- United States

- /

- Pharma

- /

- NasdaqGM:LGND

Is Ligand’s R&D Spend and Acquisition Push Shaping a Stronger Biotech Future for LGND?

Reviewed by Sasha Jovanovic

- In recent news, Ligand Pharmaceuticals highlighted continued investment in research and development, targeted acquisitions, and debt reduction, all aimed at expanding its biotechnology portfolio across multiple therapeutic areas.

- An interesting takeaway is that analysts have given Ligand seven buy ratings, reflecting strong market confidence in the company's strategy, even as it faces some profitability challenges.

- We'll explore how analysts’ positive sentiment about Ligand’s financial stability and biotechnology focus impacts the company’s investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ligand Pharmaceuticals Investment Narrative Recap

To be a Ligand Pharmaceuticals shareholder, investors need to believe in the company's model of expanding its royalty portfolio across diverse therapeutic areas and converting innovation into sustained cash flow. The recent focus on R&D investment and debt reduction supports long-term pipeline expansion, but it does not immediately alter the most important catalysts, new partner drug launches and royalty stream stability, or the main risk of over-reliance on a few key assets for earnings consistency.

Among recent company announcements, the launch of ZELSUVMI by Pelthos Therapeutics stands out, as it triggered a milestone payment and adds a new revenue stream. This milestone is relevant to the company's short-term catalysts, providing a tangible example of how product commercialization supports royalty growth for Ligand.

By contrast, investors should be aware that concentrated royalty assets may leave Ligand vulnerable if any major partner faces setbacks or...

Read the full narrative on Ligand Pharmaceuticals (it's free!)

Ligand Pharmaceuticals' outlook anticipates $315.6 million in revenue and $121.1 million in earnings by 2028. This projection reflects an 18.9% annual revenue growth rate and an earnings increase of $197 million from the current earnings of $-75.9 million.

Uncover how Ligand Pharmaceuticals' forecasts yield a $183.12 fair value, in line with its current price.

Exploring Other Perspectives

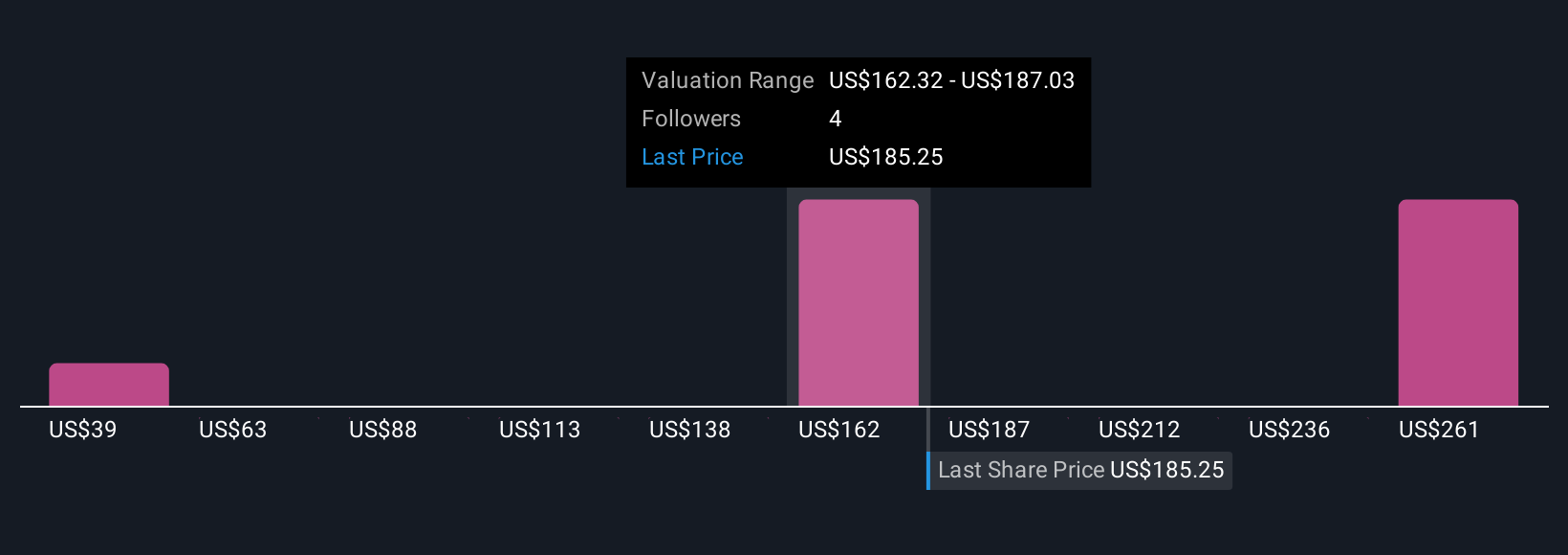

Simply Wall St Community members estimate Ligand's fair value between US$38.77 and US$285.86 across three analyses. While new royalty streams are a key growth catalyst, opinions vary on how these will impact future returns, explore how your perspective aligns with others.

Explore 3 other fair value estimates on Ligand Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own Ligand Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ligand Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ligand Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ligand Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LGND

Ligand Pharmaceuticals

A biopharmaceutical company, develops and licenses biopharmaceutical assets worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives