- United States

- /

- Pharma

- /

- NasdaqGS:LENZ

LENZ Therapeutics’s Valuation: Examining the Impact of VIZZ’s Groundbreaking FDA Approval and US Launch

Reviewed by Kshitija Bhandaru

LENZ Therapeutics (LENZ) has just announced that VIZZ, its newly FDA-approved aceclidine-based eye drop for presbyopia, is now being distributed to eye care professionals across the United States. Consumer availability is set for October, and retail expansion will follow soon.

See our latest analysis for LENZ Therapeutics.

With VIZZ now hitting the market, LENZ Therapeutics is in the spotlight, and the recent commercial launch has stirred up investor interest. Over the past year, the total shareholder return has been just under 1%, but the latest product news and a robust growth outlook may be shifting market sentiment. Momentum looks poised to build as LENZ moves from development to commercialization in a large, underserved market.

If this breakthrough has you thinking about what’s next in healthcare innovation, you might want to explore other names on our curated list in See the full list for free.

This rapid commercial rollout, paired with a nearly 90% one-year total return, raises a key question for investors: Is LENZ undervalued at current levels, or has the market already priced in most of its future growth?

Price-to-Book of 6.7x: Is it justified?

LENZ Therapeutics is currently trading at a price-to-book (P/B) ratio of 6.7x, notably lower than its peer group average of 9.9x. With shares last closing at $48.74, this metric suggests the market is assigning a lower valuation relative to peer companies.

The price-to-book ratio compares a company’s market value to its book value, serving as a widely used metric for evaluating pharmaceutical and biotech firms with limited or negative earnings. For LENZ, a P/B below the peer average could indicate either the market’s caution about profitability or a potential opportunity for value investors if near-term growth materializes.

Compared to the broader US Pharmaceuticals industry, however, LENZ’s P/B of 6.7x is significantly higher than the industry average of 2.2x. This signals that despite appearing undervalued next to similar growth peers, LENZ still demands a substantial premium versus the typical company in the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 6.7x (UNDERVALUED compared to peers, OVERVALUED compared to industry average)

However, ongoing net losses and dependence on continued revenue growth could challenge LENZ’s valuation if market adoption falls short or if operational setbacks occur.

Find out about the key risks to this LENZ Therapeutics narrative.

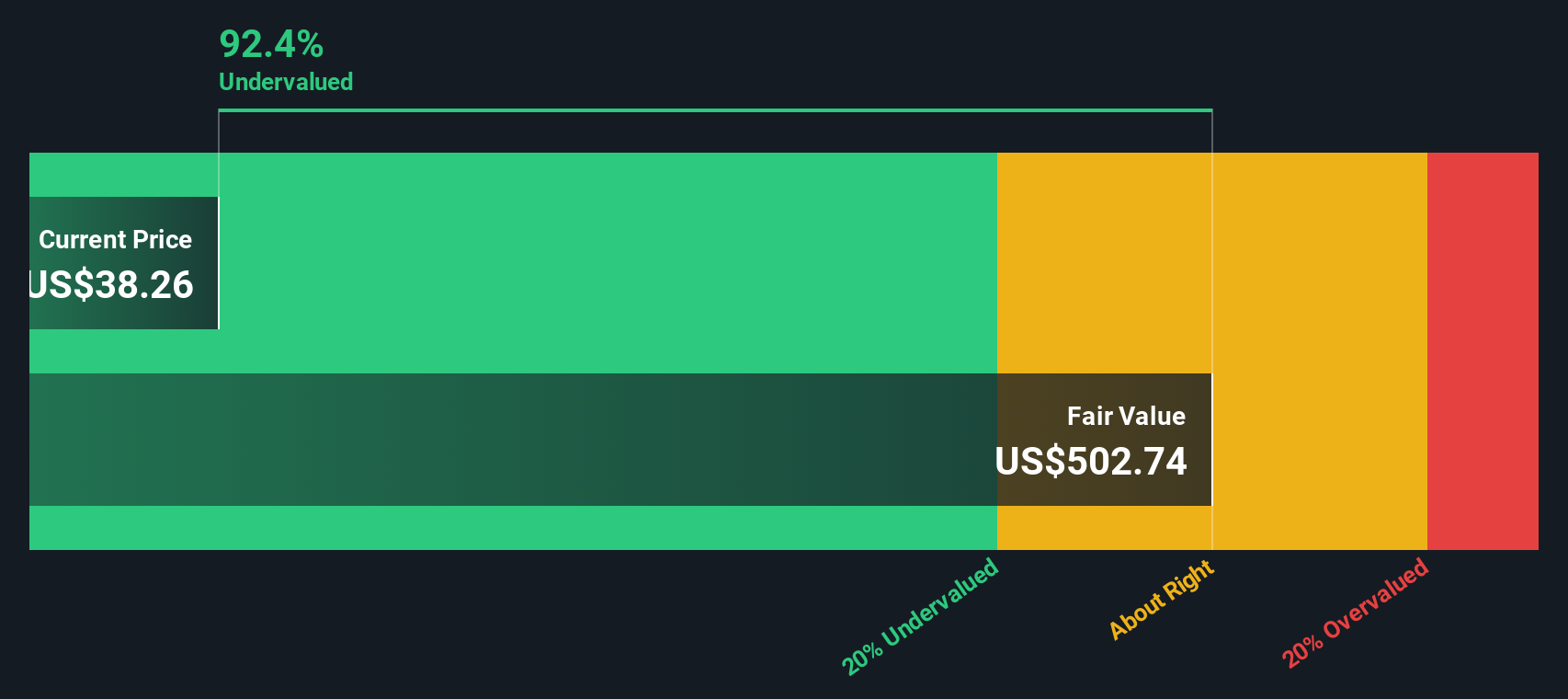

Another View: SWS DCF Model Suggests Deep Undervaluation

While the price-to-book ratio shows LENZ as relatively undervalued versus peers but expensive compared to the broader industry, our SWS DCF model presents a much different perspective. According to this method, LENZ is trading around 90% below its estimated fair value, which points to significant upside potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out LENZ Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own LENZ Therapeutics Narrative

If you have your own perspective on LENZ or want to dig deeper into the numbers, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your LENZ Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit your search to just one opportunity. There are plenty of fast-moving markets where you can get ahead of the trend with Simply Wall St.

- Unlock potential income by checking out these 19 dividend stocks with yields > 3%, which offer high yields and the chance for steady returns.

- Spot tomorrow’s breakthroughs when you browse these 24 AI penny stocks, which are pushing boundaries with artificial intelligence and reshaping entire industries.

- Catch undervalued gems before the crowd by searching through these 896 undervalued stocks based on cash flows, which could deliver standout gains as the market recognizes their true promise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LENZ

LENZ Therapeutics

Operates as a biopharmaceutical company that focuses on the development and commercialization of therapies to improve vision in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives