- United States

- /

- Banks

- /

- NasdaqCM:BCAL

Top Growth Stocks With High Insider Ownership In US For August 2024

Reviewed by Simply Wall St

The U.S. stock market has experienced significant volatility recently, with major indexes like the Dow Jones, S&P 500, and Nasdaq Composite seeing sharp declines amid a chip stock selloff and economic concerns. As investors navigate these turbulent times, growth companies with high insider ownership can offer unique advantages due to the confidence insiders have in their own businesses.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 24.7% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Duolingo (NasdaqGS:DUOL) | 15% | 47.9% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

We'll examine a selection from our screener results.

Southern California Bancorp (NasdaqCM:BCAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Southern California Bancorp, with a market cap of $292.86 million, operates as the holding company for Bank of Southern California, N.A.

Operations: Revenue from commercial banking operations amounts to $87.33 million.

Insider Ownership: 23.1%

Earnings Growth Forecast: 102.1% p.a.

Southern California Bancorp, with substantial insider ownership, is positioned for significant growth. The company's earnings are forecast to grow over 100% annually, outpacing market expectations. Despite recent challenges like increased net charge-offs and reduced net income (US$0.19 million in Q2 2024 vs US$6.72 million a year ago), its revenue is expected to grow over 50% annually. Recent developments include a merger with California BanCorp and multiple additions to Russell indices, enhancing its market visibility.

- Click here to discover the nuances of Southern California Bancorp with our detailed analytical future growth report.

- The analysis detailed in our Southern California Bancorp valuation report hints at an inflated share price compared to its estimated value.

Madrigal Pharmaceuticals (NasdaqGS:MDGL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Madrigal Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company with a market cap of $6.07 billion, focuses on developing therapeutics for the treatment of non-alcoholic steatohepatitis (NASH) in the United States.

Operations: Madrigal Pharmaceuticals, Inc. primarily focuses on developing therapeutics for non-alcoholic steatohepatitis (NASH) in the United States.

Insider Ownership: 10.2%

Earnings Growth Forecast: 64.4% p.a.

Madrigal Pharmaceuticals, with significant insider ownership, is forecast to grow its revenue by 55.5% annually, outpacing market averages. Despite a recent net loss of US$147.54 million in Q1 2024 and shareholder dilution, the company is expected to become profitable within three years. Recent Phase 3 MAESTRO-NASH trial results for Rezdiffra showed promising outcomes in treating NASH, achieving both fibrosis improvement and NASH resolution endpoints, potentially bolstering future growth prospects.

- Click to explore a detailed breakdown of our findings in Madrigal Pharmaceuticals' earnings growth report.

- Our valuation report unveils the possibility Madrigal Pharmaceuticals' shares may be trading at a discount.

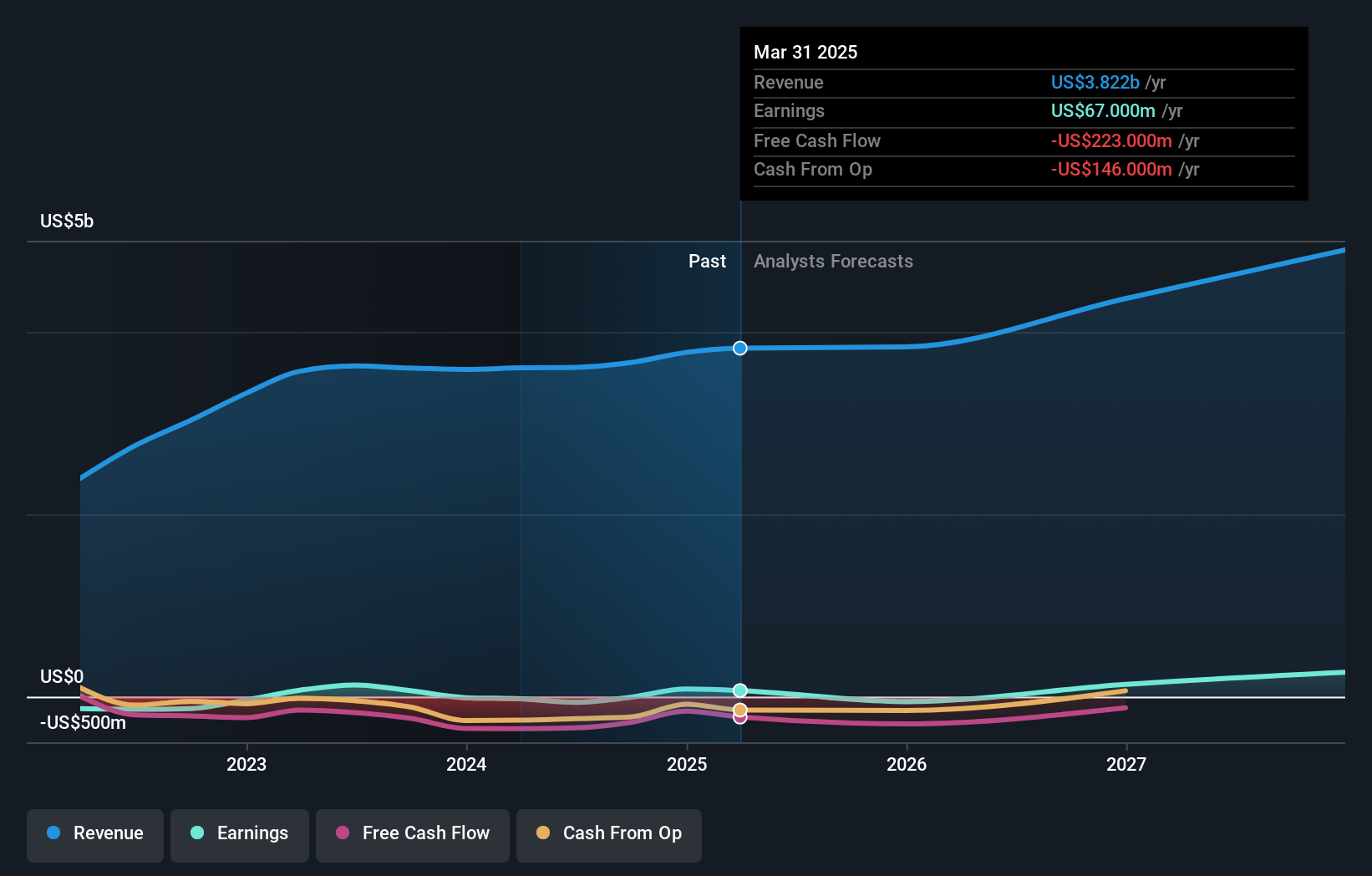

Frontier Group Holdings (NasdaqGS:ULCC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. offers low-fare passenger airline services to leisure travelers in the United States and Latin America, with a market cap of $882.40 million.

Operations: Revenue from providing air transportation for passengers amounted to $3.61 billion.

Insider Ownership: 34.8%

Earnings Growth Forecast: 83.2% p.a.

Frontier Group Holdings, with high insider ownership, is forecast to grow its revenue by 14.9% annually, surpassing the US market average. Despite a recent net loss of US$26 million in Q1 2024 and ongoing losses per share, the company is expected to become profitable within three years. Recent corporate governance changes reflect its evolving status and strategic direction, while new board member Nancy L. Lipson brings extensive legal and compliance expertise to support future growth initiatives.

- Unlock comprehensive insights into our analysis of Frontier Group Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Frontier Group Holdings shares in the market.

Where To Now?

- Click here to access our complete index of 182 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BCAL

Southern California Bancorp

Operates as the holding company for Bank of Southern California, N.A.

Flawless balance sheet with high growth potential.