- United States

- /

- Biotech

- /

- NasdaqGS:KRYS

US High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market wraps up a strong week with major indexes like the S&P 500 and Dow Jones Industrial Average extending their winning streaks, the tech-heavy Nasdaq has faced its first monthly decline since March, highlighting mixed sentiments in the technology sector. In this environment, identifying high-growth tech stocks requires careful consideration of companies that not only demonstrate robust innovation and adaptability but also have solid fundamentals to weather fluctuations in broader market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Pelthos Therapeutics | 47.08% | 110.99% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Workday | 11.27% | 32.61% | ★★★★★☆ |

| Circle Internet Group | 26.03% | 84.68% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.83% | 45.89% | ★★★★★☆ |

| Viridian Therapeutics | 56.32% | 54.10% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

MongoDB (MDB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MongoDB, Inc. offers a general-purpose database platform globally and has a market capitalization of $27.04 billion.

Operations: The company generates revenue primarily from its data processing segment, which contributed $2.22 billion. The business focuses on providing a versatile database platform to a global clientele.

MongoDB, a key player in the tech sector, is poised for significant growth with its recent leadership transition and innovative product launches. The company's revenue is expected to climb by 14.7% annually, outpacing the US market average of 10.5%. This growth trajectory is bolstered by MongoDB AMP, an AI-powered platform that accelerates application modernization, demonstrating MongoDB’s commitment to continuous innovation and customer-centric solutions. With Chirantan CJ Desai stepping in as CEO, bringing extensive experience from Cloudflare and ServiceNow, MongoDB aims to leverage his expertise in cloud infrastructure and large-scale SaaS platforms for sustained growth. Additionally, the company recently revised its Q3 fiscal year 2026 earnings guidance upwards due to strong performance from Atlas, signaling robust operational momentum under new leadership.

- Click here to discover the nuances of MongoDB with our detailed analytical health report.

Understand MongoDB's track record by examining our Past report.

Intapp (INTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intapp, Inc., through its subsidiary Integration Appliance, Inc., offers AI-powered solutions across the United States, the United Kingdom, and internationally with a market capitalization of approximately $3.54 billion.

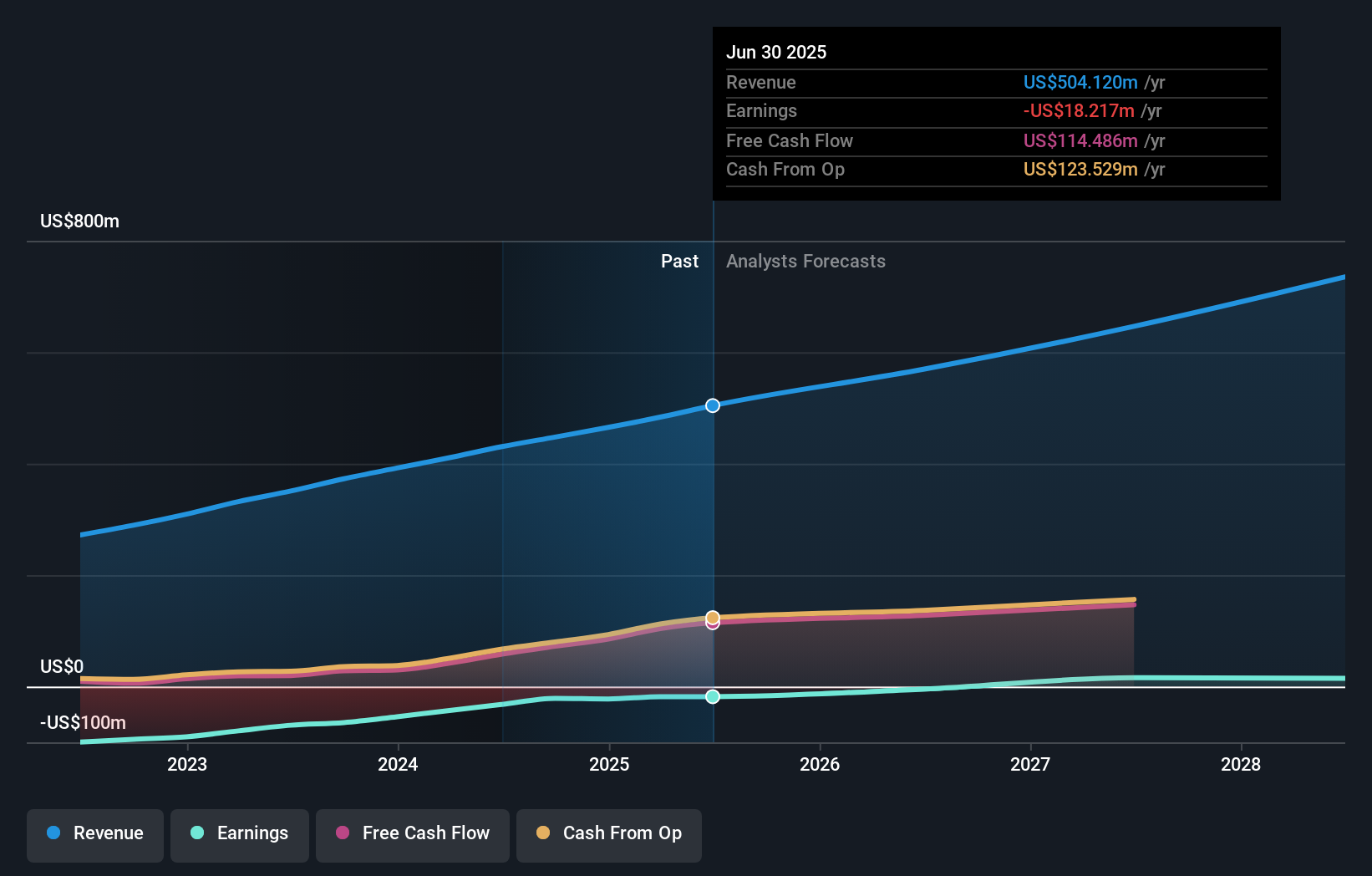

Operations: The company generates revenue primarily from its Software & Programming segment, which accounts for $524.34 million. Operating within the AI solutions sector, it serves clients globally, including in the United States and the United Kingdom.

Intapp, despite its current unprofitability, is navigating a promising trajectory with expected profitability within three years and an annual revenue growth rate of 12%, outpacing the US market average of 10.5%. The firm's commitment to innovation is evident in its R&D spending, crucial for staying competitive in the rapidly evolving tech landscape. Recent strategic moves include repurchasing shares worth $49.98 million and enhancing client engagement through Intapp Collaboration, tailored for firms like Ostberg Sinclair to streamline operations and foster growth. These actions collectively underscore Intapp’s proactive stance in refining its technological offerings and financial strategies to align with broader market opportunities and client needs.

- Navigate through the intricacies of Intapp with our comprehensive health report here.

Assess Intapp's past performance with our detailed historical performance reports.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of $6.32 billion.

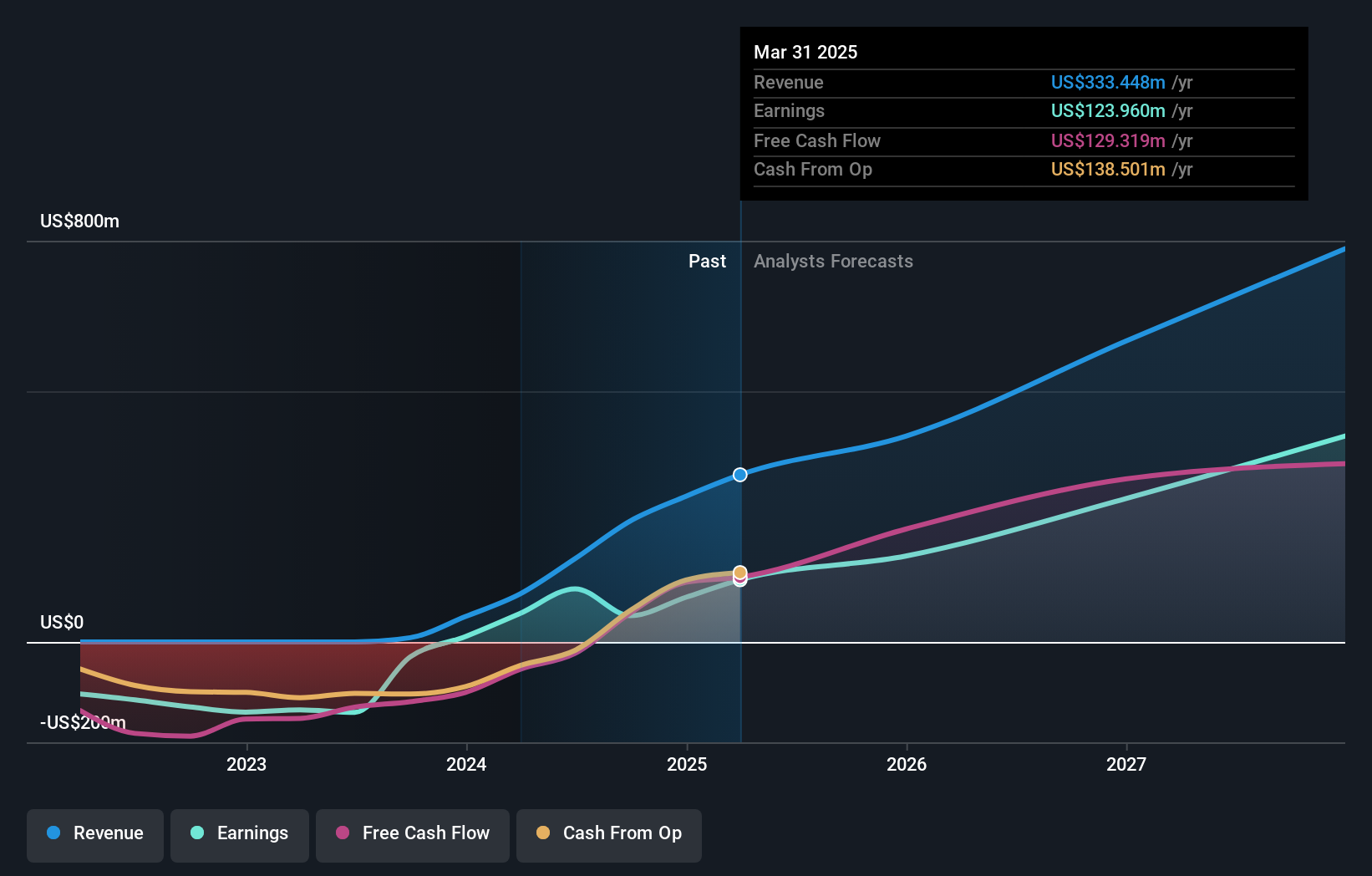

Operations: Krystal Biotech generates revenue through its focus on genetic medicines aimed at treating diseases with significant unmet medical needs, reporting $373.16 million in this segment.

Krystal Biotech's recent performance underscores its robust position in the biotech sector, with a staggering annual earnings growth of 279.8%, significantly outpacing the industry average of 52%. The company's strategic focus on R&D is evident from its allocation of substantial resources, ensuring sustained innovation and competitiveness. Recent FDA approvals and designations, such as for KB801, enhance Krystal’s portfolio and market presence, promising continued revenue streams well above the U.S. market average growth rate of 10.5%. These achievements are complemented by a notable increase in net income to $153.43 million over nine months, reflecting effective operational execution and market adaptation.

- Click here and access our complete health analysis report to understand the dynamics of Krystal Biotech.

Examine Krystal Biotech's past performance report to understand how it has performed in the past.

Summing It All Up

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 69 more companies for you to explore.Click here to unveil our expertly curated list of 72 US High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Krystal Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRYS

Krystal Biotech

A commercial-stage biotechnology company, discovers, develops, manufactures, and commercializes genetic medicines to treat diseases with high unmet medical needs in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026