- United States

- /

- Pharma

- /

- NasdaqCM:LQDA

YUTREPIA’s Launch and Payer Contracts Could Be a Game Changer for Liquidia (LQDA)

Reviewed by Sasha Jovanovic

- Earlier this year, Liquidia reported strong Q2 2025 earnings driven by the launch of its product YUTREPIA, with initial revenues primarily from channel inventory.

- The company has secured contracts with major commercial payers, positioning it for enhanced market access and potential growth in patient demand for Q3.

- Let's explore how YUTREPIA’s successful launch and payer contracts influence Liquidia's current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Liquidia's Investment Narrative?

To be a shareholder in Liquidia right now, conviction depends on the belief that YUTREPIA can drive a real shift from initial inventory shipments to recurring patient demand, especially after securing fresh contracts with major payers. The recent news confirms strong initial revenue from YUTREPIA's launch and suggests improved access, so a key near-term catalyst is whether these payer contracts convert into ongoing sales growth. This could potentially accelerate revenue uptake earlier than some expected, directly affecting short-term momentum. At the same time, litigation remains an ever-present risk with United Therapeutics' patent challenges continuing; there’s also the reality of continued, sizable losses and high valuation relative to peers. So while the news boosts optimism for quicker adoption, it does not eliminate the overhang from legal uncertainties and financial losses that continue to weigh on the business.

However, the legal risk tied to ongoing patent disputes remains crucial for investors to understand.

Exploring Other Perspectives

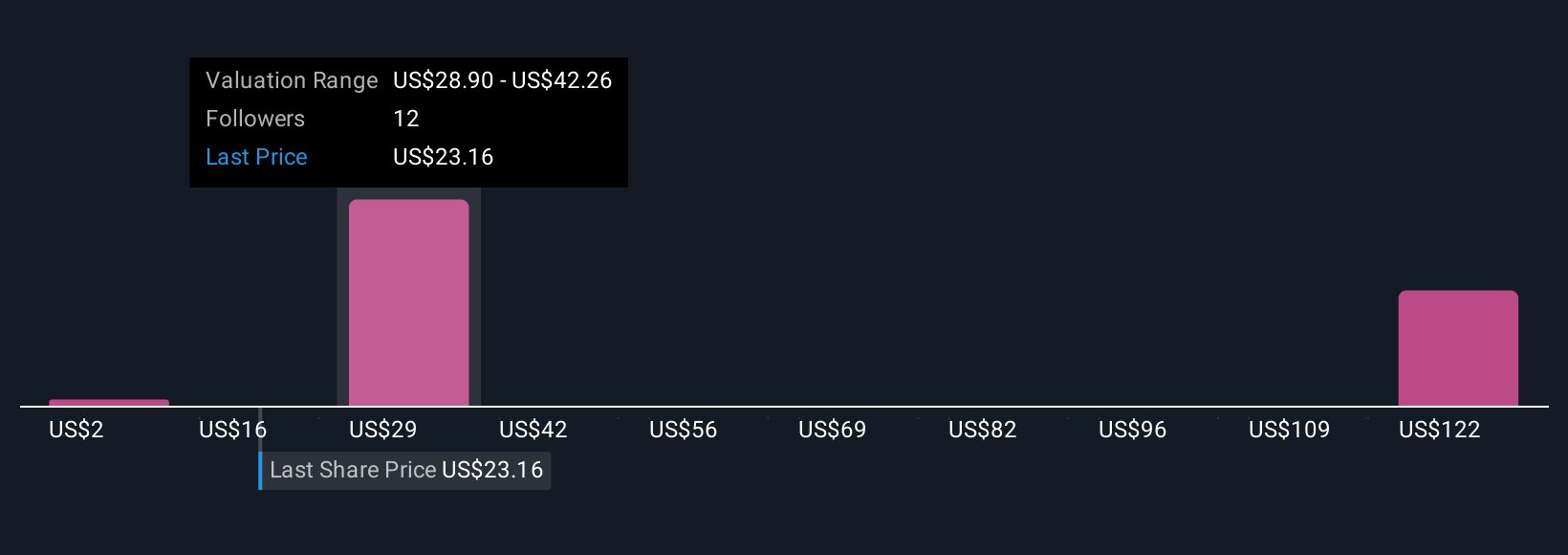

Explore 3 other fair value estimates on Liquidia - why the stock might be worth less than half the current price!

Build Your Own Liquidia Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liquidia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Liquidia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liquidia's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LQDA

Liquidia

A biopharmaceutical company, develops, manufactures, and commercializes various products for unmet patient needs in the United States.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives