- United States

- /

- Biotech

- /

- NasdaqGM:KYMR

Getting In Cheap On Kymera Therapeutics, Inc. (NASDAQ:KYMR) Is Unlikely

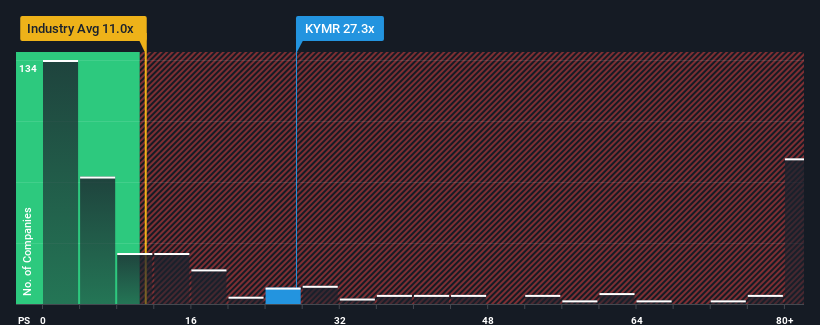

Kymera Therapeutics, Inc.'s (NASDAQ:KYMR) price-to-sales (or "P/S") ratio of 27.3x might make it look like a strong sell right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios below 11x and even P/S below 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Kymera Therapeutics

How Has Kymera Therapeutics Performed Recently?

Kymera Therapeutics could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Kymera Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Kymera Therapeutics' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Kymera Therapeutics' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 87% last year. As a result, it also grew revenue by 24% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 3.5% each year during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 140% per year, which paints a poor picture.

With this information, we find it concerning that Kymera Therapeutics is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Kymera Therapeutics' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

For a company with revenues that are set to decline in the context of a growing industry, Kymera Therapeutics' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Kymera Therapeutics you should be aware of, and 1 of them makes us a bit uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kymera Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KYMR

Kymera Therapeutics

A biopharmaceutical company, focuses on discovering and developing novel small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives