- United States

- /

- Biotech

- /

- NasdaqGS:KRYS

Krystal Biotech And 2 More Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a mix of volatility and upward momentum, driven by strong bank earnings and fluctuating trade tensions with China, investors are keenly observing growth companies with substantial insider ownership. In this environment, stocks like Krystal Biotech stand out as they often signal confidence from those closest to the company's operations, potentially offering resilience amid economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 73.1% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Here we highlight a subset of our preferred stocks from the screener.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

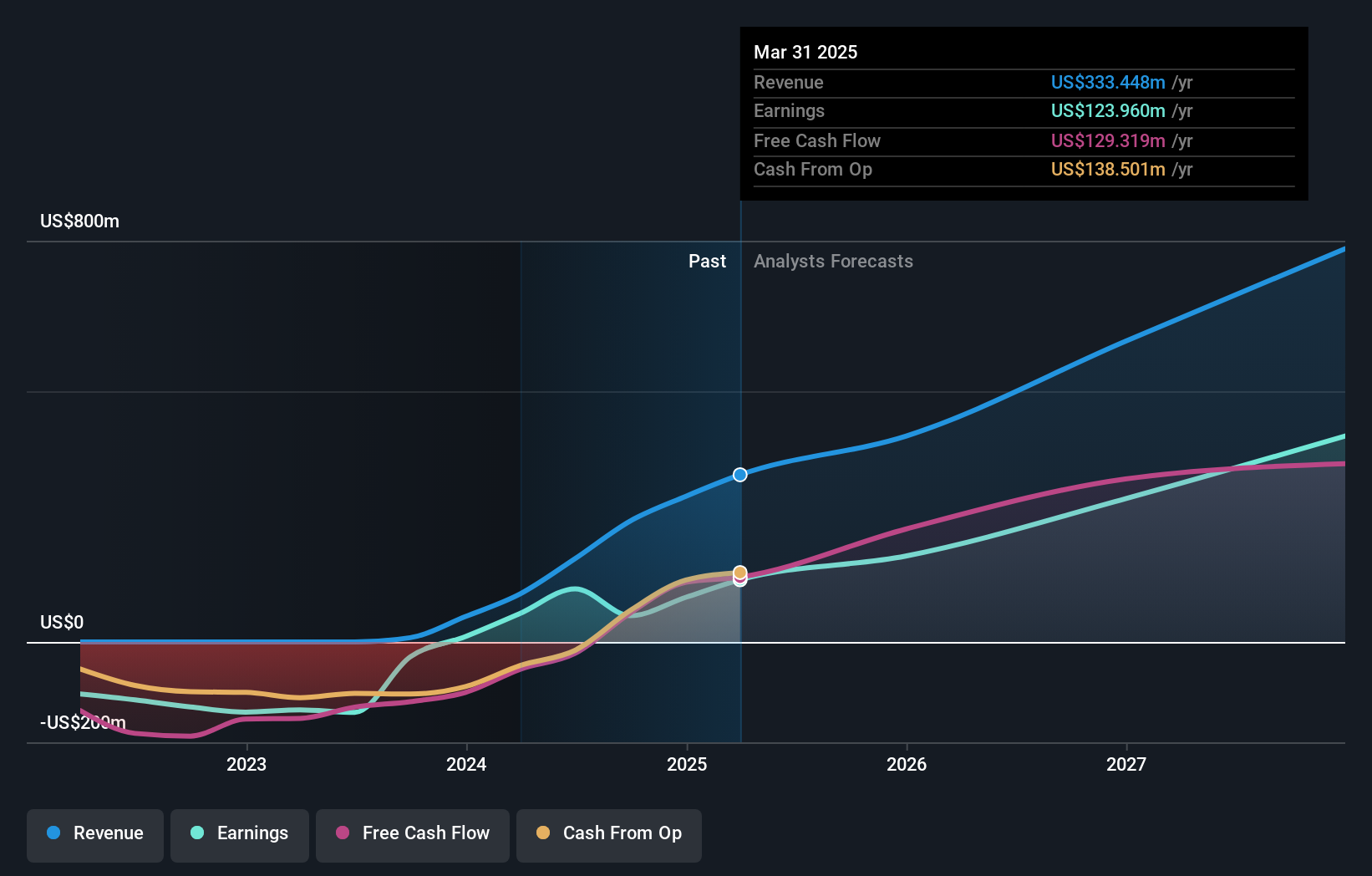

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of approximately $5.35 billion.

Operations: The company's revenue is primarily derived from its genetic medicines segment, which generated $359.21 million.

Insider Ownership: 10.4%

Krystal Biotech exhibits strong growth potential, with forecasted revenue and earnings growth rates exceeding 20% annually. Despite trading below estimated fair value, its return on equity is expected to remain low. Recent FDA platform technology designation for its KB801 gene therapy may streamline development processes. The company's expanding pipeline includes promising treatments like VYJUVEK, recently approved in Japan for DEB treatment, enhancing Krystal's market reach and reinforcing its innovative genetic medicine portfolio.

- Delve into the full analysis future growth report here for a deeper understanding of Krystal Biotech.

- Insights from our recent valuation report point to the potential undervaluation of Krystal Biotech shares in the market.

RingCentral (RNG)

Simply Wall St Growth Rating: ★★★★☆☆

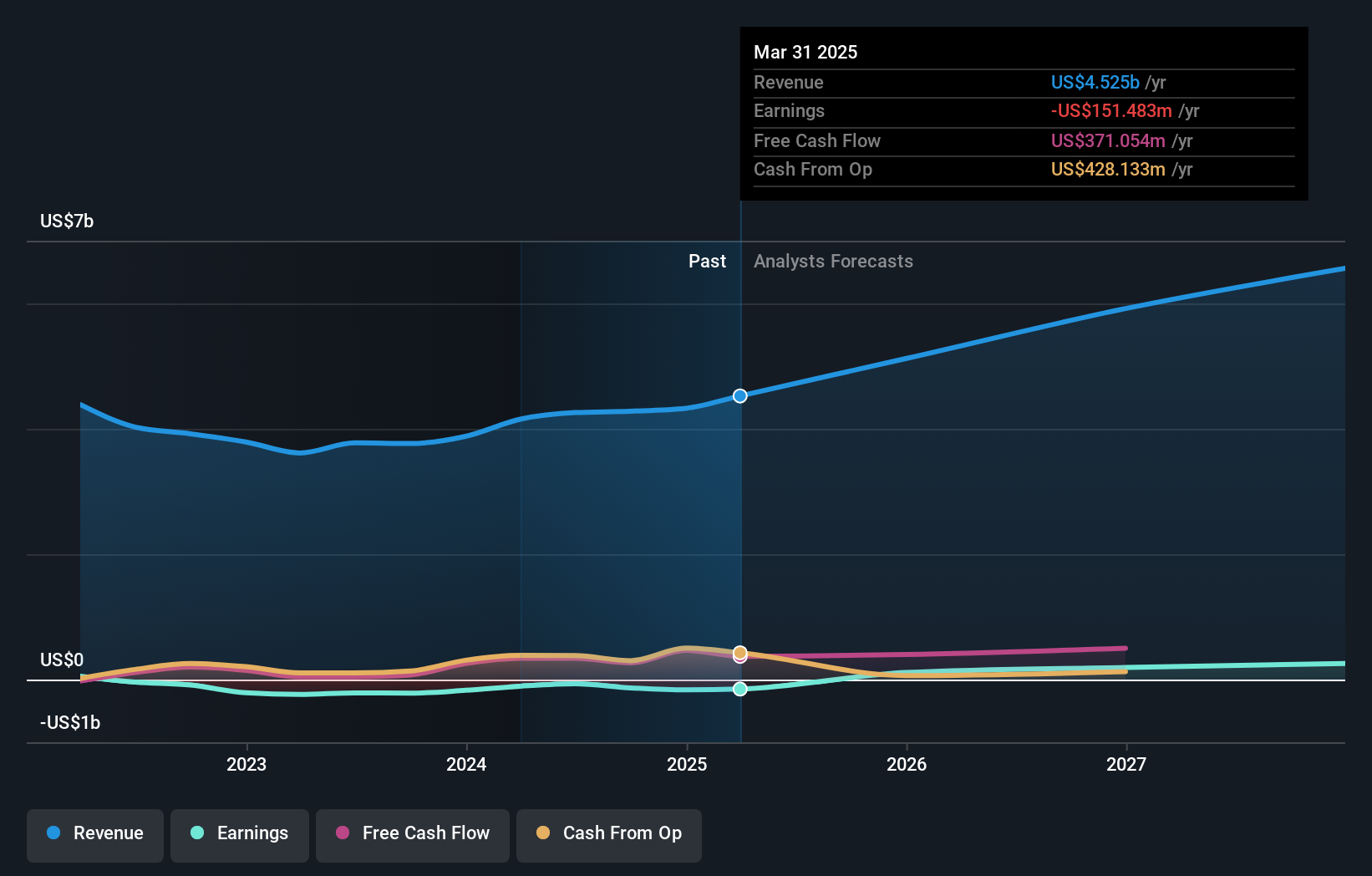

Overview: RingCentral, Inc. offers cloud-based business communications and contact center solutions globally, with a market cap of approximately $2.43 billion.

Operations: The company generates revenue from its Internet Software & Services segment, amounting to $2.46 billion.

Insider Ownership: 10.2%

RingCentral, Inc. is trading significantly below its estimated fair value and shows promising potential with a forecasted annual earnings growth of 48.58%. Despite slower revenue growth projections compared to the market, the company is expected to become profitable within three years. Recent strategic moves include a $1.24 billion credit facility expansion aimed at refinancing debt and reducing borrowing costs, alongside innovative product enhancements such as AI Receptionist Everywhere, bolstering its position in cloud communications technology.

- Navigate through the intricacies of RingCentral with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that RingCentral is trading behind its estimated value.

Tutor Perini (TPC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients globally, with a market cap of approximately $3.28 billion.

Operations: Tutor Perini's revenue segments include Specialty Contractors at $617.10 million, Civil (Including Management Services) at approximately $2.60 billion, and Building (Including Management Services) at $1.79 billion.

Insider Ownership: 14.4%

Tutor Perini is trading well below its estimated fair value, with a forecasted annual earnings growth of 90.9%. Despite revenue growth projections lagging behind the ideal rate, the company is set to become profitable within three years. Recent developments include a $181.8 million task order for a defense project in Guam and an increased earnings guidance for 2025. Significant insider selling has occurred recently, though more shares have been bought than sold over three months.

- Click to explore a detailed breakdown of our findings in Tutor Perini's earnings growth report.

- Our valuation report unveils the possibility Tutor Perini's shares may be trading at a discount.

Next Steps

- Navigate through the entire inventory of 202 Fast Growing US Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Krystal Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRYS

Krystal Biotech

A commercial-stage biotechnology company, discovers, develops, manufactures, and commercializes genetic medicines to treat diseases with high unmet medical needs in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives