Stock Analysis

- United States

- /

- Energy Services

- /

- NYSE:TTI

Unveiling Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the third quarter of 2024 begins, U.S. stocks are showing signs of resilience with notable gains, despite underlying concerns about sector imbalances and interest rate uncertainties. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Underneath we present a selection of stocks filtered out by our screen.

Medpace Holdings (NasdaqGS:MEDP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medpace Holdings, Inc. is a global clinical research organization offering drug and medical device development services, with a market capitalization of approximately $12.73 billion.

Operations: The company generates its revenue primarily through the development, management, and execution of clinical trials, totaling $1.96 billion.

Insider Ownership: 17.4%

Return On Equity Forecast: 33% (2027 estimate)

Medpace Holdings, a growth-oriented company with significant insider ownership, has shown robust financial performance with a forecasted revenue increase to US$2.15 billion to US$2.20 billion in 2024, up from US$1.89 billion in 2023. Despite no substantial insider purchases recently, the firm's strategic amendments aim to enhance governance structures, potentially aligning long-term shareholder interests. However, recent substantial insider selling and moderate expected earnings growth suggest cautious optimism for investors focusing on growth and ownership stability.

- Take a closer look at Medpace Holdings' potential here in our earnings growth report.

- The analysis detailed in our Medpace Holdings valuation report hints at an inflated share price compared to its estimated value.

TETRA Technologies (NYSE:TTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc., along with its subsidiaries, operates as an energy services and solutions company with a market capitalization of approximately $453.74 million.

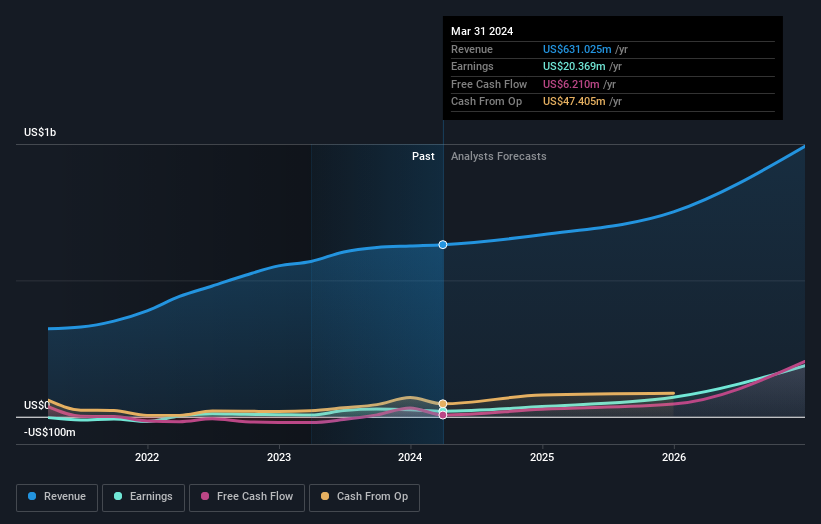

Operations: The company generates its revenue primarily from two segments: Water & Flowback Services at $309.76 million and Completion Fluids & Products at $321.27 million.

Insider Ownership: 10.2%

Return On Equity Forecast: N/A (2027 estimate)

TETRA Technologies, despite a significant decrease in net income from US$6.04 million to US$0.915 million in the first quarter of 2024, is trading at 90% below its estimated fair value and analysts expect a substantial price increase of 121.4%. The company's earnings are projected to grow by 43.3% annually, outpacing the US market forecast of 14.7%. However, its revenue growth at 15% per year is slower than desired benchmarks for high-growth entities but still exceeds the market average of 8.6%.

- Click here and access our complete growth analysis report to understand the dynamics of TETRA Technologies.

- In light of our recent valuation report, it seems possible that TETRA Technologies is trading behind its estimated value.

TXO Partners (NYSE:TXO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TXO Partners, L.P. is an oil and natural gas company engaged in acquiring, developing, optimizing, and exploiting conventional oil and gas reserves in North America, with a market capitalization of approximately $754.76 million.

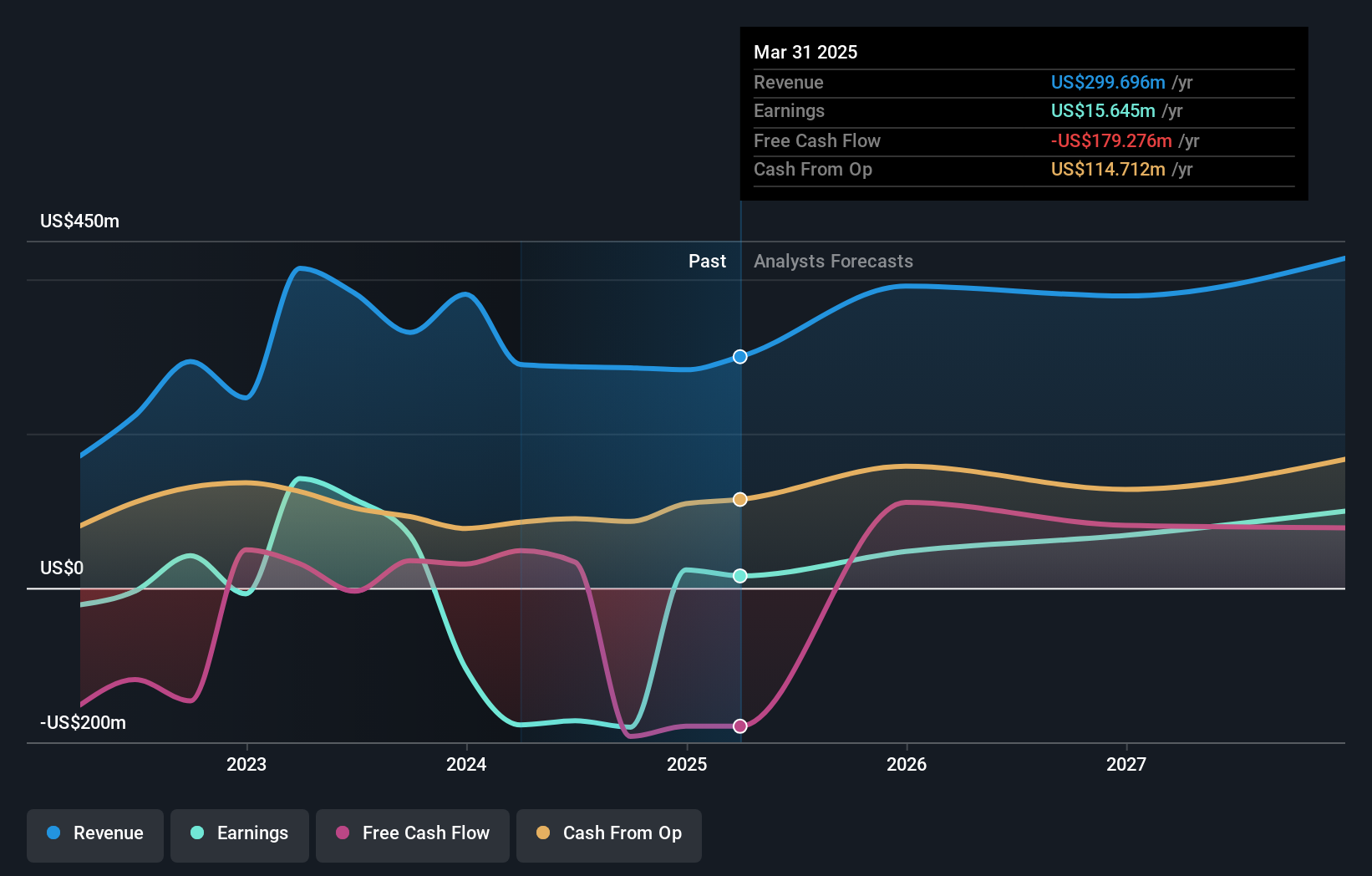

Operations: The company generates its revenue primarily from the exploration and production of oil, natural gas, and natural gas liquids, totaling approximately $289.76 million.

Insider Ownership: 25.9%

Return On Equity Forecast: N/A (2027 estimate)

TXO Partners, with a forecasted annual revenue growth of 20.7%, is expected to outpace the US market average significantly. Recently, TXO completed a follow-on equity offering raising US$130 million, indicating possible expansion or debt reduction strategies. Insider activities show more buying than selling in the last three months, reflecting confidence from those closest to the company. However, recent earnings have dipped significantly from US$83.81 million to US$10.27 million year-over-year, casting some concerns on short-term profitability despite long-term growth prospects and substantial insider ownership enhancing its appeal as a growth-oriented investment with high insider engagement.

- Click to explore a detailed breakdown of our findings in TXO Partners' earnings growth report.

- Upon reviewing our latest valuation report, TXO Partners' share price might be too optimistic.

Taking Advantage

- Navigate through the entire inventory of 183 Fast Growing US Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether TETRA Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTI

Solid track record and good value.