- United States

- /

- Biotech

- /

- NasdaqGM:IVVD

Could Invivyd's (IVVD) Pipeline Expansion Reveal a Shift in Its Long-Term Competitive Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, Invivyd, Inc. announced the nomination of VBY329, a monoclonal antibody candidate for RSV prevention in neonates, infants, and children, for preclinical development, highlighting its promising binding and neutralization profile against multiple RSV variants and resistance determinants.

- The announcement also signaled Invivyd’s intent to extend its antibody platform to other infectious diseases and unveiled ongoing discovery programs aimed at vulnerable populations, underscoring the company’s expanded innovation pipeline.

- We’ll now explore how the launch of VBY329 may influence Invivyd’s investment narrative by expanding its portfolio beyond COVID-19 therapy.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Invivyd Investment Narrative Recap

To be a shareholder in Invivyd, you need confidence in the company’s antibody discovery platform to expand successfully beyond COVID-19 therapies, reducing product concentration risk. The VBY329 announcement signals early steps toward portfolio diversification, but it does not materially shift the most important short-term catalyst, commercial traction and regulatory progress for PEMGARDA, nor does it resolve the key current risk tied to revenue dependence on COVID-19 products and competitive pipeline advancement.

Most relevant to this news, Invivyd’s recent $124,999,400 follow-on equity offering strengthens its capital base. This additional funding may help support broader R&D efforts, including VBY329’s preclinical work, but it also highlights ongoing reliance on external capital which could impact shareholder value should product milestones not be met in a timely manner. In contrast, investors should be aware that slower-than-expected development or regulatory setbacks for new antibody programs could...

Read the full narrative on Invivyd (it's free!)

Invivyd's narrative projects $349.7 million in revenue and $100.0 million in earnings by 2028. This requires 96.3% yearly revenue growth and a $210.1 million increase in earnings from -$110.1 million today.

Uncover how Invivyd's forecasts yield a $7.33 fair value, a 215% upside to its current price.

Exploring Other Perspectives

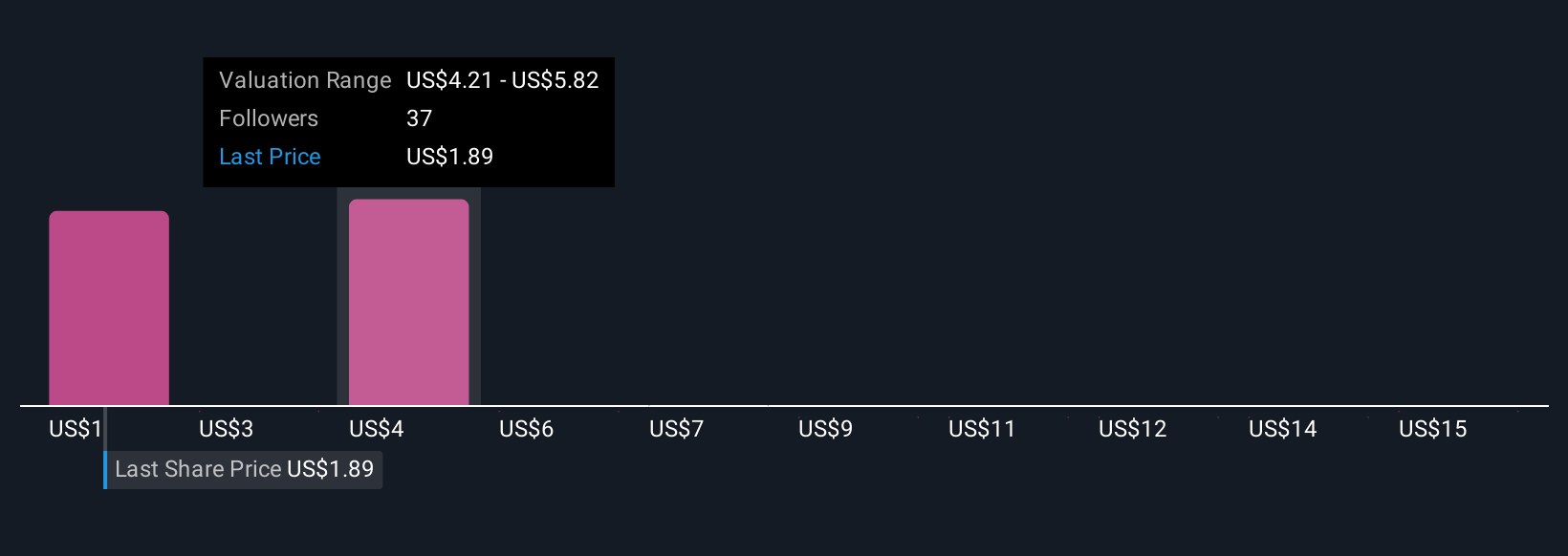

Sixteen members of the Simply Wall St Community estimate Invivyd’s fair value between US$1.40 and US$27.13, reflecting wide-ranging expectations. Continued reliance on PEMGARDA and regulatory uncertainty remain central issues to keep in mind as you review these varied viewpoints.

Explore 16 other fair value estimates on Invivyd - why the stock might be worth 40% less than the current price!

Build Your Own Invivyd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Invivyd research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Invivyd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Invivyd's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IVVD

Invivyd

A biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.