- United States

- /

- Pharma

- /

- NasdaqGS:JAZZ

Insufficient Growth At Jazz Pharmaceuticals plc (NASDAQ:JAZZ) Hampers Share Price

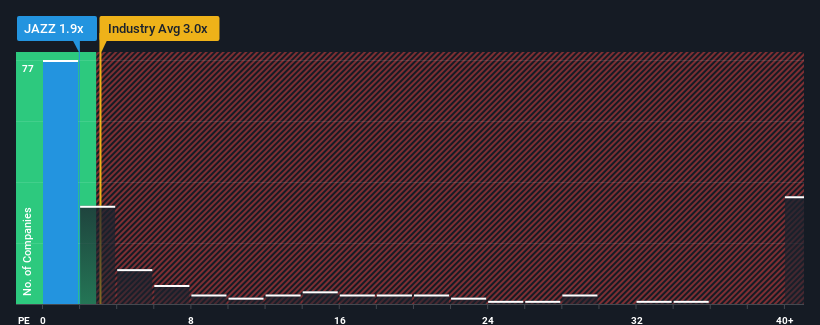

Jazz Pharmaceuticals plc's (NASDAQ:JAZZ) price-to-sales (or "P/S") ratio of 1.9x might make it look like a buy right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 3x and even P/S above 20x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Jazz Pharmaceuticals

What Does Jazz Pharmaceuticals' P/S Mean For Shareholders?

Recent times haven't been great for Jazz Pharmaceuticals as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jazz Pharmaceuticals.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jazz Pharmaceuticals' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 4.8%. This was backed up an excellent period prior to see revenue up by 62% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 6.1% each year over the next three years. That's shaping up to be materially lower than the 20% per year growth forecast for the broader industry.

In light of this, it's understandable that Jazz Pharmaceuticals' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Jazz Pharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Jazz Pharmaceuticals is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:JAZZ

Jazz Pharmaceuticals

Jazz Pharmaceuticals plc identifies, develops, and commercializes pharmaceutical products for unmet medical needs in the United States, Europe, and internationally.

Undervalued with acceptable track record.