- United States

- /

- Pharma

- /

- NasdaqCM:LPCN

Lipocine (NASDAQ:LPCN) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Lipocine Inc. (NASDAQ:LPCN) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Lipocine

What Is Lipocine's Net Debt?

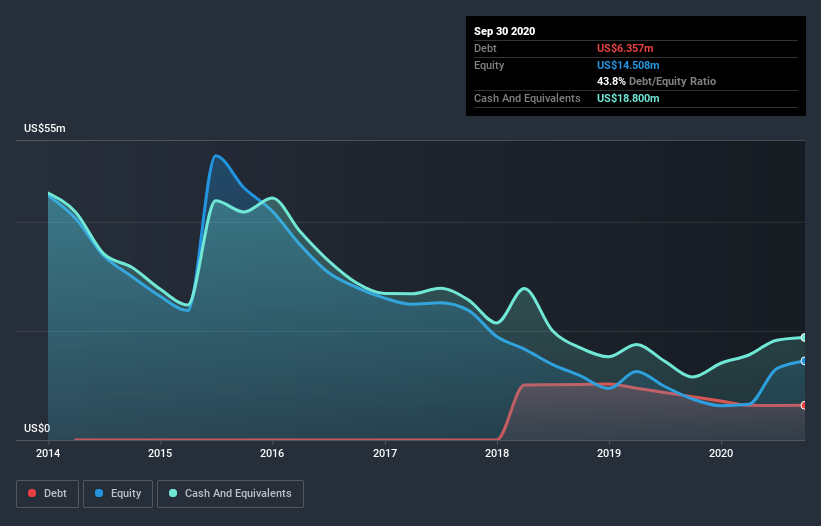

As you can see below, Lipocine had US$6.36m of debt at September 2020, down from US$7.94m a year prior. But it also has US$18.8m in cash to offset that, meaning it has US$12.4m net cash.

How Healthy Is Lipocine's Balance Sheet?

The latest balance sheet data shows that Lipocine had liabilities of US$5.79m due within a year, and liabilities of US$4.45m falling due after that. Offsetting these obligations, it had cash of US$18.8m as well as receivables valued at US$11.2k due within 12 months. So it actually has US$8.57m more liquid assets than total liabilities.

This surplus suggests that Lipocine has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Lipocine boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Lipocine's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given it has no significant operating revenue at the moment, shareholders will be hoping Lipocine can make progress and gain better traction for the business, before it runs low on cash.

So How Risky Is Lipocine?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Lipocine had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$15m of cash and made a loss of US$20m. However, it has net cash of US$12.4m, so it has a bit of time before it will need more capital. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Lipocine is showing 2 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Lipocine, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:LPCN

Lipocine

A clinical-stage biopharmaceutical company, engages in the research and development for the delivery of drugs for the treatment of central nervous system (CNS) disorders.

Flawless balance sheet slight.

Market Insights

Community Narratives