- United States

- /

- Biotech

- /

- NasdaqGM:JANX

Janux Therapeutics (JANX) Is Down 50.7% After Positive JANX007 Phase 1 mCRPC Update - What's Changed

Reviewed by Sasha Jovanovic

- Janux Therapeutics recently reported positive updated interim Phase 1 data for its PSMA-directed TRACTr candidate JANX007 in metastatic castration-resistant prostate cancer, based on 109 treated patients as of the October 15, 2025 cutoff, and held a virtual event on December 1 to discuss the results.

- The update highlights not only progress for JANX007 but also reinforces Janux’s broader TRACTr and ARM platforms, which span multiple solid tumors and an emerging CD19 program in autoimmune disease.

- We’ll now examine how the encouraging JANX007 interim results in mCRPC shape Janux’s investment narrative and future clinical development prospects.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Janux Therapeutics' Investment Narrative?

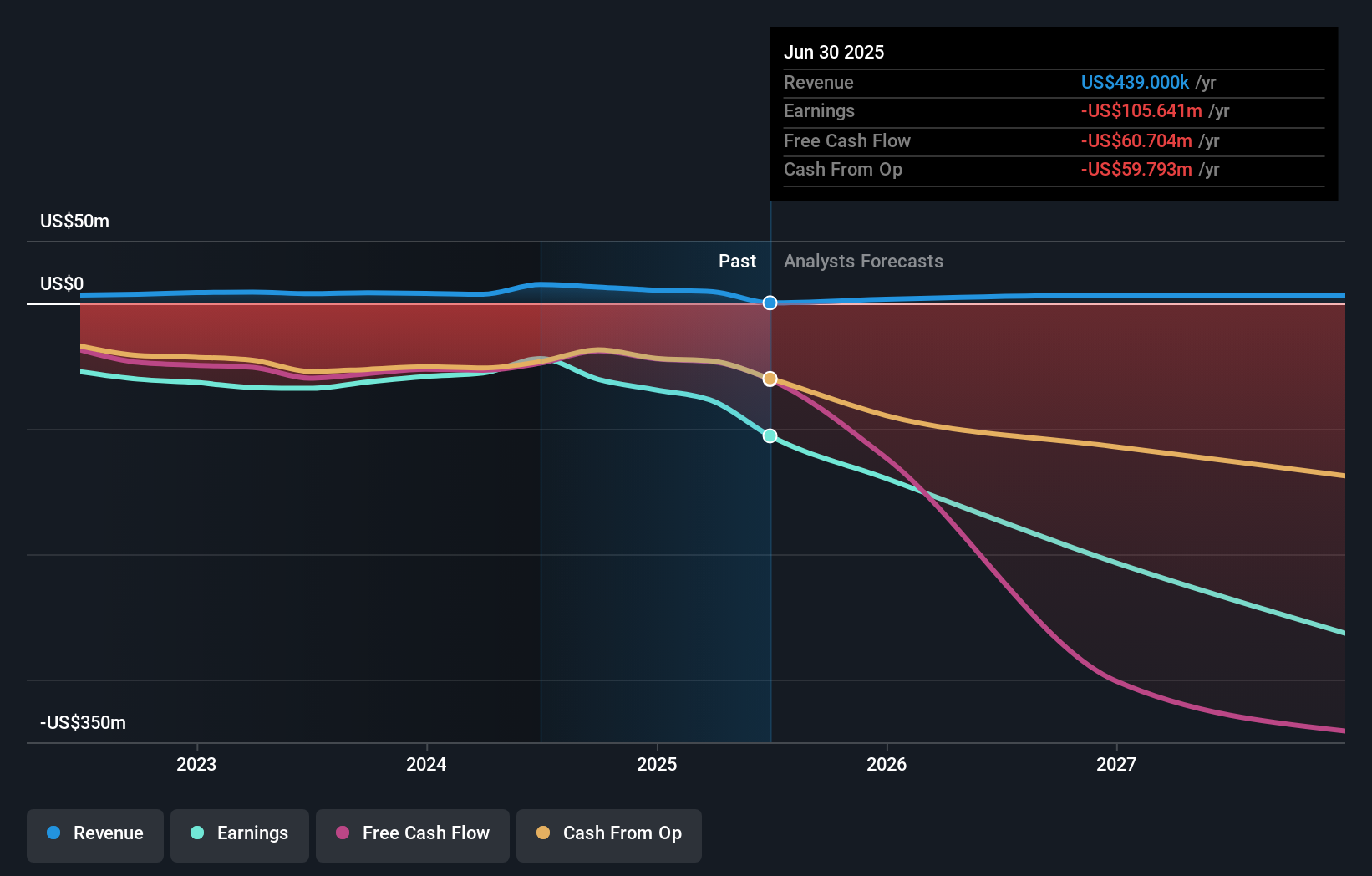

To own Janux Therapeutics, you really have to buy into the idea that its TRACTr and ARM platforms can turn early clinical validation into a multi-asset oncology and autoimmune franchise, despite years of expected losses. The latest positive JANX007 Phase 1 update in mCRPC is central to that story, because it gives the company a more tangible proof point after a year of steep share price declines and heavy volatility. In the near term, JANX007 data flow and progress on JANX008 and the CD19-ARM program look like the key potential catalysts, and this new readout may help reframe expectations around those assets. At the same time, Janux remains unprofitable with widening losses, a relatively new management team and high CEO pay, so execution risk and financing needs stay front and center.

However, one issue around leadership and cash burn is easy to overlook, and investors should not. In light of our recent valuation report, it seems possible that Janux Therapeutics is trading beyond its estimated value.Exploring Other Perspectives

Explore 3 other fair value estimates on Janux Therapeutics - why the stock might be worth just $48.00!

Build Your Own Janux Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Janux Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Janux Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Janux Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:JANX

Janux Therapeutics

A clinical stage biopharmaceutical company, develops immunotherapies based on Tumor Activated T Cell Engager (TRACTr) and Tumor Activated Immunomodulator (TRACIr) platforms technology to treat patients with cancer.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026