financial health report.

- Gain insights into 908 Devices' outlook and expected performance with our report on the company's earnings estimates.

Caribou Biosciences (NasdaqGS:CRBU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caribou Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing genome-edited allogeneic cell therapies for treating hematologic malignancies and autoimmune diseases, with a market cap of $73.47 million.

Operations: The company's revenue is derived from its efforts in developing a pipeline of allogeneic CAR-T and CAR-NK cell therapies, totaling $9.99 million.

Market Cap: $73.47M

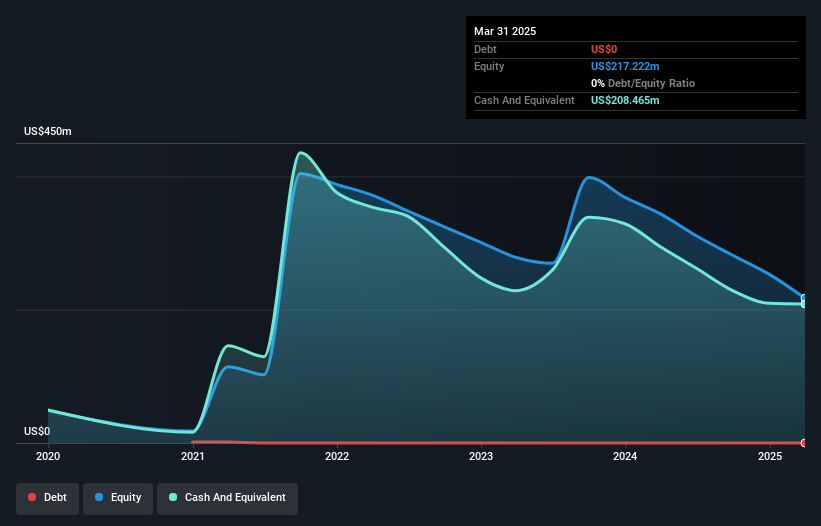

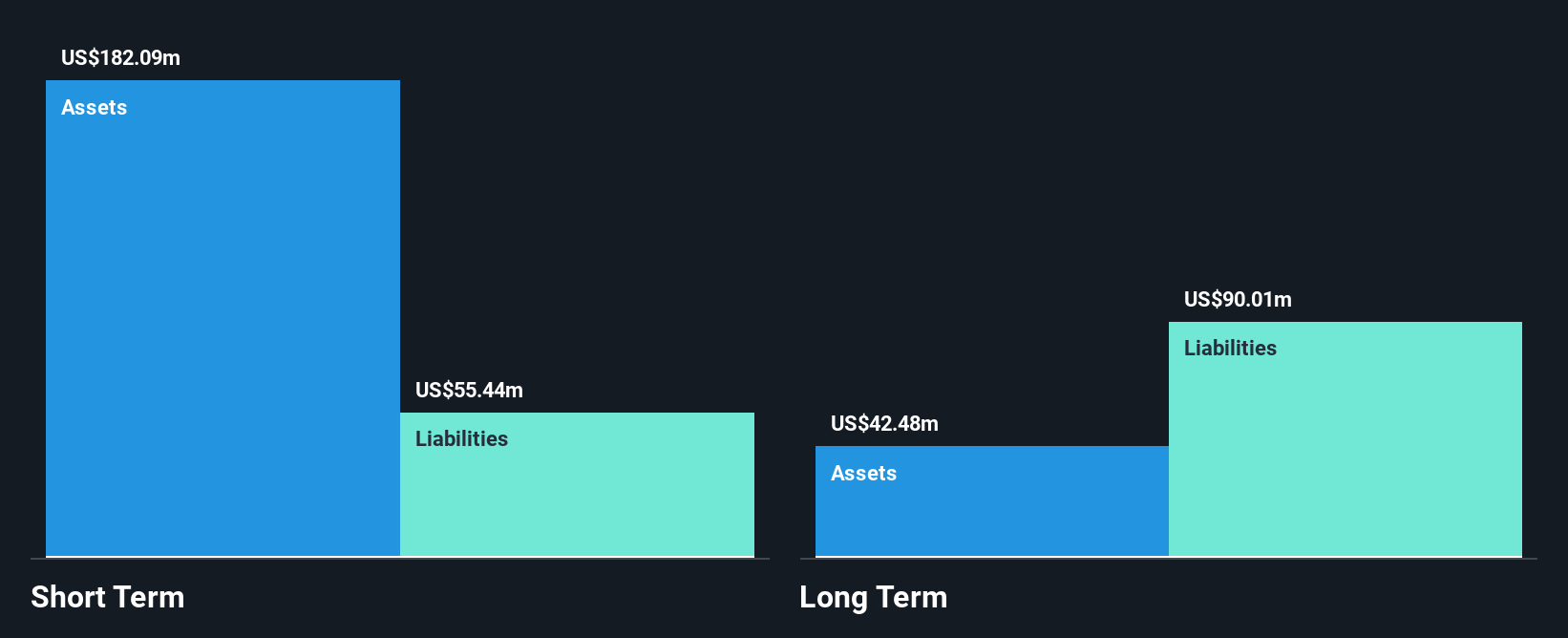

Caribou Biosciences, with a market cap of US$73.47 million, faces typical challenges of penny stocks, including unprofitability and increased losses, reporting a net loss of US$149.11 million for 2024. Despite this, the company has a solid cash runway exceeding one year and no debt obligations. Its short-term assets (US$219.4 million) comfortably cover both short-term and long-term liabilities. While revenue is projected to grow significantly at 68.54% annually, achieving profitability remains uncertain in the near term. The management team is experienced with an average tenure of 2.8 years, contributing to strategic stability amidst financial hurdles.

- Dive into the specifics of Caribou Biosciences here with our thorough balance sheet health report.

- Examine Caribou Biosciences' earnings growth report to understand how analysts expect it to perform.

MacroGenics (NasdaqGS:MGNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MacroGenics, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, manufacturing, and commercializing antibody-based cancer therapeutics in the United States with a market cap of $69.40 million.

Operations: The company's revenue is derived from developing and commercializing monoclonal antibody-based therapeutics, totaling $149.96 million.

Market Cap: $69.4M

MacroGenics, Inc., with a market cap of US$69.40 million, navigates the challenges typical of penny stocks by maintaining a solid financial position despite being unprofitable. The company reported 2024 revenues of US$149.96 million but faced a net loss of US$66.97 million. Its short-term assets (US$217.5 million) exceed both short-term and long-term liabilities, and it remains debt-free with no significant shareholder dilution over the past year. Although earnings are forecast to decline by 16.5% annually over the next three years, MacroGenics possesses an experienced management team and board aiding in strategic direction amidst its high share price volatility.

- Navigate through the intricacies of MacroGenics with our comprehensive balance sheet health report here.

- Explore MacroGenics' analyst forecasts in our growth report.

Next Steps

- Dive into all 777 of the US Penny Stocks we have identified here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRBU

Caribou Biosciences

A clinical-stage biopharmaceutical company, engages in the development of genome-edited allogeneic cell therapies for the treatment of hematologic malignancies and autoimmune diseases in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives