- United States

- /

- Biotech

- /

- NasdaqGM:KYMR

Kymera Therapeutics, Inc.'s (NASDAQ:KYMR) Shares Climb 33% But Its Business Is Yet to Catch Up

Despite an already strong run, Kymera Therapeutics, Inc. (NASDAQ:KYMR) shares have been powering on, with a gain of 33% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 4.6% isn't as attractive.

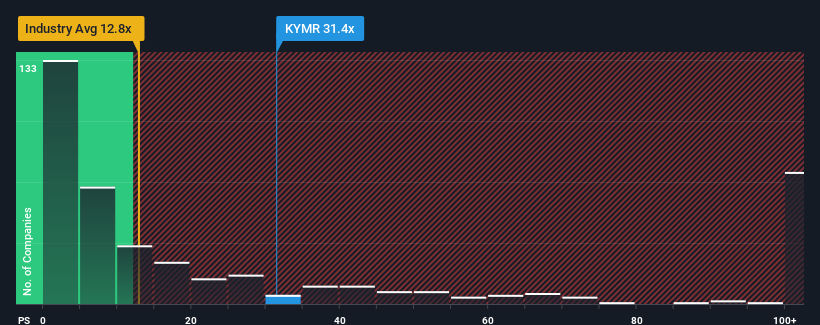

Since its price has surged higher, Kymera Therapeutics may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 31.4x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 12.8x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Kymera Therapeutics

How Has Kymera Therapeutics Performed Recently?

Recent times haven't been great for Kymera Therapeutics as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Kymera Therapeutics will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Kymera Therapeutics?

In order to justify its P/S ratio, Kymera Therapeutics would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 103% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% per year over the next three years. With the industry predicted to deliver 248% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Kymera Therapeutics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shares in Kymera Therapeutics have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Kymera Therapeutics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 3 warning signs for Kymera Therapeutics (1 is significant!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kymera Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KYMR

Kymera Therapeutics

Together with its subsidiary, a clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

Flawless balance sheet with limited growth.