- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

How Investors Are Reacting To Legend Biotech (LEGN) FDA Label Update Featuring CARVYKTI Survival Data

Reviewed by Sasha Jovanovic

- On October 10, 2025, Legend Biotech announced that the U.S. FDA approved a label update for CARVYKTI® to include overall survival data from a Phase 3 study showing a significant improvement for relapsed and refractory multiple myeloma patients compared to standard therapies.

- The updated label also introduced new safety warnings, highlighting a balance between clinical benefit and emerging risks to guide physician decision-making and patient management.

- We’ll explore how the inclusion of statistically significant long-term survival data could shift Legend Biotech’s investment narrative for CAR-T therapies.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Legend Biotech Investment Narrative Recap

To be a shareholder in Legend Biotech, you need conviction in the long-term opportunity of CARVYKTI®, particularly that robust survival data and ongoing clinical expansion outweigh near-term financial losses and product concentration risk. The FDA approval of a label update for CARVYKTI® with new overall survival data directly strengthens the main short-term catalyst, expanded prescribing confidence and broader patient access, while the addition of new safety warnings slightly heightens ongoing product safety risk but does not materially alter the core business thesis at this time.

Among recent developments, the new global manufacturing and supply agreement with Janssen Pharmaceuticals is especially relevant, since it supports the required scale-up for anticipated demand following the label update. The agreement aligns both partners operationally as Legend works to establish CARVYKTI® as a standard treatment in earlier lines, amplifying access, yet also increases the extent of shared risk if adverse events or supply constraints emerge.

However, investors should also be aware that despite promising efficacy, new safety signals around rare but serious complications now require…

Read the full narrative on Legend Biotech (it's free!)

Legend Biotech's narrative projects $2.3 billion revenue and $632.7 million earnings by 2028. This requires 42.3% yearly revenue growth and a $958 million earnings increase from -$325.3 million today.

Uncover how Legend Biotech's forecasts yield a $76.00 fair value, a 138% upside to its current price.

Exploring Other Perspectives

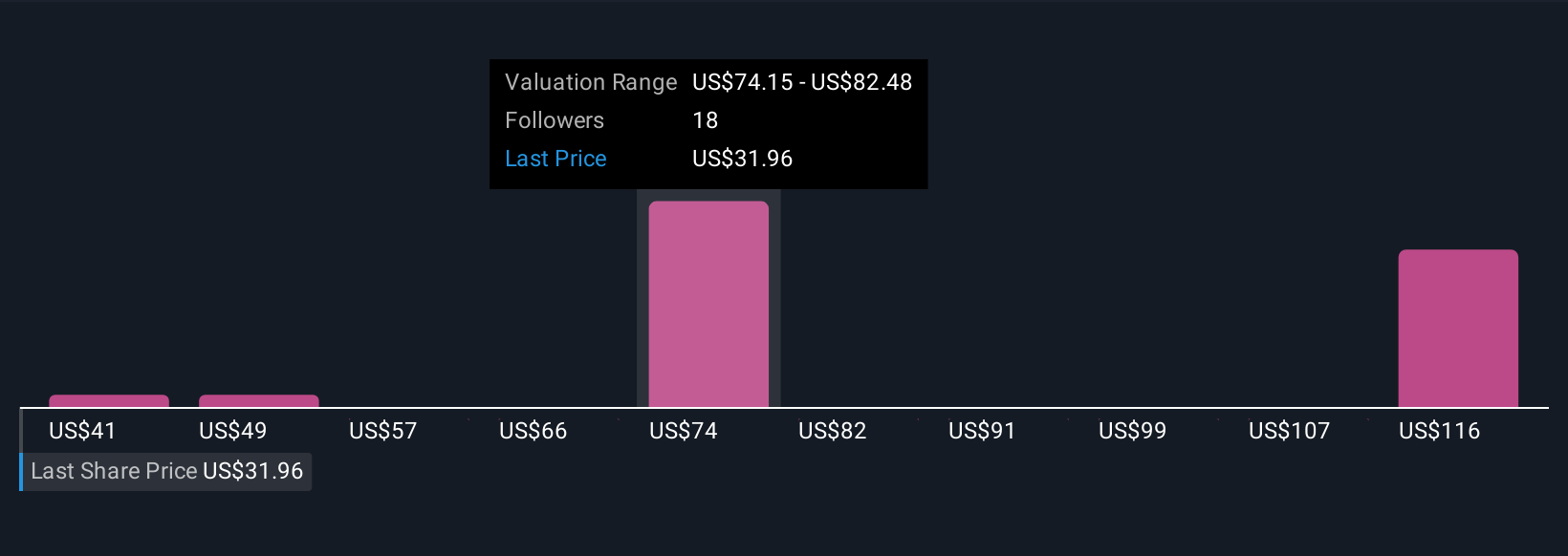

Six retail investors in the Simply Wall St Community estimate Legend Biotech's fair value between US$40.82 and US$124.15 per share. With overall survival data recognized in the label and broader adoption potential, you may want to compare these diverse views to updated catalysts for CARVYKTI®.

Explore 6 other fair value estimates on Legend Biotech - why the stock might be worth just $40.82!

Build Your Own Legend Biotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Legend Biotech research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Legend Biotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Legend Biotech's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

Through its subsidiaries, operates as a biopharmaceutical company that discovers, develops, manufactures, and commercializes novel cell therapies for oncology and other indications in the United States, China, and Europe.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives