- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

How Investors Are Reacting To Legend Biotech (LEGN) Securing Global Carvykti Supply Deal With Janssen

Reviewed by Sasha Jovanovic

- On October 6, 2025, Janssen Pharmaceuticals announced a supply agreement with Legend Biotech for the global manufacturing and distribution of Carvykti, excluding Greater China.

- This collaboration is set to boost Legend Biotech’s operational capabilities and global reach for its CAR-T cell therapy, potentially addressing prior production constraints.

- We’ll explore how Legend Biotech’s expanded production partnership with Janssen may shape its investment outlook and margin improvement prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Legend Biotech Investment Narrative Recap

Legend Biotech's story hinges on belief in the sustained global expansion of its flagship CARVYKTI therapy and the company’s ability to address historical supply constraints while managing significant dependence on a single product. The Janssen supply agreement directly targets one of the most important short-term catalysts, expanding operational scale and smoothing Carvykti’s global rollout, but does not fully resolve the pressing risk of product concentration, which still weighs on Legend’s long-term business profile.

Among recent announcements, the company’s Q2 2025 results revealed continued revenue growth to US$255.06 million but rising losses, highlighting the challenge of balancing aggressive investment with a pathway to profitability. These financial results remain closely linked to the execution of new supply deals and manufacturing capabilities, which are near-term levers for Legend’s operational and margin improvements.

In contrast, investors should also be aware that Legend remains highly reliant on a single revenue stream…

Read the full narrative on Legend Biotech (it's free!)

Legend Biotech's narrative projects $2.3 billion revenue and $632.7 million earnings by 2028. This requires 42.3% yearly revenue growth and a $958 million earnings increase from -$325.3 million today.

Uncover how Legend Biotech's forecasts yield a $77.46 fair value, a 144% upside to its current price.

Exploring Other Perspectives

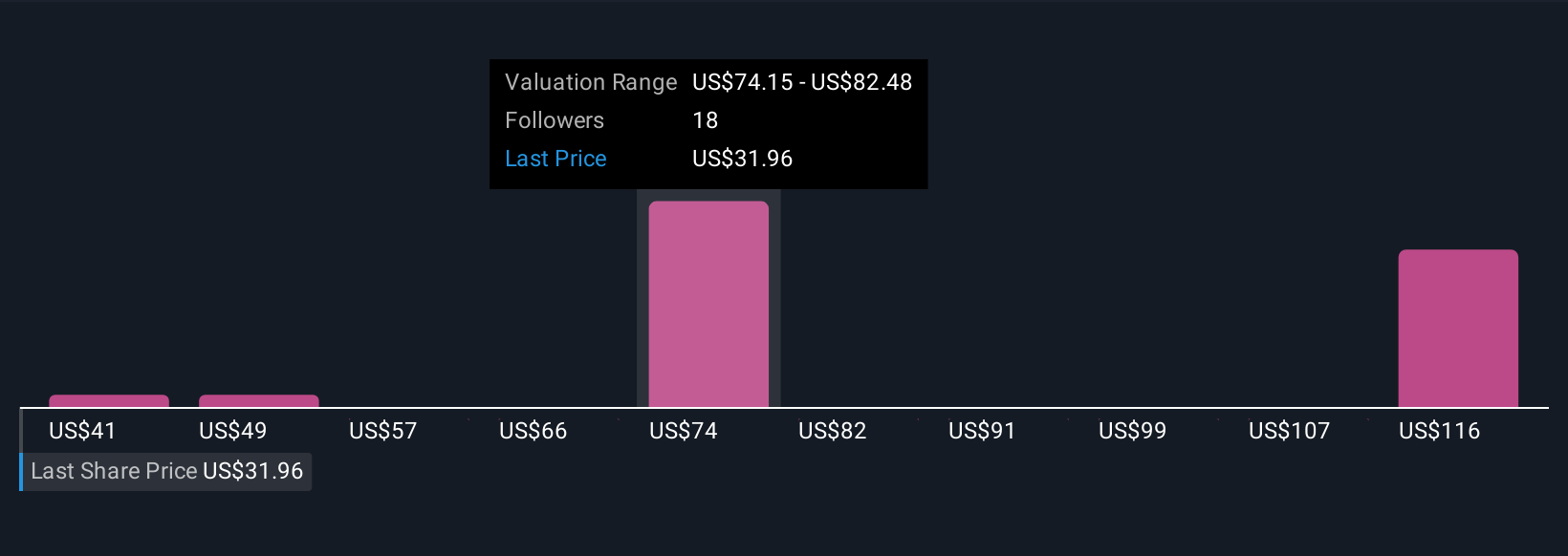

Fair value estimates from the Simply Wall St Community span US$40.82 to US$197.26, drawn from six contributors. While many are focused on international growth, the company’s single-product reliance remains a clear point of contention about its long-term resilience, consider exploring these varying opinions to sharpen your own view.

Explore 6 other fair value estimates on Legend Biotech - why the stock might be worth just $40.82!

Build Your Own Legend Biotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Legend Biotech research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Legend Biotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Legend Biotech's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

Through its subsidiaries, operates as a biopharmaceutical company that discovers, develops, manufactures, and commercializes novel cell therapies for oncology and other indications in the United States, China, and Europe.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives