- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

Investors Don't See Light At End Of Kiniksa Pharmaceuticals, Ltd.'s (NASDAQ:KNSA) Tunnel

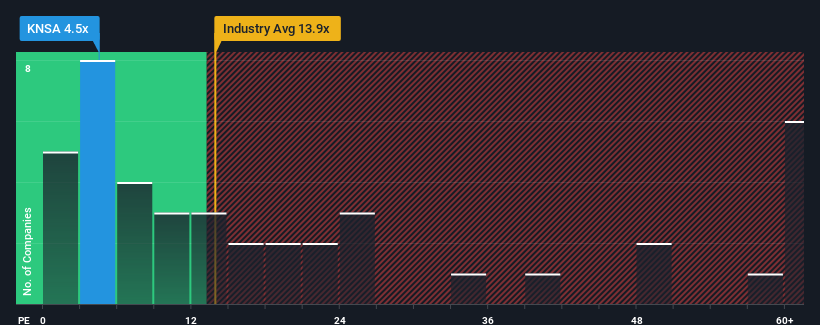

With a price-to-earnings (or "P/E") ratio of 4.5x Kiniksa Pharmaceuticals, Ltd. (NASDAQ:KNSA) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 15x and even P/E's higher than 30x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Kiniksa Pharmaceuticals could be doing better as it's been growing earnings less than most other companies lately. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Kiniksa Pharmaceuticals

Is There Any Growth For Kiniksa Pharmaceuticals?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Kiniksa Pharmaceuticals' to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 88% per year over the next three years. That's not great when the rest of the market is expected to grow by 9.8% each year.

In light of this, it's understandable that Kiniksa Pharmaceuticals' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Kiniksa Pharmaceuticals' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Kiniksa Pharmaceuticals maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Kiniksa Pharmaceuticals.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Kiniksa Pharmaceuticals International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, developing and commercializing novel therapies for diseases with unmet need and focuses on cardiovascular indications worldwide.

Very undervalued with flawless balance sheet.