- United States

- /

- Biotech

- /

- NasdaqGS:KURA

Kura Oncology (KURA) Is Down 7.2% After First KOMZIFTI Sale Triggers $135M Milestone Payment

Reviewed by Sasha Jovanovic

- Kura Oncology recently reported that it completed the first U.S. commercial sale of KOMZIFTI (ziftomenib), its newly FDA-approved oral menin inhibitor for adults with relapsed or refractory NPM1‑mutated acute myeloid leukemia, which also triggered a US$135,000,000 milestone payment from partner Kyowa Kirin expected before year-end 2025.

- This first sale, combined with KOMZIFTI’s inclusion in NCCN guidelines as a Category 2A recommended option, signals early clinical acceptance and provides an immediate non-dilutive cash influx to support Kura’s broader oncology pipeline.

- We’ll now examine how this US$135,000,000 milestone from Kyowa Kirin may reshape Kura Oncology’s investment narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kura Oncology Investment Narrative Recap

To own Kura Oncology today, you need to believe KOMZIFTI can become a meaningful commercial product while funding risk is kept in check as the broader pipeline matures. The first U.S. sale and related US$135,000,000 milestone meaningfully ease near term balance sheet pressure, but execution risk around KOMZIFTI uptake and ongoing clinical trials still looks like the key swing factor for the stock.

The most relevant recent development here is KOMZIFTI’s inclusion in the NCCN Guidelines as a Category 2A recommended option, which supports early adoption following FDA approval. Together with the initial commercial sale, this clinical endorsement underpins the near term revenue opportunity that the Kyowa Kirin milestone is helping to finance, while investors continue to watch KOMET-017 Phase III progress as the next major inflection point.

Yet while the near term cash boost reduces financing pressure, investors still need to be aware of the risk that...

Read the full narrative on Kura Oncology (it's free!)

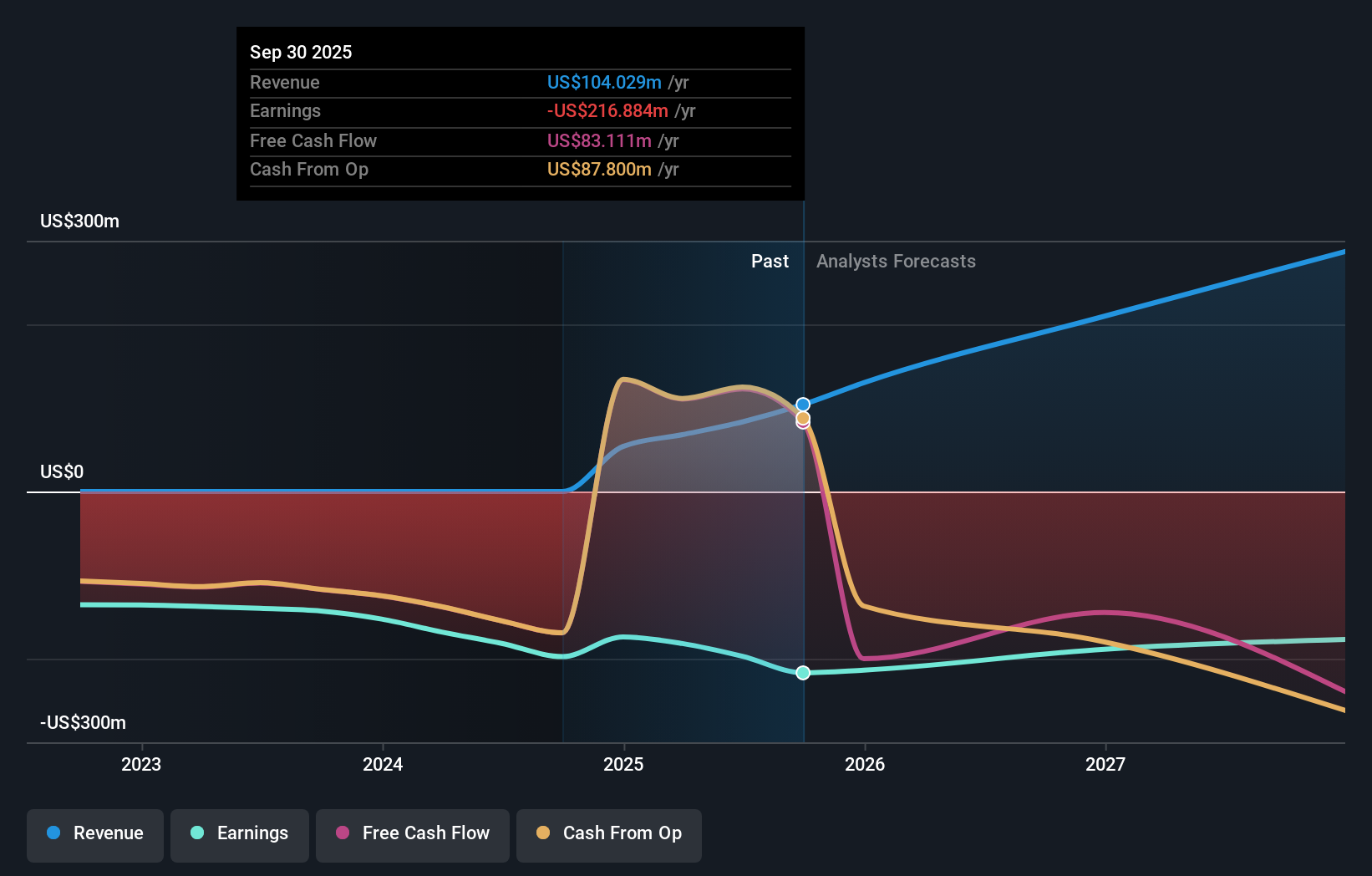

Kura Oncology's narrative projects $434.8 million revenue and $69.8 million earnings by 2028. This requires 73.5% yearly revenue growth and a $267.0 million earnings increase from $-197.2 million today.

Uncover how Kura Oncology's forecasts yield a $31.80 fair value, a 186% upside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member values Kura at US$31.80 per share, highlighting how a single private forecast can differ from current pricing. You may want to weigh that against the company’s reliance on successful commercialization of KOMZIFTI to support its high forecast revenue growth and ongoing losses.

Explore another fair value estimate on Kura Oncology - why the stock might be worth over 2x more than the current price!

Build Your Own Kura Oncology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kura Oncology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Kura Oncology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kura Oncology's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kura Oncology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KURA

Kura Oncology

A clinical-stage biopharmaceutical company, develops medicines for the treatment of cancer.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026