- United States

- /

- Pharma

- /

- NasdaqGS:LENZ

LENZ Therapeutics (LENZ) Soars 20.7% After FDA-Approved VIZZ Launch for Presbyopia Patients

Reviewed by Sasha Jovanovic

- LENZ Therapeutics has announced that VIZZ, the first and only FDA-approved aceclidine-based eye drop for presbyopia in adults, is now available in the United States, with nationwide sample distribution to eye care professionals underway and commercial shipments to consumers starting in October.

- This launch positions LENZ as a key player in the large and previously underserved U.S. presbyopia market, with clinical trial results showing rapid and sustained improvement in near vision for the majority of patients.

- We'll look at how the entry of VIZZ as a first-of-its-kind treatment shapes LENZ Therapeutics' investment narrative and future growth prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is LENZ Therapeutics' Investment Narrative?

For shareholders in LENZ Therapeutics, the big picture centers on belief in the commercial and clinical potential of VIZZ, the just-launched, FDA-approved eye drop for presbyopia, a market affecting millions of adults. The company’s move from pre-commercial to commercial-stage with VIZZ marks a shift in the short-term catalysts, immediately bringing execution risk and real-world uptake into focus. Previously, the key drivers were regulatory progress and an expanding pipeline, but now early sales metrics, physician feedback and distribution success will likely drive sentiment and price movement. This approval pushes LENZ closer to meaningful revenue generation, but with losses widening and limited current revenues, financial performance in the near term remains a challenge. While recent share price gains suggest high expectations, failure to achieve broad physician adoption or unexpected safety concerns could reverse this optimism. The VIZZ launch is material, shifting the narrative from promise to proof, and the stakes have risen accordingly.

On the flip side, as execution risk grows, so does exposure if uptake falls short of investor hopes.

Exploring Other Perspectives

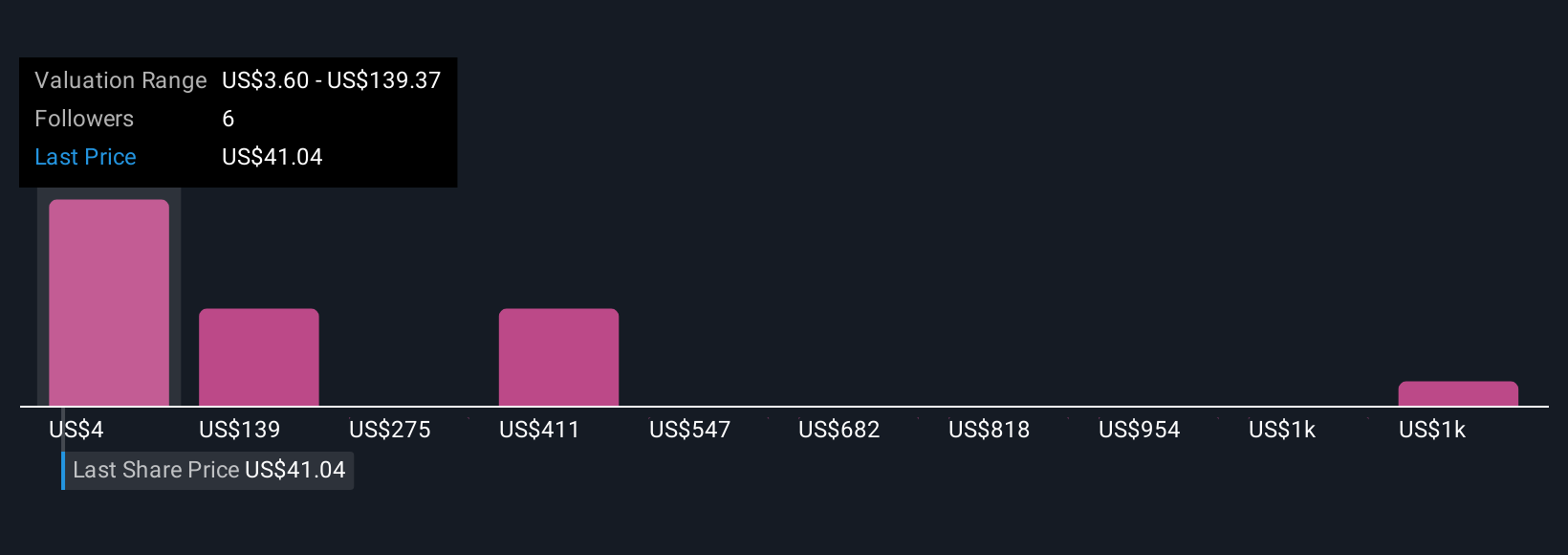

Explore 7 other fair value estimates on LENZ Therapeutics - why the stock might be worth less than half the current price!

Build Your Own LENZ Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LENZ Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LENZ Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LENZ Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LENZ

LENZ Therapeutics

Operates as a biopharmaceutical company that focuses on the development and commercialization of therapies to improve vision in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives