Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Kala Pharmaceuticals, Inc. (NASDAQ:KALA) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Kala Pharmaceuticals

What Is Kala Pharmaceuticals's Net Debt?

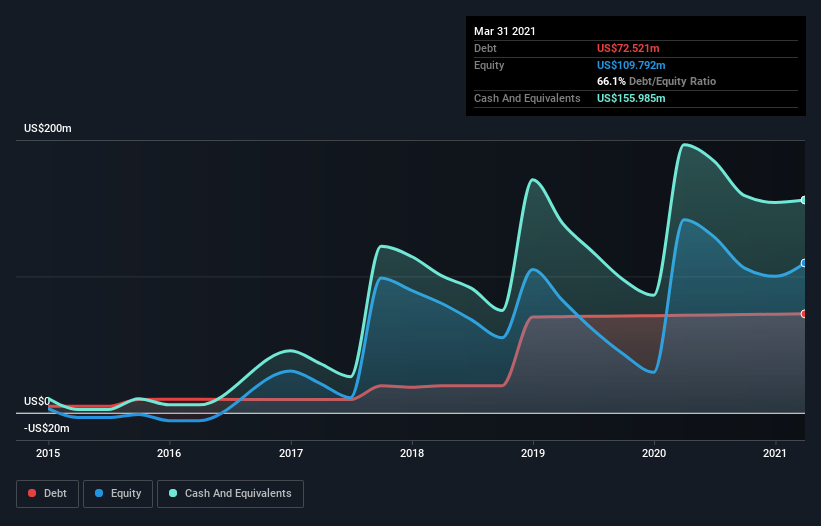

As you can see below, Kala Pharmaceuticals had US$72.5m of debt, at March 2021, which is about the same as the year before. You can click the chart for greater detail. However, its balance sheet shows it holds US$156.0m in cash, so it actually has US$83.5m net cash.

A Look At Kala Pharmaceuticals' Liabilities

We can see from the most recent balance sheet that Kala Pharmaceuticals had liabilities of US$20.0m falling due within a year, and liabilities of US$100.0m due beyond that. Offsetting this, it had US$156.0m in cash and US$12.2m in receivables that were due within 12 months. So it actually has US$48.2m more liquid assets than total liabilities.

It's good to see that Kala Pharmaceuticals has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Kala Pharmaceuticals has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Kala Pharmaceuticals's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Kala Pharmaceuticals reported revenue of US$8.6m, which is a gain of 49%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Kala Pharmaceuticals?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Kala Pharmaceuticals lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$105m and booked a US$113m accounting loss. However, it has net cash of US$83.5m, so it has a bit of time before it will need more capital. Kala Pharmaceuticals's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Kala Pharmaceuticals that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Kala Pharmaceuticals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KALA BIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:KALA

KALA BIO

A clinical-stage biopharmaceutical company, engages in the research, development, and commercialization of innovative therapies for rare and severe eye diseases in the United States.

Medium-low with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives